Taglich Brothers Brokers Lower Earnings Estimates for Intellinetics, Inc. (NYSEAMERICAN:INLX)

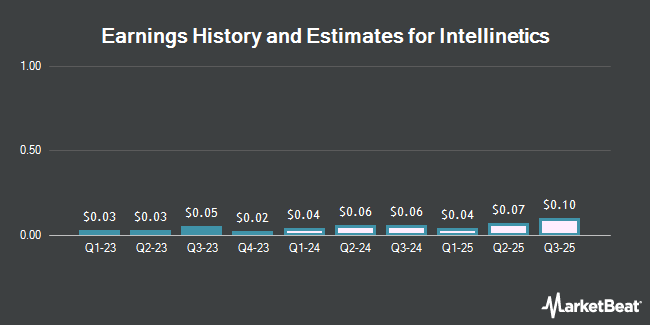

Intellinetics, Inc. (NYSEAMERICAN:INLX – Free Report) – Analysts at Taglich Brothers dropped their Q1 2024 earnings per share estimates for Intellinetics in a research note issued to investors on Tuesday, April 2nd. Taglich Brothers analyst H. Halpern now forecasts that the company will post earnings per share of $0.04 for the quarter, down from their prior estimate of $0.06. The consensus estimate for Intellinetics’ current full-year earnings is $0.30 per share. Taglich Brothers also issued estimates for Intellinetics’ Q2 2024 earnings at $0.06 EPS, Q3 2024 earnings at $0.06 EPS, Q1 2025 earnings at $0.04 EPS, Q2 2025 earnings at $0.07 EPS, Q3 2025 earnings at $0.10 EPS, Q4 2025 earnings at $0.07 EPS and FY2025 earnings at $0.28 EPS.

Intellinetics Stock Performance

Shares of NYSEAMERICAN:INLX opened at $6.09 on Thursday. The stock has a market capitalization of $25.03 million, a PE ratio of 46.85 and a beta of 0.32. Intellinetics has a 52-week low of $2.92 and a 52-week high of $10.99. The company has a debt-to-equity ratio of 0.31, a current ratio of 1.01 and a quick ratio of 0.99.

Intellinetics (NYSEAMERICAN:INLX – Get Free Report) last announced its quarterly earnings data on Thursday, March 28th. The company reported $0.02 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.04 by ($0.02). Intellinetics had a return on equity of 5.73% and a net margin of 3.08%. The firm had revenue of $4.19 million during the quarter, compared to analysts’ expectations of $4.10 million.

Institutional Trading of Intellinetics

A hedge fund recently bought a new stake in Intellinetics stock. Vanguard Group Inc. acquired a new stake in Intellinetics, Inc. (NYSEAMERICAN:INLX – Free Report) during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 10,325 shares of the company’s stock, valued at approximately $52,000. Vanguard Group Inc. owned 0.25% of Intellinetics at the end of the most recent quarter. Institutional investors and hedge funds own 0.75% of the company’s stock.

About Intellinetics

Intellinetics, Inc designs, develops, tests, markets, and licenses document services and software solutions in the United States. The company operates in two segments, Document Management and Document Conversion. Its software platform allows its customers to capture and manage documents across operations, such as scanned hard-copy documents and digital documents, including Microsoft Office 365, digital images, audios, videos, and emails.

Featured Articles

Receive News & Ratings for Intellinetics Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Intellinetics and related companies with MarketBeat.com’s FREE daily email newsletter.