National Bank Financial Brokers Decrease Earnings Estimates for Franco-Nevada Co. (NYSE:FNV)

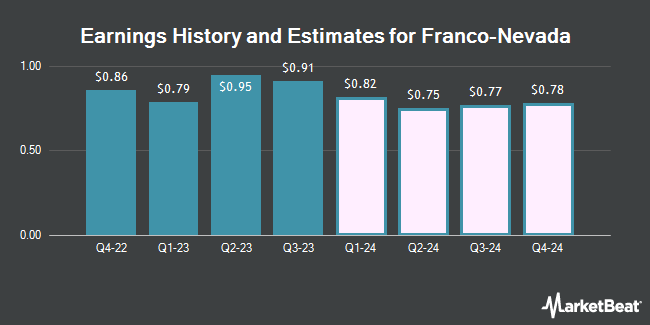

Franco-Nevada Co. (NYSE:FNV – Free Report) (TSE:FNV) – Research analysts at National Bank Financial cut their FY2024 earnings estimates for shares of Franco-Nevada in a note issued to investors on Wednesday, March 6th. National Bank Financial analyst S. Nagle now forecasts that the basic materials company will post earnings of $2.80 per share for the year, down from their prior estimate of $3.00. The consensus estimate for Franco-Nevada’s current full-year earnings is $3.14 per share. National Bank Financial also issued estimates for Franco-Nevada’s FY2026 earnings at $3.32 EPS.

A number of other equities analysts have also recently weighed in on the stock. Raymond James reduced their price target on shares of Franco-Nevada from $148.00 to $141.00 and set an “outperform” rating on the stock in a research report on Tuesday, December 12th. Scotiabank cut their price objective on shares of Franco-Nevada from $141.00 to $139.00 and set a “sector perform” rating on the stock in a research report on Thursday. BMO Capital Markets cut their price objective on shares of Franco-Nevada from $219.00 to $214.00 and set an “outperform” rating on the stock in a research report on Tuesday, November 21st. TD Securities cut their price objective on shares of Franco-Nevada from $135.00 to $125.00 and set a “hold” rating on the stock in a research report on Thursday, November 30th. Finally, TheStreet cut shares of Franco-Nevada from a “c+” rating to a “d+” rating in a research report on Tuesday. One research analyst has rated the stock with a sell rating, six have given a hold rating and four have issued a buy rating to the company. According to MarketBeat, the company currently has a consensus rating of “Hold” and a consensus target price of $148.56.

Get Our Latest Report on Franco-Nevada

Franco-Nevada Stock Up 2.5 %

Shares of NYSE FNV opened at $115.01 on Friday. The company’s fifty day moving average is $108.54 and its 200-day moving average is $120.78. The stock has a market cap of $22.10 billion, a price-to-earnings ratio of -47.33, a P/E/G ratio of 5.27 and a beta of 0.70. Franco-Nevada has a twelve month low of $102.29 and a twelve month high of $161.25.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently bought and sold shares of the stock. Mercer Global Advisors Inc. ADV boosted its holdings in Franco-Nevada by 3.4% in the 2nd quarter. Mercer Global Advisors Inc. ADV now owns 2,234 shares of the basic materials company’s stock valued at $319,000 after purchasing an additional 73 shares during the period. IHT Wealth Management LLC lifted its holdings in shares of Franco-Nevada by 4.6% during the 4th quarter. IHT Wealth Management LLC now owns 1,782 shares of the basic materials company’s stock worth $329,000 after acquiring an additional 78 shares during the period. Fortune Financial Advisors LLC lifted its holdings in shares of Franco-Nevada by 1.8% during the 3rd quarter. Fortune Financial Advisors LLC now owns 4,483 shares of the basic materials company’s stock worth $598,000 after acquiring an additional 81 shares during the period. Thrivent Financial for Lutherans lifted its holdings in shares of Franco-Nevada by 1.7% during the 3rd quarter. Thrivent Financial for Lutherans now owns 5,236 shares of the basic materials company’s stock worth $626,000 after acquiring an additional 85 shares during the period. Finally, Pekin Hardy Strauss Inc. lifted its holdings in shares of Franco-Nevada by 0.5% during the 2nd quarter. Pekin Hardy Strauss Inc. now owns 17,753 shares of the basic materials company’s stock worth $2,532,000 after acquiring an additional 90 shares during the period. Institutional investors and hedge funds own 66.70% of the company’s stock.

Franco-Nevada Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, March 28th. Investors of record on Thursday, March 14th will be paid a $0.36 dividend. The ex-dividend date is Wednesday, March 13th. This represents a $1.44 dividend on an annualized basis and a yield of 1.25%. This is a positive change from Franco-Nevada’s previous quarterly dividend of $0.34. Franco-Nevada’s dividend payout ratio is -55.97%.

About Franco-Nevada

Franco-Nevada Corporation operates as a gold-focused royalty and streaming company in Latin America, the United States, Canada, and internationally. It operates through Mining and Energy segments. The company manages its portfolio with a focus on precious metals, such as gold, silver, and platinum group metals; and engages in the sale of crude oil, natural gas, and natural gas liquids.

Read More

Receive News & Ratings for Franco-Nevada Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Franco-Nevada and related companies with MarketBeat.com’s FREE daily email newsletter.