Brokers Set Expectations for Arch Resources, Inc.’s Q2 2024 Earnings (NYSE:ARCH)

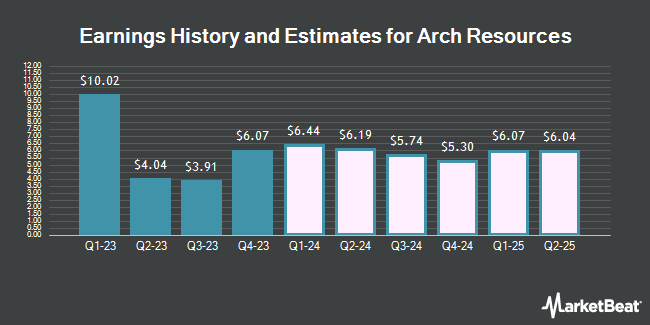

Arch Resources, Inc. (NYSE:ARCH – Free Report) – Investment analysts at B. Riley decreased their Q2 2024 EPS estimates for Arch Resources in a research note issued to investors on Tuesday, March 5th. B. Riley analyst L. Pipes now expects that the energy company will post earnings per share of $6.19 for the quarter, down from their previous estimate of $6.69. B. Riley currently has a “Buy” rating and a $223.00 target price on the stock. The consensus estimate for Arch Resources’ current full-year earnings is $23.25 per share. B. Riley also issued estimates for Arch Resources’ Q4 2024 earnings at $5.30 EPS and FY2026 earnings at $23.34 EPS.

Arch Resources (NYSE:ARCH – Get Free Report) last announced its quarterly earnings results on Thursday, February 15th. The energy company reported $6.07 earnings per share for the quarter, missing the consensus estimate of $6.90 by ($0.83). The firm had revenue of $774.00 million for the quarter, compared to the consensus estimate of $704.53 million. Arch Resources had a net margin of 14.75% and a return on equity of 32.20%. Arch Resources’s revenue was down 9.9% on a year-over-year basis. During the same period last year, the business earned $23.18 EPS.

Several other brokerages also recently weighed in on ARCH. BMO Capital Markets raised their price target on shares of Arch Resources from $170.00 to $175.00 and gave the company an “outperform” rating in a research report on Friday, November 17th. StockNews.com raised shares of Arch Resources from a “hold” rating to a “buy” rating in a research report on Wednesday, February 28th.

View Our Latest Analysis on Arch Resources

Arch Resources Price Performance

Shares of ARCH opened at $184.43 on Wednesday. The company has a market capitalization of $3.39 billion, a P/E ratio of 7.67 and a beta of 0.68. The company has a quick ratio of 1.83, a current ratio of 2.49 and a debt-to-equity ratio of 0.07. The firm has a 50 day moving average of $171.64 and a 200 day moving average of $159.97. Arch Resources has a twelve month low of $102.42 and a twelve month high of $187.45.

Institutional Trading of Arch Resources

A number of large investors have recently made changes to their positions in the business. Advisors Asset Management Inc. lifted its position in shares of Arch Resources by 35.3% in the 3rd quarter. Advisors Asset Management Inc. now owns 62,030 shares of the energy company’s stock worth $10,586,000 after purchasing an additional 16,185 shares during the period. Boston Partners purchased a new stake in Arch Resources during the third quarter valued at approximately $1,138,000. Aigen Investment Management LP lifted its position in Arch Resources by 139.3% during the third quarter. Aigen Investment Management LP now owns 8,518 shares of the energy company’s stock valued at $1,454,000 after acquiring an additional 4,958 shares during the last quarter. Maple Rock Capital Partners Inc. lifted its position in Arch Resources by 12.4% during the second quarter. Maple Rock Capital Partners Inc. now owns 394,239 shares of the energy company’s stock valued at $44,454,000 after acquiring an additional 43,500 shares during the last quarter. Finally, Barclays PLC lifted its position in Arch Resources by 15.8% during the third quarter. Barclays PLC now owns 339,666 shares of the energy company’s stock valued at $57,967,000 after acquiring an additional 46,253 shares during the last quarter. 85.03% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other news, VP Paul T. Demzik sold 3,522 shares of the business’s stock in a transaction on Monday, March 4th. The shares were sold at an average price of $175.00, for a total transaction of $616,350.00. Following the completion of the sale, the vice president now owns 5,715 shares of the company’s stock, valued at approximately $1,000,125. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. In related news, VP Paul T. Demzik sold 3,522 shares of Arch Resources stock in a transaction on Monday, March 4th. The shares were sold at an average price of $175.00, for a total transaction of $616,350.00. Following the transaction, the vice president now owns 5,715 shares in the company, valued at approximately $1,000,125. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, VP Rosemary L. Klein sold 1,708 shares of Arch Resources stock in a transaction on Friday, January 19th. The shares were sold at an average price of $185.00, for a total transaction of $315,980.00. Following the transaction, the vice president now owns 6,449 shares in the company, valued at approximately $1,193,065. The disclosure for this sale can be found here. In the last quarter, insiders sold 17,660 shares of company stock valued at $3,088,218. Company insiders own 5.40% of the company’s stock.

Arch Resources Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, March 15th. Shareholders of record on Thursday, February 29th will be given a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a yield of 0.54%. The ex-dividend date of this dividend is Wednesday, February 28th. Arch Resources’s dividend payout ratio (DPR) is presently 4.16%.

Arch Resources Company Profile

Arch Resources, Inc engages in the production and sale of metallurgical products. It operates in two segments, Metallurgical and Thermal. The company operates active mines. It owned or controlled primarily through long-term leases of coal land in Ohio, Maryland, Virginia, West Virginia, Wyoming, Kentucky, Montana, Pennsylvania, Colorado, and Illinois; and smaller parcels of property in Alabama, Indiana, Washington, Arkansas, California, Utah, and Texas.

Featured Stories

Receive News & Ratings for Arch Resources Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Arch Resources and related companies with MarketBeat.com’s FREE daily email newsletter.