Brokers Set Expectations for Alnylam Pharmaceuticals, Inc.’s FY2026 Earnings (NASDAQ:ALNY)

Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY – Free Report) – Research analysts at Zacks Research issued their FY2026 earnings estimates for Alnylam Pharmaceuticals in a report released on Thursday, March 7th. Zacks Research analyst A. Chakraborty forecasts that the biopharmaceutical company will earn $2.69 per share for the year. The consensus estimate for Alnylam Pharmaceuticals’ current full-year earnings is ($4.73) per share.

Other analysts have also recently issued research reports about the stock. HC Wainwright reissued a “buy” rating and set a $395.00 price objective on shares of Alnylam Pharmaceuticals in a report on Tuesday, March 5th. William Blair reaffirmed an “outperform” rating on shares of Alnylam Pharmaceuticals in a report on Monday, January 8th. Piper Sandler lifted their price objective on shares of Alnylam Pharmaceuticals from $210.00 to $217.00 and gave the company an “overweight” rating in a research report on Thursday, December 14th. Morgan Stanley lowered their price objective on shares of Alnylam Pharmaceuticals from $184.00 to $176.00 and set an “equal weight” rating on the stock in a research report on Tuesday, February 13th. Finally, Wells Fargo & Company decreased their target price on shares of Alnylam Pharmaceuticals from $171.00 to $161.00 and set an “equal weight” rating on the stock in a research report on Friday, February 16th. Eight equities research analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company. According to MarketBeat.com, the company has an average rating of “Moderate Buy” and an average target price of $216.12.

View Our Latest Report on Alnylam Pharmaceuticals

Alnylam Pharmaceuticals Stock Performance

NASDAQ ALNY opened at $149.82 on Monday. The firm has a 50 day simple moving average of $172.42 and a 200-day simple moving average of $174.82. Alnylam Pharmaceuticals has a one year low of $143.52 and a one year high of $218.88. The firm has a market cap of $18.87 billion, a price-to-earnings ratio of -42.08 and a beta of 0.39.

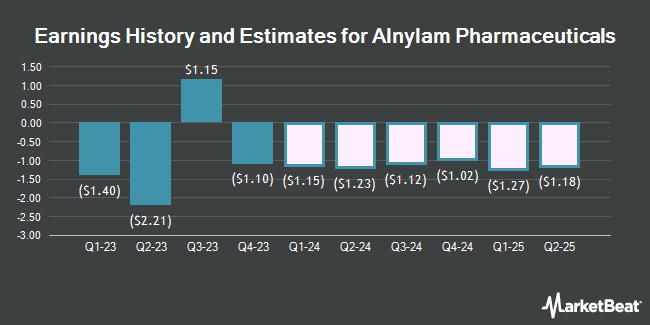

Alnylam Pharmaceuticals (NASDAQ:ALNY – Get Free Report) last issued its earnings results on Thursday, February 15th. The biopharmaceutical company reported ($1.10) EPS for the quarter, beating analysts’ consensus estimates of ($1.20) by $0.10. The business had revenue of $439.72 million during the quarter, compared to analyst estimates of $439.38 million. Alnylam Pharmaceuticals’s quarterly revenue was up 31.2% on a year-over-year basis. During the same quarter last year, the company earned ($1.68) earnings per share.

Insider Buying and Selling

In other news, Director Michael W. Bonney sold 30,000 shares of the company’s stock in a transaction that occurred on Wednesday, December 27th. The stock was sold at an average price of $195.00, for a total transaction of $5,850,000.00. Following the completion of the transaction, the director now directly owns 16,029 shares in the company, valued at $3,125,655. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Corporate insiders own 1.40% of the company’s stock.

Institutional Trading of Alnylam Pharmaceuticals

A number of institutional investors and hedge funds have recently modified their holdings of ALNY. DnB Asset Management AS lifted its stake in shares of Alnylam Pharmaceuticals by 102.3% during the third quarter. DnB Asset Management AS now owns 51,212 shares of the biopharmaceutical company’s stock valued at $9,070,000 after acquiring an additional 25,898 shares during the period. Toronto Dominion Bank increased its holdings in shares of Alnylam Pharmaceuticals by 79.1% in the third quarter. Toronto Dominion Bank now owns 55,262 shares of the biopharmaceutical company’s stock worth $9,787,000 after acquiring an additional 24,400 shares in the last quarter. Profund Advisors LLC increased its holdings in shares of Alnylam Pharmaceuticals by 14.2% in the second quarter. Profund Advisors LLC now owns 7,729 shares of the biopharmaceutical company’s stock worth $1,468,000 after acquiring an additional 959 shares in the last quarter. Hsbc Holdings PLC grew its holdings in shares of Alnylam Pharmaceuticals by 14.7% during the third quarter. Hsbc Holdings PLC now owns 35,185 shares of the biopharmaceutical company’s stock worth $6,230,000 after buying an additional 4,508 shares in the last quarter. Finally, Royal London Asset Management Ltd. grew its holdings in shares of Alnylam Pharmaceuticals by 86.7% during the third quarter. Royal London Asset Management Ltd. now owns 306,595 shares of the biopharmaceutical company’s stock worth $54,303,000 after buying an additional 142,357 shares in the last quarter. 93.98% of the stock is currently owned by institutional investors.

About Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc, a biopharmaceutical company, focuses on discovering, developing, and commercializing novel therapeutics based on ribonucleic acid interference. Its marketed products include ONPATTRO (patisiran) for the treatment of the polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults; AMVUTTRA for the treatment of hATTR amyloidosis with polyneuropathy in adults; GIVLAARI for the treatment of adults with acute hepatic porphyria; and OXLUMO for the treatment of primary hyperoxaluria type 1.

Further Reading

Receive News & Ratings for Alnylam Pharmaceuticals Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Alnylam Pharmaceuticals and related companies with MarketBeat.com’s FREE daily email newsletter.