Brokers Set Expectations for Best Buy Co., Inc.’s Q3 2025 Earnings (NYSE:BBY)

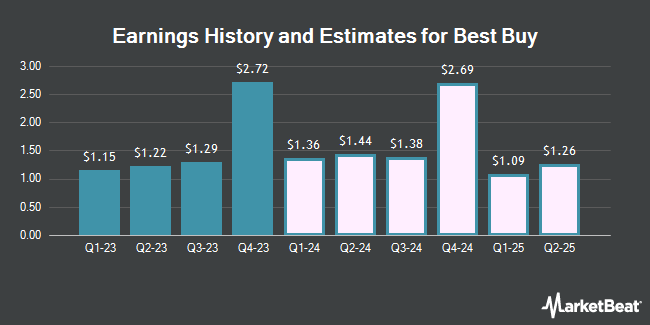

Best Buy Co., Inc. (NYSE:BBY – Free Report) – Investment analysts at Zacks Research boosted their Q3 2025 earnings per share estimates for shares of Best Buy in a report released on Thursday, March 21st. Zacks Research analyst R. Department now expects that the technology retailer will post earnings per share of $1.30 for the quarter, up from their prior estimate of $1.28. The consensus estimate for Best Buy’s current full-year earnings is $6.03 per share. Zacks Research also issued estimates for Best Buy’s FY2025 earnings at $6.00 EPS, Q3 2026 earnings at $1.48 EPS and FY2026 earnings at $6.75 EPS.

Several other analysts have also commented on the company. TheStreet raised Best Buy from a “c” rating to a “b-” rating in a report on Thursday, February 29th. The Goldman Sachs Group lifted their target price on Best Buy from $81.00 to $90.00 and gave the company a “buy” rating in a research report on Friday, March 1st. Citigroup lifted their target price on Best Buy from $67.00 to $76.00 and gave the company a “sell” rating in a research report on Friday, March 1st. JPMorgan Chase & Co. upgraded Best Buy from a “neutral” rating to an “overweight” rating and boosted their price objective for the company from $89.00 to $101.00 in a research report on Friday. Finally, Barclays boosted their price objective on Best Buy from $69.00 to $88.00 and gave the company an “equal weight” rating in a research report on Friday, March 1st. One equities research analyst has rated the stock with a sell rating, eight have assigned a hold rating and seven have assigned a buy rating to the stock. According to MarketBeat, Best Buy currently has a consensus rating of “Hold” and an average price target of $84.27.

Get Our Latest Stock Analysis on BBY

Best Buy Stock Performance

Shares of BBY opened at $81.66 on Monday. The company has a debt-to-equity ratio of 0.38, a current ratio of 1.00 and a quick ratio of 0.37. Best Buy has a one year low of $62.30 and a one year high of $86.11. The firm has a market capitalization of $17.59 billion, a P/E ratio of 14.35, a PEG ratio of 2.13 and a beta of 1.49. The business has a fifty day moving average of $75.71 and a 200 day moving average of $72.74.

Best Buy (NYSE:BBY – Get Free Report) last issued its quarterly earnings data on Thursday, February 29th. The technology retailer reported $2.72 EPS for the quarter, topping the consensus estimate of $2.51 by $0.21. Best Buy had a return on equity of 48.45% and a net margin of 2.86%. The company had revenue of $14.65 billion during the quarter, compared to analyst estimates of $14.58 billion. During the same quarter in the previous year, the company posted $2.61 earnings per share. Best Buy’s revenue was down .6% compared to the same quarter last year.

Institutional Inflows and Outflows

A number of hedge funds have recently modified their holdings of BBY. Mirabella Financial Services LLP purchased a new stake in Best Buy during the third quarter worth $831,000. Van ECK Associates Corp lifted its holdings in Best Buy by 35.6% during the third quarter. Van ECK Associates Corp now owns 94,282 shares of the technology retailer’s stock worth $6,550,000 after buying an additional 24,763 shares during the period. Dai ichi Life Insurance Company Ltd lifted its holdings in Best Buy by 1,405.3% during the third quarter. Dai ichi Life Insurance Company Ltd now owns 214,232 shares of the technology retailer’s stock worth $14,883,000 after buying an additional 200,000 shares during the period. Banco Santander S.A. purchased a new stake in Best Buy during the third quarter worth $3,885,000. Finally, National Bank of Canada FI lifted its holdings in Best Buy by 126.6% during the third quarter. National Bank of Canada FI now owns 77,784 shares of the technology retailer’s stock worth $5,372,000 after buying an additional 43,457 shares during the period. Institutional investors own 76.10% of the company’s stock.

Best Buy Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, April 11th. Stockholders of record on Thursday, March 21st will be paid a dividend of $0.94 per share. This is a boost from Best Buy’s previous quarterly dividend of $0.92. The ex-dividend date of this dividend is Wednesday, March 20th. This represents a $3.76 dividend on an annualized basis and a dividend yield of 4.60%. Best Buy’s dividend payout ratio is currently 66.08%.

About Best Buy

Best Buy Co, Inc engages in the retail of technology products in the United States and Canada. The company operates in two segments, Domestic and International. Its stores provide computing and mobile phone products, such as desktops, notebooks, and peripherals; mobile phones comprising related mobile network carrier commissions; networking products; tablets covering e-readers; smartwatches; and consumer electronics consisting of digital imaging, health and fitness products, home theater, portable audio comprising headphones and portable speakers, and smart home products.

Read More

Receive News & Ratings for Best Buy Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Best Buy and related companies with MarketBeat.com’s FREE daily email newsletter.