Seaport Res Ptn Brokers Cut Earnings Estimates for Citigroup Inc. (NYSE:C)

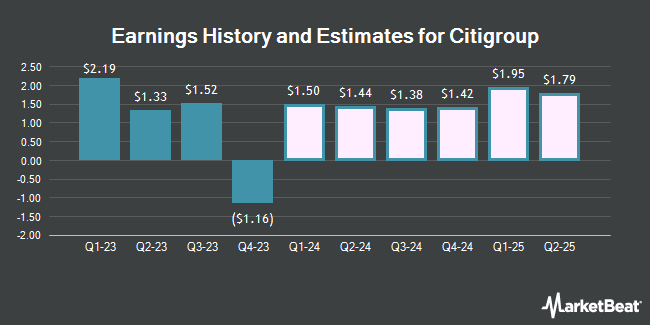

Citigroup Inc. (NYSE:C – Free Report) – Equities researchers at Seaport Res Ptn decreased their Q1 2024 earnings estimates for Citigroup in a report released on Thursday, April 4th. Seaport Res Ptn analyst J. Mitchell now expects that the company will post earnings per share of $1.15 for the quarter, down from their previous forecast of $1.73. The consensus estimate for Citigroup’s current full-year earnings is $5.79 per share. Seaport Res Ptn also issued estimates for Citigroup’s Q2 2024 earnings at $1.56 EPS and Q4 2024 earnings at $1.60 EPS.

Other equities analysts have also recently issued reports about the company. The Goldman Sachs Group reiterated a “buy” rating on shares of Citigroup in a research note on Monday, April 1st. Wells Fargo & Company reiterated an “overweight” rating and set a $80.00 target price on shares of Citigroup in a research note on Monday, April 1st. TheStreet upgraded Citigroup from a “c+” rating to a “b-” rating in a research note on Wednesday, December 13th. Societe Generale cut Citigroup from a “hold” rating to a “sell” rating in a research note on Monday, January 8th. Finally, Daiwa Capital Markets upgraded Citigroup from a “neutral” rating to a “buy” rating and set a $63.00 target price for the company in a research note on Monday, December 18th. One analyst has rated the stock with a sell rating, five have assigned a hold rating and eleven have assigned a buy rating to the stock. According to MarketBeat.com, the stock has an average rating of “Moderate Buy” and a consensus target price of $61.27.

View Our Latest Stock Analysis on Citigroup

Citigroup Stock Performance

Citigroup stock opened at $61.60 on Monday. The stock has a market cap of $117.98 billion, a P/E ratio of 15.44, a price-to-earnings-growth ratio of 0.95 and a beta of 1.52. The company has a current ratio of 0.95, a quick ratio of 0.95 and a debt-to-equity ratio of 1.52. The stock has a 50 day moving average of $57.41 and a 200-day moving average of $49.99. Citigroup has a 52 week low of $38.17 and a 52 week high of $63.90.

Citigroup (NYSE:C – Get Free Report) last issued its quarterly earnings data on Friday, January 12th. The company reported ($1.16) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.73 by ($1.89). Citigroup had a net margin of 5.88% and a return on equity of 6.49%. The firm had revenue of $17.44 billion during the quarter, compared to analyst estimates of $18.71 billion. During the same period last year, the business earned $1.10 EPS. The firm’s revenue was down 3.1% compared to the same quarter last year.

Citigroup Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, May 24th. Shareholders of record on Monday, May 6th will be paid a $0.53 dividend. This represents a $2.12 dividend on an annualized basis and a yield of 3.44%. The ex-dividend date of this dividend is Friday, May 3rd. Citigroup’s payout ratio is 53.13%.

Institutional Investors Weigh In On Citigroup

A number of hedge funds have recently added to or reduced their stakes in the stock. Snider Financial Group increased its holdings in shares of Citigroup by 96,645.9% during the first quarter. Snider Financial Group now owns 84,494,926 shares of the company’s stock valued at $4,512,000 after purchasing an additional 84,407,589 shares during the period. Geode Capital Management LLC increased its holdings in shares of Citigroup by 1.5% during the first quarter. Geode Capital Management LLC now owns 35,179,006 shares of the company’s stock valued at $1,646,775,000 after purchasing an additional 519,202 shares during the period. Morgan Stanley increased its holdings in shares of Citigroup by 2.6% during the fourth quarter. Morgan Stanley now owns 25,852,678 shares of the company’s stock valued at $1,169,317,000 after purchasing an additional 666,560 shares during the period. Fisher Asset Management LLC increased its holdings in shares of Citigroup by 8.0% during the fourth quarter. Fisher Asset Management LLC now owns 24,755,277 shares of the company’s stock valued at $1,273,411,000 after purchasing an additional 1,836,283 shares during the period. Finally, Northern Trust Corp increased its holdings in shares of Citigroup by 1.2% during the third quarter. Northern Trust Corp now owns 20,051,311 shares of the company’s stock valued at $824,710,000 after purchasing an additional 232,652 shares during the period. 71.72% of the stock is currently owned by institutional investors.

About Citigroup

Citigroup Inc, a diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions worldwide. It operates through five segments: Services, Markets, Banking, U.S. Personal Banking, and Wealth. The Services segment includes Treasury and Trade Solutions, which provides cash management, trade, and working capital solutions to multinational corporations, financial institutions, and public sector organizations; and Securities Services, such as cross-border support for clients, local market expertise, post-trade technologies, data solutions, and various securities services solutions.

See Also

Receive News & Ratings for Citigroup Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Citigroup and related companies with MarketBeat.com’s FREE daily email newsletter.