Brokers Set Expectations for Foot Locker, Inc.’s Q1 2025 Earnings (NYSE:FL)

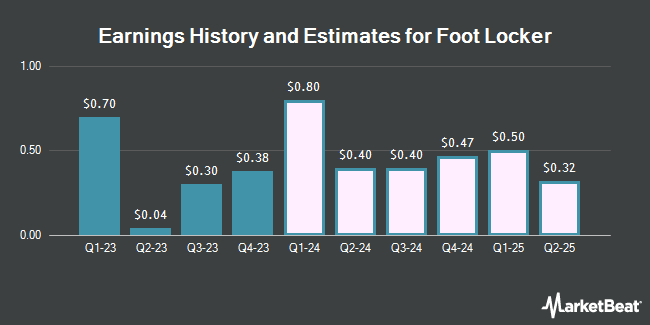

Foot Locker, Inc. (NYSE:FL – Free Report) – Equities research analysts at Wedbush decreased their Q1 2025 earnings per share (EPS) estimates for shares of Foot Locker in a note issued to investors on Wednesday, March 6th. Wedbush analyst T. Nikic now expects that the athletic footwear retailer will earn $0.17 per share for the quarter, down from their previous forecast of $0.70. The consensus estimate for Foot Locker’s current full-year earnings is $1.58 per share. Wedbush also issued estimates for Foot Locker’s Q2 2025 earnings at $0.00 EPS, Q4 2025 earnings at $0.74 EPS, FY2025 earnings at $1.58 EPS and FY2026 earnings at $2.24 EPS.

Foot Locker (NYSE:FL – Get Free Report) last announced its quarterly earnings results on Wednesday, March 6th. The athletic footwear retailer reported $0.38 EPS for the quarter, topping analysts’ consensus estimates of $0.34 by $0.04. The firm had revenue of $2.38 billion during the quarter, compared to analysts’ expectations of $2.28 billion. Foot Locker had a negative net margin of 4.04% and a positive return on equity of 4.25%. The company’s revenue for the quarter was up 2.0% compared to the same quarter last year. During the same quarter last year, the company earned $0.97 earnings per share.

FL has been the topic of a number of other research reports. Jefferies Financial Group decreased their price objective on shares of Foot Locker from $25.00 to $24.00 and set a “hold” rating on the stock in a report on Wednesday, March 6th. BTIG Research lowered Foot Locker from a “buy” rating to a “neutral” rating in a research report on Tuesday, November 21st. Williams Trading reiterated a “sell” rating and issued a $15.00 price objective on shares of Foot Locker in a research report on Wednesday, November 22nd. Guggenheim lowered their price objective on Foot Locker from $35.00 to $30.00 and set a “buy” rating for the company in a research report on Thursday. Finally, The Goldman Sachs Group lifted their price objective on Foot Locker from $18.00 to $20.00 and gave the stock a “sell” rating in a research report on Thursday, November 30th. Six equities research analysts have rated the stock with a sell rating, twelve have issued a hold rating and three have given a buy rating to the stock. According to data from MarketBeat, the stock presently has an average rating of “Hold” and a consensus target price of $27.68.

Read Our Latest Research Report on Foot Locker

Foot Locker Price Performance

NYSE:FL opened at $24.20 on Monday. The firm has a market cap of $2.28 billion, a PE ratio of -6.91, a price-to-earnings-growth ratio of 0.57 and a beta of 1.45. Foot Locker has a 12 month low of $14.84 and a 12 month high of $47.00. The company has a quick ratio of 0.35, a current ratio of 1.72 and a debt-to-equity ratio of 0.15. The company’s 50-day moving average price is $29.98 and its two-hundred day moving average price is $25.08.

Institutional Trading of Foot Locker

Several hedge funds and other institutional investors have recently bought and sold shares of FL. Macquarie Group Ltd. lifted its position in Foot Locker by 7,437.5% during the first quarter. Macquarie Group Ltd. now owns 3,678,300 shares of the athletic footwear retailer’s stock worth $145,992,000 after purchasing an additional 3,629,500 shares during the period. Barclays PLC boosted its stake in Foot Locker by 385.6% in the third quarter. Barclays PLC now owns 1,746,876 shares of the athletic footwear retailer’s stock valued at $30,307,000 after buying an additional 1,387,154 shares in the last quarter. Morgan Stanley boosted its stake in Foot Locker by 59.1% in the third quarter. Morgan Stanley now owns 3,446,965 shares of the athletic footwear retailer’s stock valued at $59,805,000 after buying an additional 1,280,389 shares in the last quarter. Vanguard Group Inc. boosted its stake in Foot Locker by 9.6% in the third quarter. Vanguard Group Inc. now owns 10,292,817 shares of the athletic footwear retailer’s stock valued at $178,580,000 after buying an additional 902,610 shares in the last quarter. Finally, Renaissance Technologies LLC boosted its stake in Foot Locker by 5,122.3% in the first quarter. Renaissance Technologies LLC now owns 913,900 shares of the athletic footwear retailer’s stock valued at $27,106,000 after buying an additional 896,400 shares in the last quarter.

Foot Locker Company Profile

Foot Locker, Inc, through its subsidiaries, operates as a footwear and apparel retailer in North America, Europe, Australia, New Zealand, Asia, and the Middle East. Its brand portfolio includes Foot Locker, a youth culture brand comprising sneakers and apparel; Kids Foot Locker, which offers athletic footwear, apparel, and accessories for children; and Champs Sports that operates as a mall-based specialty athletic footwear and apparel retailer.

Further Reading

Receive News & Ratings for Foot Locker Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Foot Locker and related companies with MarketBeat.com’s FREE daily email newsletter.