Brokers Set Expectations for Enterprise Products Partners L.P.’s Q2 2024 Earnings (NYSE:EPD)

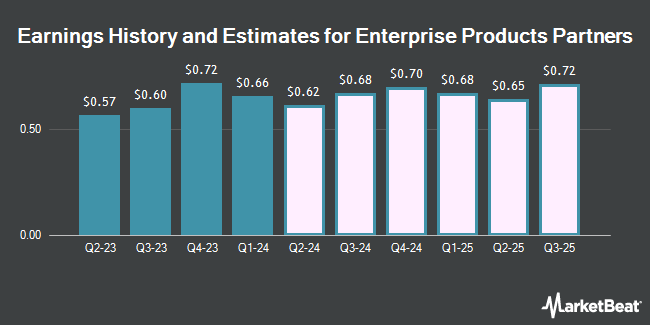

Enterprise Products Partners L.P. (NYSE:EPD – Free Report) – Investment analysts at US Capital Advisors increased their Q2 2024 earnings per share (EPS) estimates for Enterprise Products Partners in a research note issued on Tuesday, May 21st. US Capital Advisors analyst J. Carreker now anticipates that the oil and gas producer will post earnings of $0.61 per share for the quarter, up from their prior forecast of $0.60. The consensus estimate for Enterprise Products Partners’ current full-year earnings is $2.71 per share.

EPD has been the subject of a number of other research reports. StockNews.com downgraded Enterprise Products Partners from a “strong-buy” rating to a “buy” rating in a report on Friday, May 10th. Mizuho reiterated a “buy” rating and issued a $34.00 price objective on shares of Enterprise Products Partners in a report on Thursday, April 4th. Stifel Nicolaus upped their price objective on Enterprise Products Partners from $35.00 to $36.00 and gave the company a “buy” rating in a report on Friday, February 2nd. Scotiabank upped their price objective on Enterprise Products Partners from $31.00 to $32.00 and gave the company a “sector outperform” rating in a report on Thursday, April 4th. Finally, Barclays boosted their target price on Enterprise Products Partners from $30.00 to $31.00 and gave the company an “overweight” rating in a research note on Tuesday, March 26th. Two equities research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the company currently has an average rating of “Moderate Buy” and an average target price of $32.69.

Enterprise Products Partners Trading Down 0.9 %

NYSE EPD opened at $28.43 on Wednesday. The stock has a 50-day simple moving average of $28.83 and a 200 day simple moving average of $27.50. The company has a market capitalization of $61.74 billion, a PE ratio of 11.15 and a beta of 1.02. The company has a current ratio of 0.93, a quick ratio of 0.68 and a debt-to-equity ratio of 0.99. Enterprise Products Partners has a 12 month low of $25.19 and a 12 month high of $29.99.

Enterprise Products Partners (NYSE:EPD – Get Free Report) last released its quarterly earnings data on Tuesday, April 30th. The oil and gas producer reported $0.66 EPS for the quarter, beating analysts’ consensus estimates of $0.64 by $0.02. The business had revenue of $14.76 billion during the quarter, compared to the consensus estimate of $13.82 billion. Enterprise Products Partners had a return on equity of 19.73% and a net margin of 10.76%. The firm’s revenue was up 18.6% on a year-over-year basis. During the same quarter in the prior year, the company posted $0.64 earnings per share.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of EPD. First City Capital Management Inc. acquired a new position in Enterprise Products Partners during the first quarter valued at approximately $245,000. Koesten Hirschmann & Crabtree INC. boosted its position in Enterprise Products Partners by 64.1% during the first quarter. Koesten Hirschmann & Crabtree INC. now owns 2,297 shares of the oil and gas producer’s stock valued at $67,000 after purchasing an additional 897 shares during the last quarter. Sanibel Captiva Trust Company Inc. boosted its position in Enterprise Products Partners by 5.1% during the first quarter. Sanibel Captiva Trust Company Inc. now owns 17,464 shares of the oil and gas producer’s stock valued at $510,000 after purchasing an additional 840 shares during the last quarter. LRI Investments LLC acquired a new position in Enterprise Products Partners during the first quarter valued at approximately $564,000. Finally, Virtu Financial LLC boosted its position in Enterprise Products Partners by 41.3% during the first quarter. Virtu Financial LLC now owns 80,179 shares of the oil and gas producer’s stock valued at $2,340,000 after purchasing an additional 23,429 shares during the last quarter. 26.07% of the stock is owned by institutional investors and hedge funds.

Enterprise Products Partners Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, May 14th. Stockholders of record on Tuesday, April 30th were given a dividend of $0.515 per share. The ex-dividend date was Monday, April 29th. This represents a $2.06 annualized dividend and a dividend yield of 7.25%. Enterprise Products Partners’s dividend payout ratio is currently 80.78%.

Enterprise Products Partners Company Profile

Enterprise Products Partners L.P. provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products. It operates in four segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services, and Petrochemical & Refined Products Services.

Read More

Receive News & Ratings for Enterprise Products Partners Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Enterprise Products Partners and related companies with MarketBeat.com’s FREE daily email newsletter.