Brokers Set Expectations for Caribou Biosciences, Inc.’s Q1 2024 Earnings (NASDAQ:CRBU)

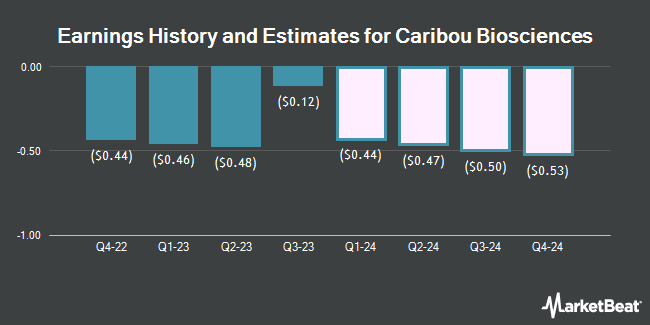

Caribou Biosciences, Inc. (NASDAQ:CRBU – Free Report) – Equities research analysts at HC Wainwright boosted their Q1 2024 earnings estimates for Caribou Biosciences in a note issued to investors on Tuesday, March 19th. HC Wainwright analyst R. Burns now anticipates that the company will post earnings of ($0.39) per share for the quarter, up from their prior forecast of ($0.42). HC Wainwright has a “Buy” rating and a $24.00 price target on the stock. The consensus estimate for Caribou Biosciences’ current full-year earnings is ($1.79) per share. HC Wainwright also issued estimates for Caribou Biosciences’ Q2 2024 earnings at ($0.40) EPS, Q3 2024 earnings at ($0.42) EPS, Q4 2024 earnings at ($0.45) EPS and FY2024 earnings at ($1.66) EPS.

Caribou Biosciences Trading Down 4.2 %

Shares of NASDAQ:CRBU opened at $5.25 on Thursday. The company has a market capitalization of $474.18 million, a PE ratio of -3.62 and a beta of 2.59. Caribou Biosciences has a twelve month low of $3.44 and a twelve month high of $8.59. The firm has a 50 day simple moving average of $6.38 and a 200-day simple moving average of $5.57.

Hedge Funds Weigh In On Caribou Biosciences

Several institutional investors have recently bought and sold shares of the company. Granahan Investment Management LLC boosted its position in shares of Caribou Biosciences by 1.4% during the 4th quarter. Granahan Investment Management LLC now owns 138,330 shares of the company’s stock worth $793,000 after purchasing an additional 1,952 shares in the last quarter. Charles Schwab Investment Management Inc. lifted its holdings in Caribou Biosciences by 0.5% in the 2nd quarter. Charles Schwab Investment Management Inc. now owns 412,625 shares of the company’s stock valued at $1,754,000 after purchasing an additional 2,176 shares in the last quarter. Rhumbline Advisers lifted its holdings in Caribou Biosciences by 2.6% in the 1st quarter. Rhumbline Advisers now owns 87,473 shares of the company’s stock valued at $464,000 after purchasing an additional 2,255 shares in the last quarter. Stansberry Asset Management LLC lifted its holdings in Caribou Biosciences by 3.5% in the 4th quarter. Stansberry Asset Management LLC now owns 70,004 shares of the company’s stock valued at $440,000 after purchasing an additional 2,342 shares in the last quarter. Finally, Credit Suisse AG lifted its holdings in Caribou Biosciences by 7.2% in the 3rd quarter. Credit Suisse AG now owns 34,996 shares of the company’s stock valued at $368,000 after purchasing an additional 2,360 shares in the last quarter. 59.16% of the stock is owned by institutional investors and hedge funds.

Caribou Biosciences Company Profile

Caribou Biosciences, Inc, a clinical-stage biopharmaceutical company, engages in the development of genome-edited allogeneic cell therapies for the treatment of hematologic malignancies and solid tumors in the United States and internationally. Its lead product candidates are CB-010, an allogeneic anti-CD19 CAR-T cell therapy that is in phase 1 clinical trial to treat relapsed or refractory B cell non-Hodgkin lymphoma; and CB-011, an allogeneic anti-BCMA CAR-T cell therapy that is in phase 1 clinical trial for the treatment of relapsed or refractory multiple myeloma.

Recommended Stories

Receive News & Ratings for Caribou Biosciences Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Caribou Biosciences and related companies with MarketBeat.com’s FREE daily email newsletter.