Seaport Res Ptn Brokers Cut Earnings Estimates for Boot Barn Holdings, Inc. (NYSE:BOOT)

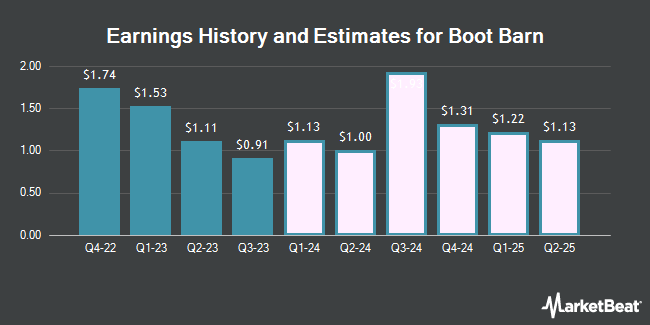

Boot Barn Holdings, Inc. (NYSE:BOOT – Free Report) – Research analysts at Seaport Res Ptn lowered their FY2024 earnings estimates for Boot Barn in a report released on Monday, January 22nd. Seaport Res Ptn analyst M. Kummetz now anticipates that the company will post earnings of $4.90 per share for the year, down from their previous forecast of $4.92. The consensus estimate for Boot Barn’s current full-year earnings is $4.98 per share. Seaport Res Ptn also issued estimates for Boot Barn’s Q4 2024 earnings at $1.09 EPS, FY2025 earnings at $5.50 EPS and FY2026 earnings at $6.20 EPS.

A number of other brokerages also recently weighed in on BOOT. Citigroup lowered their price objective on shares of Boot Barn from $116.00 to $96.00 and set a “buy” rating on the stock in a research report on Tuesday, October 24th. B. Riley started coverage on shares of Boot Barn in a report on Tuesday, November 21st. They set a “buy” rating and a $92.00 target price for the company. UBS Group raised shares of Boot Barn from a “neutral” rating to a “buy” rating and upped their target price for the company from $75.00 to $108.00 in a report on Friday, January 5th. StockNews.com cut shares of Boot Barn from a “hold” rating to a “sell” rating in a report on Friday, January 19th. Finally, Piper Sandler reduced their target price on shares of Boot Barn from $120.00 to $99.00 and set an “overweight” rating for the company in a report on Friday, November 3rd. One research analyst has rated the stock with a sell rating, two have given a hold rating and nine have assigned a buy rating to the stock. Based on data from MarketBeat.com, Boot Barn currently has a consensus rating of “Moderate Buy” and a consensus price target of $104.30.

Read Our Latest Research Report on BOOT

Boot Barn Stock Performance

Shares of NYSE BOOT opened at $73.53 on Wednesday. The company has a market cap of $2.23 billion, a PE ratio of 13.87, a P/E/G ratio of 5.33 and a beta of 2.25. The firm’s 50 day moving average price is $74.30 and its 200-day moving average price is $81.28. Boot Barn has a 52-week low of $64.33 and a 52-week high of $104.91.

Boot Barn (NYSE:BOOT – Get Free Report) last issued its earnings results on Thursday, November 2nd. The company reported $0.91 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.88 by $0.03. The firm had revenue of $374.46 million for the quarter, compared to the consensus estimate of $378.44 million. Boot Barn had a net margin of 9.49% and a return on equity of 20.28%.

Hedge Funds Weigh In On Boot Barn

Several institutional investors have recently bought and sold shares of BOOT. State of Wyoming grew its stake in Boot Barn by 57.3% during the second quarter. State of Wyoming now owns 552 shares of the company’s stock valued at $47,000 after acquiring an additional 201 shares in the last quarter. Dark Forest Capital Management LP bought a new position in Boot Barn during the first quarter valued at $68,000. Pinebridge Investments L.P. bought a new position in Boot Barn during the second quarter valued at $77,000. Lazard Asset Management LLC lifted its position in Boot Barn by 75.3% during the fourth quarter. Lazard Asset Management LLC now owns 1,686 shares of the company’s stock valued at $105,000 after purchasing an additional 724 shares during the last quarter. Finally, Point72 Hong Kong Ltd bought a new position in Boot Barn during the second quarter valued at $105,000.

Insider Transactions at Boot Barn

In other news, CFO James M. Watkins sold 15,099 shares of the stock in a transaction on Tuesday, November 7th. The shares were sold at an average price of $75.19, for a total value of $1,135,293.81. Following the completion of the sale, the chief financial officer now directly owns 12,819 shares of the company’s stock, valued at $963,860.61. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Corporate insiders own 2.20% of the company’s stock.

About Boot Barn

Boot Barn Holdings, Inc, a lifestyle retail chain, operates specialty retail stores in the United States. The company’s specialty retail stores offer western and work-related footwear, apparel, and accessories for men, women, and kids. It offers boots, shirts, jackets, hats, belts and belt buckles, handbags, western-style jewelry, rugged footwear, outerwear, overalls, denim, and flame-resistant and high-visibility clothing.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Boot Barn, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Boot Barn wasn’t on the list.

While Boot Barn currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Which stocks are major institutional investors including hedge funds and endowments buying in today’s market? Click the link below and we’ll send you MarketBeat’s list of thirteen stocks that institutional investors are buying up as quickly as they can.