Brokers Set Expectations for Intact Financial Co.’s FY2025 Earnings (TSE:IFC)

Intact Financial Co. (TSE:IFC – Free Report) – Equities researchers at National Bank Financial decreased their FY2025 earnings per share estimates for shares of Intact Financial in a research note issued to investors on Sunday, February 4th. National Bank Financial analyst J. Gloyn now forecasts that the company will post earnings per share of $14.87 for the year, down from their prior estimate of $15.08. The consensus estimate for Intact Financial’s current full-year earnings is $14.23 per share.

Several other equities research analysts also recently weighed in on IFC. Scotiabank raised their price objective on Intact Financial from C$232.00 to C$252.00 and gave the company an “outperform” rating in a report on Wednesday, January 31st. National Bankshares raised their price objective on Intact Financial from C$235.00 to C$240.00 and gave the company an “outperform” rating in a report on Monday. Desjardins lifted their target price on Intact Financial from C$225.00 to C$230.00 and gave the stock a “buy” rating in a report on Thursday, November 9th. BMO Capital Markets lifted their target price on Intact Financial from C$225.00 to C$230.00 in a report on Thursday, January 25th. Finally, Royal Bank of Canada downgraded Intact Financial from an “outperform” rating to a “sector perform” rating in a report on Thursday, January 4th. One analyst has rated the stock with a hold rating and seven have assigned a buy rating to the company. According to MarketBeat, Intact Financial presently has a consensus rating of “Moderate Buy” and a consensus price target of C$225.45.

Read Our Latest Research Report on Intact Financial

Intact Financial Trading Down 1.3 %

TSE IFC opened at C$207.89 on Tuesday. The company has a quick ratio of 0.28, a current ratio of 0.42 and a debt-to-equity ratio of 35.57. Intact Financial has a twelve month low of C$182.01 and a twelve month high of C$214.68. The company has a market cap of C$37.07 billion, a price-to-earnings ratio of 35.30, a price-to-earnings-growth ratio of 2.01 and a beta of 0.54. The business’s fifty day moving average is C$205.98 and its 200 day moving average is C$201.10.

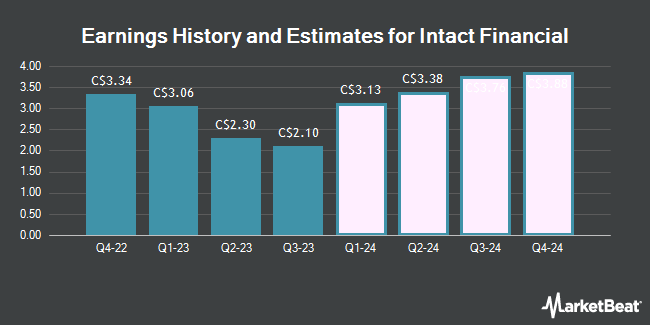

Intact Financial (TSE:IFC – Get Free Report) last issued its earnings results on Tuesday, November 7th. The company reported C$2.10 earnings per share for the quarter, beating analysts’ consensus estimates of C$1.51 by C$0.59. Intact Financial had a return on equity of 7.22% and a net margin of 5.54%. The firm had revenue of C$6.39 billion for the quarter.

About Intact Financial

Intact Financial Corporation, through its subsidiaries, provides property and casualty insurance products to individuals and businesses in Canada, the United States, the United Kingdom, and internationally. It offers personal auto insurance; insurance for motor homes, recreational vehicles, motorcycles, snowmobiles, and all-terrain vehicles; personal property insurance, such as protection for homes and contents from risks, including fire, theft, vandalism, water damage, and other damages, as well as personal liability coverage; and property coverage for tenants, condominium owners, non-owner-occupied residences, and seasonal residences, as well as travel insurance.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Intact Financial, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Intact Financial wasn’t on the list.

While Intact Financial currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.