Brokers Set Expectations for United Therapeutics Co.’s Q1 2024 Earnings (NASDAQ:UTHR)

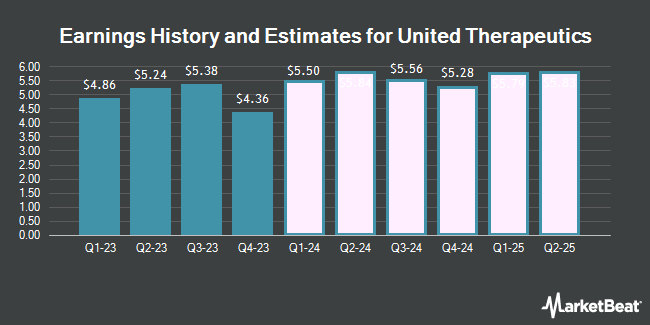

United Therapeutics Co. (NASDAQ:UTHR – Free Report) – Analysts at Leerink Partnrs raised their Q1 2024 earnings estimates for United Therapeutics in a research report issued on Tuesday, March 26th. Leerink Partnrs analyst R. Ruiz now expects that the biotechnology company will post earnings per share of $5.90 for the quarter, up from their prior forecast of $5.87. Leerink Partnrs currently has a “Outperform” rating on the stock. The consensus estimate for United Therapeutics’ current full-year earnings is $23.32 per share. Leerink Partnrs also issued estimates for United Therapeutics’ Q2 2024 earnings at $6.26 EPS and FY2024 earnings at $25.95 EPS.

United Therapeutics (NASDAQ:UTHR – Get Free Report) last announced its earnings results on Wednesday, February 21st. The biotechnology company reported $4.36 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $4.28 by $0.08. United Therapeutics had a net margin of 42.31% and a return on equity of 17.72%. The business had revenue of $614.70 million for the quarter, compared to analyst estimates of $575.01 million. During the same quarter in the previous year, the firm posted $2.67 earnings per share. United Therapeutics’s revenue was up 25.1% compared to the same quarter last year.

Several other brokerages have also issued reports on UTHR. HC Wainwright reissued a “buy” rating and issued a $300.00 price target on shares of United Therapeutics in a report on Thursday, February 22nd. StockNews.com downgraded shares of United Therapeutics from a “strong-buy” rating to a “buy” rating in a research note on Tuesday. Wedbush restated an “outperform” rating and issued a $308.00 target price on shares of United Therapeutics in a research note on Thursday, February 22nd. SVB Leerink started coverage on shares of United Therapeutics in a research report on Monday, February 5th. They set an “outperform” rating and a $330.00 price target on the stock. Finally, The Goldman Sachs Group upgraded shares of United Therapeutics from a “sell” rating to a “neutral” rating and upped their price target for the stock from $213.00 to $215.00 in a research report on Monday, February 12th. One analyst has rated the stock with a hold rating and eleven have assigned a buy rating to the stock. According to MarketBeat.com, the stock currently has a consensus rating of “Moderate Buy” and a consensus price target of $294.40.

Get Our Latest Stock Analysis on UTHR

United Therapeutics Trading Down 5.6 %

Shares of United Therapeutics stock opened at $229.72 on Thursday. The firm has a market capitalization of $10.81 billion, a PE ratio of 11.58 and a beta of 0.52. The company has a debt-to-equity ratio of 0.05, a current ratio of 4.41 and a quick ratio of 4.28. The company’s fifty day moving average price is $225.77 and its two-hundred day moving average price is $227.41. United Therapeutics has a 52-week low of $204.44 and a 52-week high of $261.54.

Hedge Funds Weigh In On United Therapeutics

Hedge funds and other institutional investors have recently made changes to their positions in the stock. GAMMA Investing LLC acquired a new position in shares of United Therapeutics in the fourth quarter worth approximately $43,000. Neo Ivy Capital Management bought a new stake in United Therapeutics in the second quarter worth approximately $48,000. Atlas Capital Advisors LLC bought a new stake in United Therapeutics in the fourth quarter worth approximately $51,000. Northwestern Mutual Wealth Management Co. increased its holdings in United Therapeutics by 49.6% in the fourth quarter. Northwestern Mutual Wealth Management Co. now owns 196 shares of the biotechnology company’s stock worth $55,000 after purchasing an additional 65 shares in the last quarter. Finally, Zions Bancorporation N.A. bought a new stake in shares of United Therapeutics during the first quarter valued at approximately $66,000. 94.08% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, EVP Paul A. Mahon sold 6,000 shares of the firm’s stock in a transaction on Thursday, January 4th. The stock was sold at an average price of $227.97, for a total value of $1,367,820.00. Following the transaction, the executive vice president now owns 36,599 shares in the company, valued at $8,343,474.03. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. In other news, CEO Martine A. Rothblatt sold 15,000 shares of United Therapeutics stock in a transaction dated Tuesday, March 26th. The stock was sold at an average price of $248.33, for a total transaction of $3,724,950.00. Following the sale, the chief executive officer now directly owns 130 shares of the company’s stock, valued at $32,282.90. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP Paul A. Mahon sold 6,000 shares of United Therapeutics stock in a transaction dated Thursday, January 4th. The shares were sold at an average price of $227.97, for a total value of $1,367,820.00. Following the sale, the executive vice president now directly owns 36,599 shares in the company, valued at $8,343,474.03. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 76,680 shares of company stock worth $17,886,630. Company insiders own 12.50% of the company’s stock.

About United Therapeutics

United Therapeutics Corporation, a biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally. The company offers Tyvaso DPI, an inhaled dry powder via pre-filled and single-use cartridges; Tyvaso, an inhaled solution via ultrasonic nebulizer; Remodulin (treprostinil) injection to treat patients with pulmonary arterial hypertension (PAH) to diminish symptoms associated with exercise; Orenitram, a tablet dosage form of treprostinil, to delay disease progression and improve exercise capacity in PAH patients; and Adcirca, an oral PDE-5 inhibitor to enhance the exercise ability in PAH patients.

Recommended Stories

Receive News & Ratings for United Therapeutics Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for United Therapeutics and related companies with MarketBeat.com’s FREE daily email newsletter.