Brokers Set Expectations for Invivyd, Inc.’s Q1 2024 Earnings (NASDAQ:IVVD)

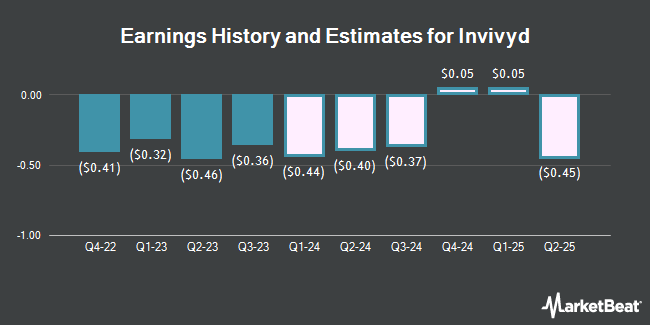

Invivyd, Inc. (NASDAQ:IVVD – Free Report) – Research analysts at HC Wainwright cut their Q1 2024 EPS estimates for shares of Invivyd in a note issued to investors on Monday, April 8th. HC Wainwright analyst P. Trucchio now anticipates that the company will earn ($0.44) per share for the quarter, down from their previous forecast of ($0.39). HC Wainwright has a “Buy” rating and a $15.00 price objective on the stock. The consensus estimate for Invivyd’s current full-year earnings is ($0.74) per share. HC Wainwright also issued estimates for Invivyd’s Q3 2024 earnings at ($0.37) EPS, Q4 2024 earnings at $0.05 EPS, FY2024 earnings at ($1.16) EPS, Q1 2025 earnings at $0.05 EPS, Q2 2025 earnings at ($0.45) EPS, Q3 2025 earnings at ($0.49) EPS, Q4 2025 earnings at ($0.05) EPS, FY2025 earnings at ($0.93) EPS, FY2026 earnings at ($0.13) EPS, FY2027 earnings at $0.41 EPS and FY2028 earnings at $1.09 EPS.

IVVD has been the subject of several other reports. Guggenheim upgraded shares of Invivyd from a “neutral” rating to a “buy” rating and set a $9.00 price objective for the company in a report on Friday, April 5th. Morgan Stanley upgraded shares of Invivyd from an “equal weight” rating to an “overweight” rating and upped their price objective for the stock from $4.00 to $10.00 in a report on Tuesday, March 26th.

Get Our Latest Stock Report on Invivyd

Invivyd Stock Down 3.4 %

Shares of IVVD opened at $2.95 on Thursday. Invivyd has a twelve month low of $0.98 and a twelve month high of $5.20. The stock has a market capitalization of $351.70 million, a P/E ratio of -1.63 and a beta of 0.63. The firm has a fifty day simple moving average of $3.90 and a two-hundred day simple moving average of $3.02.

Insiders Place Their Bets

In other Invivyd news, major shareholder Adimab, Llc sold 5,000,000 shares of the company’s stock in a transaction on Friday, January 19th. The shares were sold at an average price of $3.95, for a total value of $19,750,000.00. Following the completion of the transaction, the insider now directly owns 21,687,906 shares in the company, valued at approximately $85,667,228.70. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Company insiders own 19.10% of the company’s stock.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the business. Vanguard Group Inc. increased its stake in shares of Invivyd by 1.0% in the 4th quarter. Vanguard Group Inc. now owns 2,513,706 shares of the company’s stock worth $9,904,000 after acquiring an additional 24,692 shares in the last quarter. Goldman Sachs Group Inc. increased its stake in shares of Invivyd by 135.9% in the 4th quarter. Goldman Sachs Group Inc. now owns 54,137 shares of the company’s stock worth $213,000 after acquiring an additional 31,186 shares in the last quarter. Barclays PLC bought a new position in shares of Invivyd in the 4th quarter worth about $285,000. Bridgeway Capital Management LLC increased its stake in shares of Invivyd by 14.8% in the 4th quarter. Bridgeway Capital Management LLC now owns 510,900 shares of the company’s stock worth $2,013,000 after acquiring an additional 66,000 shares in the last quarter. Finally, Balyasny Asset Management L.P. bought a new position in shares of Invivyd in the 4th quarter worth about $342,000. 70.36% of the stock is currently owned by institutional investors.

Invivyd Company Profile

Invivyd, Inc, a clinical-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of antibody-based solutions for infectious diseases in the United States. The company’s lead product candidate is adintrevimab, a neutralizing antibody that is in Phase 3 clinical trials for the treatment and prevention of coronavirus disease, as well as developing monoclonal antibody candidates, including VYD222 and VYD224, which provides neutralizing protection against SARS-CoV-2.

Recommended Stories

Receive News & Ratings for Invivyd Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Invivyd and related companies with MarketBeat.com’s FREE daily email newsletter.