Raymond James Brokers Lower Earnings Estimates for Ero Copper Corp. (NYSE:ERO)

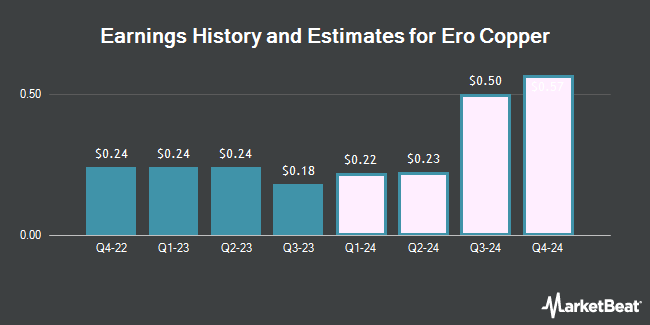

Ero Copper Corp. (NYSE:ERO – Free Report) – Analysts at Raymond James lowered their Q2 2024 EPS estimates for Ero Copper in a note issued to investors on Wednesday, February 21st. Raymond James analyst F. Hamed now anticipates that the company will earn $0.13 per share for the quarter, down from their prior estimate of $0.27. The consensus estimate for Ero Copper’s current full-year earnings is $0.84 per share. Raymond James also issued estimates for Ero Copper’s Q3 2024 earnings at $0.68 EPS, Q4 2024 earnings at $0.82 EPS and FY2024 earnings at $1.76 EPS.

Ero Copper Trading Up 1.2 %

Shares of ERO opened at $16.58 on Monday. The company has a current ratio of 1.23, a quick ratio of 0.94 and a debt-to-equity ratio of 0.65. Ero Copper has a 12-month low of $11.35 and a 12-month high of $24.38. The firm has a 50-day moving average price of $15.75 and a 200 day moving average price of $15.90. The firm has a market capitalization of $1.70 billion, a P/E ratio of 19.51 and a beta of 1.23.

Institutional Investors Weigh In On Ero Copper

Hedge funds have recently modified their holdings of the company. Qube Research & Technologies Ltd purchased a new stake in shares of Ero Copper in the third quarter valued at about $27,000. Acuitas Investments LLC boosted its stake in Ero Copper by 61.5% during the fourth quarter. Acuitas Investments LLC now owns 2,100 shares of the company’s stock worth $33,000 after buying an additional 800 shares during the period. US Bancorp DE purchased a new position in Ero Copper during the fourth quarter worth about $54,000. Deutsche Bank AG purchased a new position in Ero Copper during the fourth quarter worth about $66,000. Finally, Stonehage Fleming Financial Services Holdings Ltd purchased a new position in Ero Copper during the fourth quarter worth about $79,000. Hedge funds and other institutional investors own 52.86% of the company’s stock.

About Ero Copper

Ero Copper Corp. engages in the exploration, development, and production of mining projects in Brazil. The company engages in the production and sale of copper concentrate from the Caraíba operations, located within the Curaçá Valley, northeastern Bahia state, as well as gold and silver by-products. It also holds a 99.6% interest in the Tucumã project, a copper development project located within southeastern Pará state; and holds a 97.6% interest in the Xavantina Operations located in Mato Grosso state.

Recommended Stories

Receive News & Ratings for Ero Copper Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Ero Copper and related companies with MarketBeat.com’s FREE daily email newsletter.