Brokers Set Expectations for Enbridge Inc.’s FY2025 Earnings (TSE:ENB)

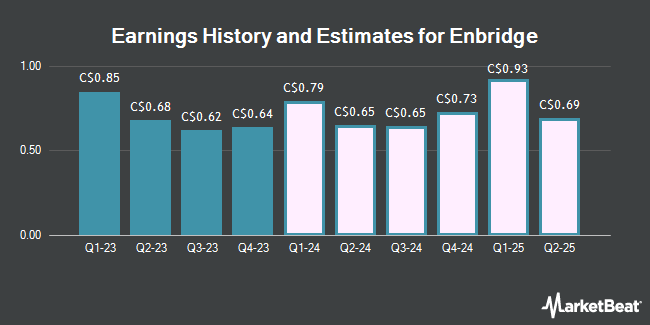

Enbridge Inc. (TSE:ENB – Free Report) (NYSE:ENB) – Equities researchers at US Capital Advisors boosted their FY2025 earnings per share (EPS) estimates for shares of Enbridge in a report released on Tuesday, May 21st. US Capital Advisors analyst J. Carreker now anticipates that the company will post earnings of $3.18 per share for the year, up from their previous forecast of $3.16. The consensus estimate for Enbridge’s current full-year earnings is $2.88 per share. US Capital Advisors also issued estimates for Enbridge’s Q4 2025 earnings at $0.87 EPS and FY2026 earnings at $3.28 EPS.

Several other brokerages have also weighed in on ENB. Barclays decreased their target price on shares of Enbridge from C$53.00 to C$51.00 in a research report on Thursday, March 7th. Jefferies Financial Group boosted their price objective on shares of Enbridge from C$53.00 to C$55.00 in a research note on Monday, May 13th. Stifel Nicolaus dropped their price objective on Enbridge from C$52.00 to C$51.00 and set a “hold” rating for the company in a report on Thursday, April 25th. Scotiabank lifted their target price on Enbridge from C$50.00 to C$54.00 and gave the company an “outperform” rating in a report on Monday, May 13th. Finally, Royal Bank of Canada dropped their price target on Enbridge from C$55.00 to C$54.00 and set an “outperform” rating for the company in a research note on Monday, February 12th. Six equities research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company’s stock. According to data from MarketBeat, the company currently has a consensus rating of “Moderate Buy” and a consensus price target of C$53.56.

Check Out Our Latest Stock Analysis on Enbridge

Enbridge Stock Performance

Shares of ENB opened at C$50.12 on Wednesday. The company has a market capitalization of C$106.76 billion, a price-to-earnings ratio of 18.91, a PEG ratio of 0.75 and a beta of 0.88. The company has a debt-to-equity ratio of 130.31, a quick ratio of 0.44 and a current ratio of 0.68. Enbridge has a 1 year low of C$42.75 and a 1 year high of C$52.34. The company’s 50 day simple moving average is C$48.85 and its 200 day simple moving average is C$47.90.

Enbridge Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Saturday, June 1st. Stockholders of record on Wednesday, May 15th will be issued a $0.915 dividend. This represents a $3.66 annualized dividend and a dividend yield of 7.30%. The ex-dividend date of this dividend is Tuesday, May 14th. Enbridge’s dividend payout ratio (DPR) is presently 138.11%.

Enbridge Company Profile

Enbridge Inc, together with its subsidiaries, operates as an energy infrastructure company. The company operates through five segments: Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storage, Renewable Power Generation, and Energy Services. The Liquids Pipelines segment operates pipelines and related terminals to transport various grades of crude oil and other liquid hydrocarbons in Canada and the United States.

Featured Stories

Receive News & Ratings for Enbridge Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Enbridge and related companies with MarketBeat.com’s FREE daily email newsletter.