Interactive Brokers Group Inc’s Meteoric Rise: Unpacking the 16%

Interactive Brokers Group Inc (IBKR, Financial) has experienced a notable uptick in its stock performance, with a market capitalization that now stands at $10.04 billion. The current price of $93.79 reflects a recent positive trajectory, with a 0.44% gain over the past week and an impressive 15.81% gain over the past three months. According to GuruFocus’s GF Value, the stock is currently modestly undervalued at $123.86, suggesting potential room for growth. This valuation is consistent with the past GF Valuation, which also indicated that the stock was modestly undervalued three months ago.

Introduction to Interactive Brokers Group Inc

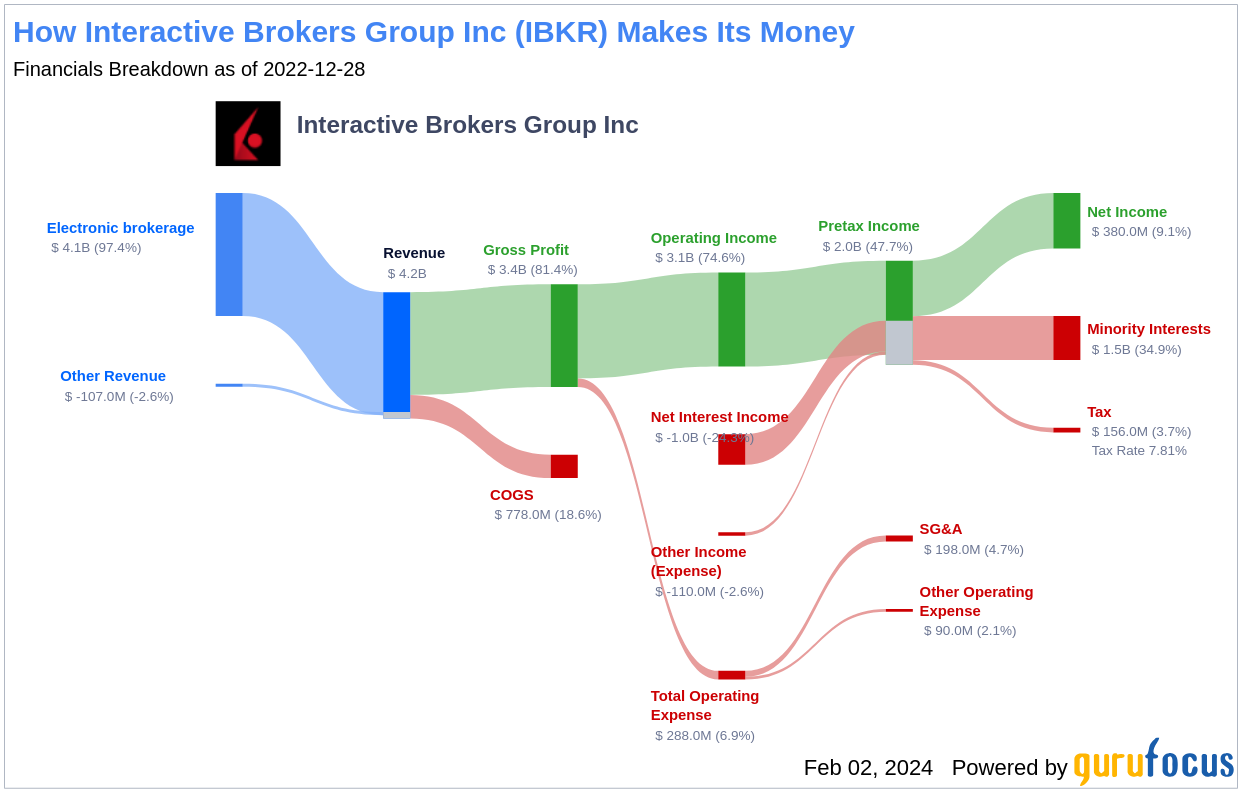

Interactive Brokers Group Inc, operating within the capital markets industry, is a well-established online brokerage firm. The company generates a significant portion of its net revenue, approximately 43%, from trading commissions across a diverse range of products. These include equity, options, futures, foreign exchange, bonds, mutual funds, and ETFs. Additionally, Interactive Brokers benefits from net interest income, which accounts for about 54% of net revenue, primarily from idle client cash. Fees from ancillary services contribute around 6% to the net revenue, while principal trading and other activities have a minor negative impact. The firm’s revenue is predominantly sourced from the U.S., which provides about 70%, with the remaining 30% coming from international markets.

Assessing Interactive Brokers’ Profitability

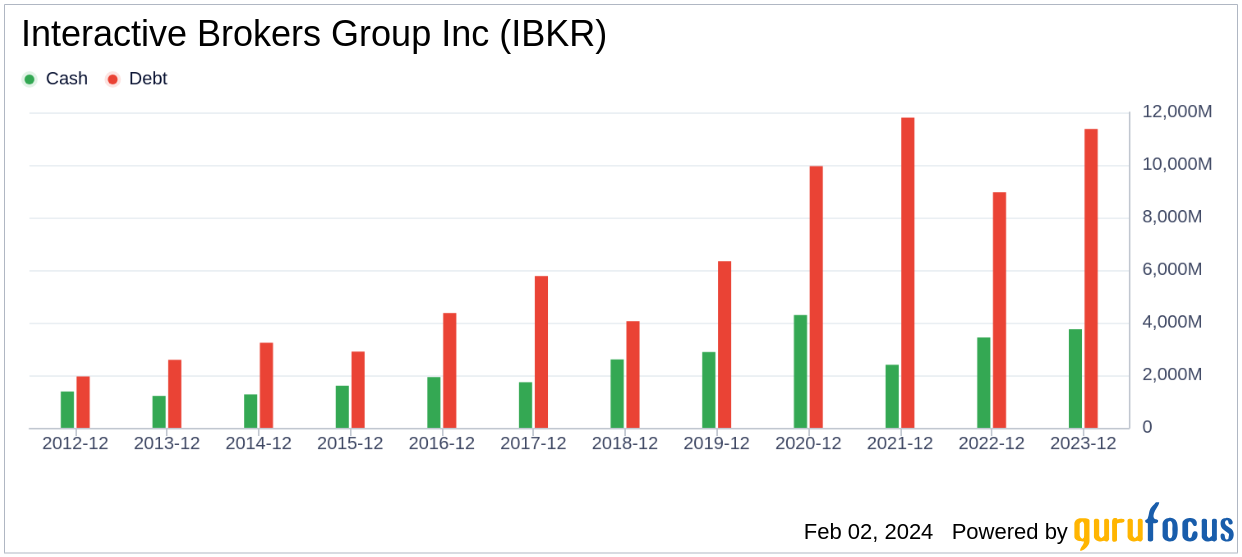

Interactive Brokers Group Inc boasts a strong Profitability Rank of 8/10, reflecting its robust financial health. The company’s operating margin is an impressive 83.92%, outperforming 92.07% of 643 companies in the industry. Its return on equity (ROE) stands at 18.77%, higher than 83.38% of its peers. The return on assets (ROA) is 0.50%, surpassing 40.5% of competitors, while the return on invested capital (ROIC) is a remarkable 30.35%, better than 91.65% of similar companies. Interactive Brokers has maintained profitability for the past 10 years, a testament to its consistent performance and financial stability.

Growth Trajectory of Interactive Brokers

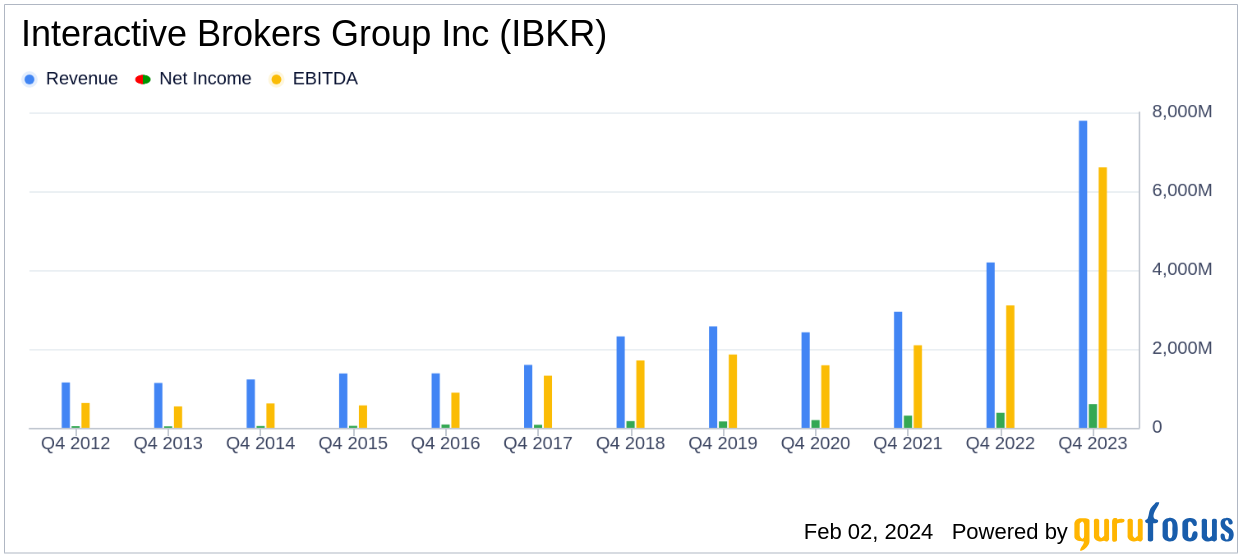

The company’s Growth Rank is also commendable at 8/10. Interactive Brokers has seen a 3-Year Revenue Growth Rate per Share of 7.20%, which is better than 50.67% of 673 companies in the same industry. The 5-Year Revenue Growth Rate per Share is even higher at 8.70%, surpassing 58.14% of its industry peers. Looking ahead, the Total Revenue Growth Rate (Future 3Y To 5Y Est) is projected at 4.55%, which is more optimistic than 49.32% of the industry. The 3-Year EPS without NRI Growth Rate is a robust 21.30%, and the 5-Year EPS without NRI Growth Rate is an even stronger 25.20%. The EPS Growth Rate (Future 3Y To 5Y Est) is estimated at 7.44%, indicating the company’s potential for continued earnings expansion.

Notable Shareholders in Interactive Brokers

Interactive Brokers Group Inc has attracted the attention of several prominent investors. Ron Baron (Trades, Portfolio) leads the pack with 555,818 shares, representing a 0.52% stake in the company. Following him is George Soros (Trades, Portfolio), holding 253,131 shares, which equates to a 0.24% share. Jim Simons (Trades, Portfolio) also has a significant investment with 167,100 shares, accounting for 0.16% of the company’s shares.

Competitive Landscape

When compared to its competitors, Interactive Brokers stands strong. Robinhood Markets Inc (HOOD, Financial) has a market cap slightly lower at $9.32 billion, while MarketAxess Holdings Inc (MKTX, Financial) and Jefferies Financial Group Inc (JEF, Financial) have market caps of $8.21 billion and $8.56 billion, respectively. This places Interactive Brokers at the forefront of the capital markets industry in terms of market capitalization.

Conclusion: Interactive Brokers’ Financial Fortitude and Market Standing

In conclusion, Interactive Brokers Group Inc exhibits a solid financial foundation and a competitive edge in the capital markets sector. The company’s stock performance, particularly the 15.81% gain over the past three months, underscores its market strength and investor confidence. With a GF Value indicating the stock is modestly undervalued, there is potential for further growth. The company’s profitability indicators and growth prospects paint a promising picture for the future, making it an attractive option for value investors seeking a robust and growing company in the capital markets industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.