Brokers Offer Predictions for Titan Machinery Inc.’s Q1 2025 Earnings (NASDAQ:TITN)

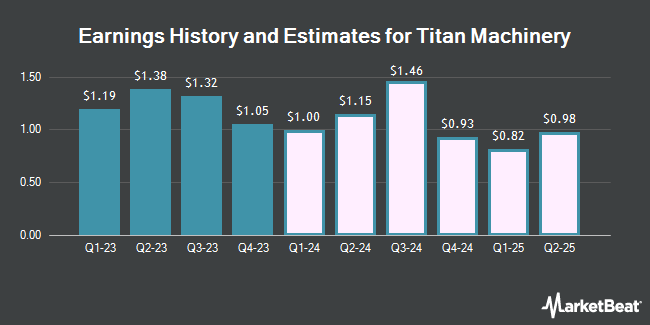

Titan Machinery Inc. (NASDAQ:TITN – Free Report) – Stock analysts at William Blair issued their Q1 2025 earnings estimates for shares of Titan Machinery in a research note issued on Thursday, March 21st. William Blair analyst L. De. Maria anticipates that the company will earn $0.80 per share for the quarter. The consensus estimate for Titan Machinery’s current full-year earnings is $3.25 per share.

TITN has been the topic of a number of other reports. Stephens reaffirmed an “overweight” rating and set a $42.00 target price on shares of Titan Machinery in a research report on Friday, January 12th. TheStreet downgraded shares of Titan Machinery from a “b-” rating to a “c+” rating in a research note on Monday, February 26th. One analyst has rated the stock with a hold rating and four have assigned a buy rating to the company’s stock. Based on data from MarketBeat, the company currently has a consensus rating of “Moderate Buy” and an average price target of $45.33.

Check Out Our Latest Research Report on TITN

Titan Machinery Stock Performance

Shares of NASDAQ:TITN opened at $23.55 on Monday. The firm has a market cap of $538.12 million, a PE ratio of 4.77 and a beta of 1.40. The firm’s 50 day simple moving average is $26.08 and its 200-day simple moving average is $26.29. Titan Machinery has a one year low of $21.44 and a one year high of $35.88. The company has a debt-to-equity ratio of 0.14, a quick ratio of 0.24 and a current ratio of 1.45.

Titan Machinery (NASDAQ:TITN – Get Free Report) last issued its earnings results on Thursday, March 21st. The company reported $1.05 EPS for the quarter, topping analysts’ consensus estimates of $0.99 by $0.06. The business had revenue of $852.10 million for the quarter, compared to analyst estimates of $734.99 million. Titan Machinery had a net margin of 4.08% and a return on equity of 18.88%. The company’s quarterly revenue was up 46.2% compared to the same quarter last year. During the same period last year, the company posted $0.81 earnings per share.

Hedge Funds Weigh In On Titan Machinery

A number of hedge funds and other institutional investors have recently modified their holdings of the business. American Century Companies Inc. boosted its stake in Titan Machinery by 241.0% in the third quarter. American Century Companies Inc. now owns 721,521 shares of the company’s stock valued at $19,178,000 after acquiring an additional 509,919 shares in the last quarter. Voss Capital LLC acquired a new stake in Titan Machinery in the third quarter valued at approximately $4,173,000. Millennium Management LLC boosted its stake in Titan Machinery by 129.8% in the fourth quarter. Millennium Management LLC now owns 270,632 shares of the company’s stock valued at $10,752,000 after acquiring an additional 152,849 shares in the last quarter. Prudential Financial Inc. boosted its stake in Titan Machinery by 89.1% in the first quarter. Prudential Financial Inc. now owns 258,894 shares of the company’s stock valued at $7,316,000 after acquiring an additional 122,000 shares in the last quarter. Finally, Renaissance Technologies LLC boosted its stake in Titan Machinery by 73.1% in the second quarter. Renaissance Technologies LLC now owns 288,200 shares of the company’s stock valued at $6,459,000 after acquiring an additional 121,700 shares in the last quarter. 82.83% of the stock is currently owned by institutional investors.

Titan Machinery Company Profile

Titan Machinery Inc owns and operates a network of full service agricultural and construction equipment stores in the United States and Europe. It operates through three segments: Agriculture, Construction, and International. The company sells new and used equipment, including agricultural and construction equipment manufactured under the CNH Industrial family of brands, as well as equipment from various other manufacturers.

Featured Articles

Receive News & Ratings for Titan Machinery Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Titan Machinery and related companies with MarketBeat.com’s FREE daily email newsletter.