William Blair Brokers Lower Earnings Estimates for Glaukos Co. (NYSE:GKOS)

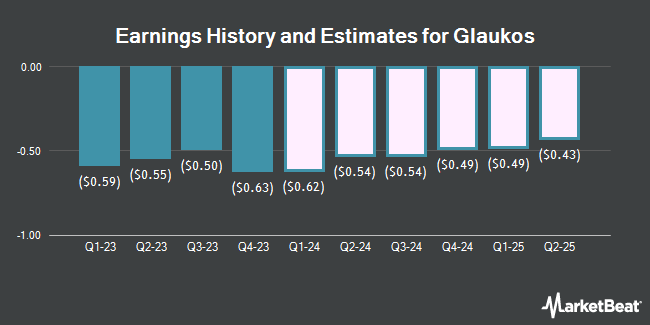

Glaukos Co. (NYSE:GKOS – Free Report) – Stock analysts at William Blair lowered their Q1 2024 earnings estimates for Glaukos in a report issued on Thursday, February 22nd. William Blair analyst M. Kaczor now anticipates that the medical instruments supplier will earn ($0.66) per share for the quarter, down from their prior forecast of ($0.54). The consensus estimate for Glaukos’ current full-year earnings is ($2.13) per share. William Blair also issued estimates for Glaukos’ Q2 2024 earnings at ($0.56) EPS, Q3 2024 earnings at ($0.56) EPS, Q4 2024 earnings at ($0.39) EPS, FY2024 earnings at ($2.17) EPS and Q4 2025 earnings at ($0.35) EPS.

Glaukos (NYSE:GKOS – Get Free Report) last released its earnings results on Wednesday, February 21st. The medical instruments supplier reported ($0.63) EPS for the quarter, missing the consensus estimate of ($0.56) by ($0.07). Glaukos had a negative return on equity of 22.67% and a negative net margin of 42.79%. The company had revenue of $82.40 million during the quarter, compared to analysts’ expectations of $81.00 million. During the same period last year, the firm posted ($0.53) EPS. Glaukos’s quarterly revenue was up 15.7% compared to the same quarter last year.

Other equities analysts also recently issued research reports about the stock. JPMorgan Chase & Co. raised shares of Glaukos from a “neutral” rating to an “overweight” rating and boosted their target price for the stock from $66.00 to $91.00 in a report on Thursday, December 21st. TheStreet downgraded shares of Glaukos from a “c-” rating to a “d+” rating in a research note on Friday, November 24th. Wells Fargo & Company upped their price target on shares of Glaukos from $83.00 to $103.00 and gave the company an “overweight” rating in a research note on Thursday. Piper Sandler upped their price target on shares of Glaukos from $90.00 to $105.00 and gave the company an “overweight” rating in a research note on Friday, December 22nd. Finally, Morgan Stanley initiated coverage on shares of Glaukos in a research note on Monday, December 4th. They set an “equal weight” rating and a $65.00 price target on the stock. Three research analysts have rated the stock with a hold rating and six have given a buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of “Moderate Buy” and a consensus target price of $91.80.

View Our Latest Research Report on GKOS

Glaukos Price Performance

GKOS stock opened at $89.57 on Monday. Glaukos has a one year low of $44.26 and a one year high of $97.24. The company’s fifty day moving average price is $88.05 and its 200-day moving average price is $76.09. The company has a debt-to-equity ratio of 0.77, a quick ratio of 5.36 and a current ratio of 5.34. The company has a market capitalization of $4.37 billion, a PE ratio of -32.22 and a beta of 1.11.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently added to or reduced their stakes in GKOS. National Bank of Canada FI bought a new position in Glaukos during the 4th quarter worth about $46,000. GAMMA Investing LLC purchased a new stake in shares of Glaukos during the fourth quarter valued at about $55,000. Tower Research Capital LLC TRC raised its position in shares of Glaukos by 257.8% in the 1st quarter. Tower Research Capital LLC TRC now owns 1,238 shares of the medical instruments supplier’s stock valued at $62,000 after purchasing an additional 892 shares during the last quarter. Silverarc Capital Management LLC purchased a new position in shares of Glaukos in the 2nd quarter valued at approximately $71,000. Finally, Quadrant Capital Group LLC raised its position in shares of Glaukos by 54.8% in the 4th quarter. Quadrant Capital Group LLC now owns 929 shares of the medical instruments supplier’s stock valued at $74,000 after purchasing an additional 329 shares during the last quarter. 99.04% of the stock is currently owned by institutional investors.

Insider Activity

In other news, CFO Alex R. Thurman sold 1,270 shares of the company’s stock in a transaction dated Friday, December 15th. The shares were sold at an average price of $79.80, for a total value of $101,346.00. Following the transaction, the chief financial officer now directly owns 55,825 shares in the company, valued at $4,454,835. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. In other news, CFO Alex R. Thurman sold 1,270 shares of the company’s stock in a transaction dated Friday, December 15th. The shares were sold at an average price of $79.80, for a total value of $101,346.00. Following the transaction, the chief financial officer now directly owns 55,825 shares in the company, valued at $4,454,835. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, COO Joseph E. Gilliam sold 524 shares of the company’s stock in a transaction dated Monday, January 22nd. The stock was sold at an average price of $94.01, for a total transaction of $49,261.24. Following the completion of the transaction, the chief operating officer now owns 119,802 shares in the company, valued at $11,262,586.02. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 264,915 shares of company stock valued at $22,173,725. 7.80% of the stock is currently owned by company insiders.

About Glaukos

Glaukos Corporation, an ophthalmic medical technology and pharmaceutical company, focuses on the development of novel therapies for the treatment of glaucoma, corneal disorders, and retinal diseases. It offers iStent, iStent inject, iStent inject W micro-bypass stents that enhance aqueous humor outflow inserted in cataract surgery to treat mild-to-moderate open-angle glaucoma.

Further Reading

Receive News & Ratings for Glaukos Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Glaukos and related companies with MarketBeat.com’s FREE daily email newsletter.