Telsey Advisory Group Brokers Decrease Earnings Estimates for adidas AG (OTCMKTS:ADDYY)

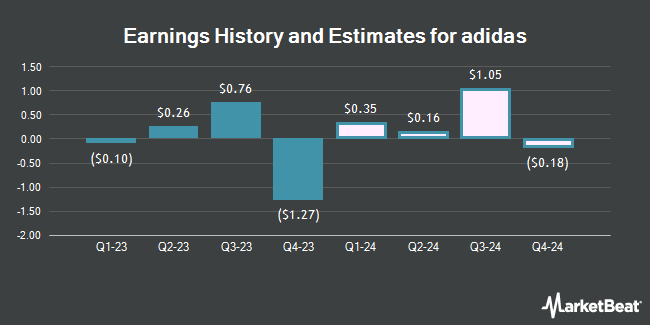

adidas AG (OTCMKTS:ADDYY – Free Report) – Research analysts at Telsey Advisory Group cut their Q3 2024 EPS estimates for shares of adidas in a note issued to investors on Wednesday, May 1st. Telsey Advisory Group analyst C. Fernandez now forecasts that the company will post earnings of $1.23 per share for the quarter, down from their previous forecast of $1.30. The consensus estimate for adidas’ current full-year earnings is $1.83 per share. Telsey Advisory Group also issued estimates for adidas’ Q1 2025 earnings at $0.98 EPS, Q2 2025 earnings at $0.85 EPS, Q3 2025 earnings at $1.81 EPS, Q4 2025 earnings at $0.06 EPS and FY2026 earnings at $5.66 EPS.

A number of other equities analysts have also commented on the stock. Stifel Nicolaus upgraded shares of adidas from a “hold” rating to a “buy” rating in a report on Wednesday, April 24th. Royal Bank of Canada upgraded adidas from a “sector perform” rating to an “outperform” rating in a research note on Monday, February 5th. Finally, Morgan Stanley raised adidas from an “underweight” rating to an “overweight” rating in a research report on Monday, April 15th. Eight research analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, adidas currently has an average rating of “Buy”.

Check Out Our Latest Research Report on adidas

adidas Price Performance

OTCMKTS ADDYY opened at $121.18 on Friday. The company’s fifty day simple moving average is $110.33 and its 200-day simple moving average is $101.59. The company has a debt-to-equity ratio of 0.49, a current ratio of 1.22 and a quick ratio of 0.66. adidas has a 52 week low of $79.58 and a 52 week high of $125.54.

adidas (OTCMKTS:ADDYY – Get Free Report) last issued its earnings results on Wednesday, March 13th. The company reported ($1.27) earnings per share for the quarter, missing the consensus estimate of ($0.91) by ($0.36). The company had revenue of $5.18 billion during the quarter, compared to analysts’ expectations of $5.22 billion. adidas had a negative return on equity of 2.21% and a negative net margin of 0.33%.

adidas Cuts Dividend

The business also recently declared a dividend, which will be paid on Wednesday, May 29th. Investors of record on Monday, May 20th will be issued a $0.2394 dividend. The ex-dividend date of this dividend is Friday, May 17th. adidas’s dividend payout ratio (DPR) is -109.09%.

Institutional Investors Weigh In On adidas

Hedge funds have recently added to or reduced their stakes in the stock. Capital Square LLC acquired a new stake in adidas in the 4th quarter valued at approximately $1,405,000. GAMMA Investing LLC acquired a new position in shares of adidas during the fourth quarter valued at $45,000. Fisher Asset Management LLC raised its stake in shares of adidas by 27.5% during the fourth quarter. Fisher Asset Management LLC now owns 12,741 shares of the company’s stock valued at $1,296,000 after purchasing an additional 2,749 shares in the last quarter. Finally, Mar Vista Investment Partners LLC lifted its holdings in adidas by 8.0% in the fourth quarter. Mar Vista Investment Partners LLC now owns 27,044 shares of the company’s stock worth $2,749,000 after purchasing an additional 2,000 shares during the period.

adidas Company Profile

adidas AG, together with its subsidiaries, designs, develops, produces, and markets athletic and sports lifestyle products in Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific, and Latin America. It offers footwear, apparel, and accessories and gear, such as bags and balls under the adidas brand; golf footwear and apparel under the adidas Golf brand; and outdoor footwear under the Five Ten brand.

Read More

Receive News & Ratings for adidas Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for adidas and related companies with MarketBeat.com’s FREE daily email newsletter.