Brokers Set Expectations for Hasbro, Inc.’s Q3 2025 Earnings (NASDAQ:HAS)

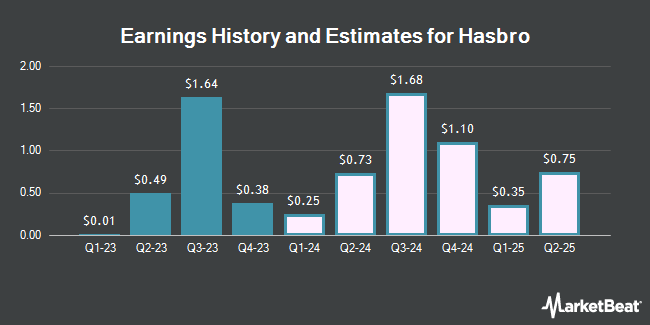

Hasbro, Inc. (NASDAQ:HAS – Free Report) – Investment analysts at Zacks Research raised their Q3 2025 EPS estimates for Hasbro in a research note issued to investors on Tuesday, March 12th. Zacks Research analyst R. Department now forecasts that the company will earn $1.63 per share for the quarter, up from their prior estimate of $1.62. The consensus estimate for Hasbro’s current full-year earnings is $3.23 per share. Zacks Research also issued estimates for Hasbro’s FY2025 earnings at $3.80 EPS.

HAS has been the topic of several other research reports. StockNews.com downgraded shares of Hasbro from a “hold” rating to a “sell” rating in a research note on Thursday, March 7th. DA Davidson lowered shares of Hasbro from a “buy” rating to a “neutral” rating and cut their price objective for the company from $60.00 to $53.00 in a report on Tuesday, January 2nd. JPMorgan Chase & Co. lifted their price objective on Hasbro from $52.00 to $54.00 and gave the stock a “neutral” rating in a research note on Wednesday, February 14th. Finally, TheStreet downgraded Hasbro from a “c-” rating to a “d+” rating in a report on Tuesday, February 13th. One investment analyst has rated the stock with a sell rating, five have given a hold rating and three have issued a buy rating to the company’s stock. According to MarketBeat.com, Hasbro presently has an average rating of “Hold” and a consensus target price of $66.78.

Read Our Latest Analysis on Hasbro

Hasbro Price Performance

NASDAQ:HAS opened at $53.31 on Friday. Hasbro has a 52 week low of $42.66 and a 52 week high of $73.57. The company has a debt-to-equity ratio of 2.73, a quick ratio of 0.97 and a current ratio of 1.13. The company has a market capitalization of $7.40 billion, a price-to-earnings ratio of -4.97, a PEG ratio of 1.41 and a beta of 0.73. The company has a 50-day moving average of $50.24 and a 200-day moving average of $53.37.

Hasbro (NASDAQ:HAS – Get Free Report) last announced its earnings results on Tuesday, February 13th. The company reported $0.38 earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of $0.64 by ($0.26). The company had revenue of $1.29 billion for the quarter, compared to the consensus estimate of $1.33 billion. Hasbro had a positive return on equity of 16.34% and a negative net margin of 29.77%. The company’s revenue was down 23.2% compared to the same quarter last year. During the same period last year, the firm posted $1.31 EPS.

Hasbro Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, May 15th. Investors of record on Wednesday, May 1st will be paid a $0.70 dividend. The ex-dividend date is Tuesday, April 30th. This represents a $2.80 annualized dividend and a yield of 5.25%. Hasbro’s dividend payout ratio (DPR) is currently -26.12%.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently bought and sold shares of HAS. Penserra Capital Management LLC acquired a new stake in Hasbro in the 2nd quarter worth about $54,000. Aigen Investment Management LP bought a new stake in shares of Hasbro during the 3rd quarter valued at $1,250,000. Janney Montgomery Scott LLC raised its position in shares of Hasbro by 6.5% in the 3rd quarter. Janney Montgomery Scott LLC now owns 47,369 shares of the company’s stock valued at $3,133,000 after buying an additional 2,875 shares in the last quarter. Albion Financial Group UT boosted its position in shares of Hasbro by 105.7% during the 3rd quarter. Albion Financial Group UT now owns 58,743 shares of the company’s stock worth $3,885,000 after acquiring an additional 30,192 shares in the last quarter. Finally, Schonfeld Strategic Advisors LLC raised its holdings in shares of Hasbro by 3,088.1% during the 2nd quarter. Schonfeld Strategic Advisors LLC now owns 193,645 shares of the company’s stock worth $12,542,000 after buying an additional 187,571 shares in the last quarter. Institutional investors and hedge funds own 82.84% of the company’s stock.

Hasbro Company Profile

Hasbro, Inc, together with its subsidiaries, operates as a play and entertainment company in the United States and internationally. The company operates through Consumer Products, Wizards of the Coast and Digital Gaming, and Entertainment segments. The Consumer Products segment engages in the sourcing, marketing, and sale of toy and game products.

See Also

Receive News & Ratings for Hasbro Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Hasbro and related companies with MarketBeat.com’s FREE daily email newsletter.