Brokers Set Expectations for PulteGroup, Inc.’s FY2025 Earnings (NYSE:PHM)

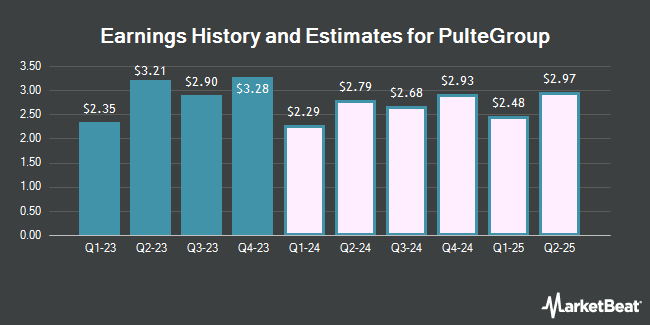

PulteGroup, Inc. (NYSE:PHM – Free Report) – Equities researchers at Seaport Res Ptn issued their FY2025 earnings per share (EPS) estimates for PulteGroup in a note issued to investors on Tuesday, January 30th. Seaport Res Ptn analyst K. Zener anticipates that the construction company will earn $11.91 per share for the year. The consensus estimate for PulteGroup’s current full-year earnings is $11.37 per share.

PulteGroup (NYSE:PHM – Get Free Report) last issued its quarterly earnings results on Tuesday, January 30th. The construction company reported $3.28 EPS for the quarter, beating analysts’ consensus estimates of $3.21 by $0.07. PulteGroup had a return on equity of 25.97% and a net margin of 16.20%. The company had revenue of $4.29 billion during the quarter, compared to the consensus estimate of $4.47 billion. During the same period last year, the business posted $3.63 earnings per share. PulteGroup’s revenue was down 15.5% on a year-over-year basis.

PHM has been the subject of several other research reports. JPMorgan Chase & Co. dropped their price objective on PulteGroup from $120.00 to $117.00 and set an “overweight” rating for the company in a research note on Wednesday, October 25th. Jefferies Financial Group initiated coverage on PulteGroup in a research note on Monday, November 27th. They set a “buy” rating and a $107.00 price target for the company. Citigroup lowered PulteGroup from a “buy” rating to a “neutral” rating and lifted their price target for the stock from $87.00 to $113.00 in a research note on Monday, January 8th. Wedbush reaffirmed a “neutral” rating and set a $85.00 price target on shares of PulteGroup in a research note on Wednesday. Finally, Barclays lifted their price target on PulteGroup from $120.00 to $126.00 and gave the stock an “overweight” rating in a research note on Wednesday. Six investment analysts have rated the stock with a hold rating and eleven have given a buy rating to the company’s stock. According to data from MarketBeat, the company presently has an average rating of “Moderate Buy” and a consensus price target of $99.00.

Read Our Latest Analysis on PulteGroup

PulteGroup Stock Performance

NYSE:PHM opened at $106.73 on Friday. The company has a debt-to-equity ratio of 0.19, a current ratio of 0.86 and a quick ratio of 0.88. The business has a fifty day simple moving average of $100.46 and a two-hundred day simple moving average of $86.44. PulteGroup has a 1 year low of $52.24 and a 1 year high of $110.75. The company has a market capitalization of $23.01 billion, a P/E ratio of 9.09, a P/E/G ratio of 0.31 and a beta of 1.56.

PulteGroup Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 2nd. Shareholders of record on Friday, March 15th will be given a dividend of $0.20 per share. This represents a $0.80 annualized dividend and a yield of 0.75%. PulteGroup’s payout ratio is 6.81%.

PulteGroup announced that its Board of Directors has authorized a share repurchase plan on Tuesday, January 30th that authorizes the company to buyback $1.50 billion in shares. This buyback authorization authorizes the construction company to purchase up to 6.5% of its stock through open market purchases. Stock buyback plans are often an indication that the company’s management believes its shares are undervalued.

Institutional Trading of PulteGroup

Several large investors have recently bought and sold shares of PHM. Illinois Municipal Retirement Fund boosted its position in shares of PulteGroup by 24.9% in the 3rd quarter. Illinois Municipal Retirement Fund now owns 26,341 shares of the construction company’s stock worth $1,951,000 after purchasing an additional 5,257 shares in the last quarter. Dupont Capital Management Corp lifted its position in PulteGroup by 103.9% in the 2nd quarter. Dupont Capital Management Corp now owns 5,903 shares of the construction company’s stock valued at $459,000 after acquiring an additional 3,008 shares in the last quarter. LPL Financial LLC lifted its position in PulteGroup by 95.8% in the 2nd quarter. LPL Financial LLC now owns 134,384 shares of the construction company’s stock valued at $10,439,000 after acquiring an additional 65,746 shares in the last quarter. Acadian Asset Management LLC lifted its position in PulteGroup by 161.1% in the 2nd quarter. Acadian Asset Management LLC now owns 1,253,791 shares of the construction company’s stock valued at $97,376,000 after acquiring an additional 773,543 shares in the last quarter. Finally, Tokio Marine Asset Management Co. Ltd. raised its stake in PulteGroup by 21.5% during the 2nd quarter. Tokio Marine Asset Management Co. Ltd. now owns 5,534 shares of the construction company’s stock valued at $430,000 after buying an additional 979 shares during the last quarter. 89.84% of the stock is owned by institutional investors.

About PulteGroup

PulteGroup, Inc, through its subsidiaries, primarily engages in the homebuilding business in the United States. It acquires and develops land primarily for residential purposes; and constructs housing on such land. The company also offers various home designs, including single-family detached, townhomes, condominiums, and duplexes under the Centex, Pulte Homes, Del Webb, DiVosta Homes, American West, and John Wieland Homes and Neighborhoods brand names.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PulteGroup, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and PulteGroup wasn’t on the list.

While PulteGroup currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

MarketBeat’s analysts have just released their top five short plays for February 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.