Zacks Research Brokers Cut Earnings Estimates for Mid-America Apartment Communities, Inc. (NYSE:MAA)

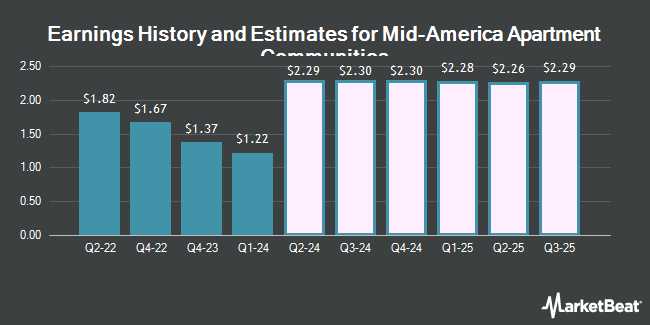

Mid-America Apartment Communities, Inc. (NYSE:MAA – Free Report) – Stock analysts at Zacks Research cut their Q2 2024 earnings per share estimates for Mid-America Apartment Communities in a research report issued to clients and investors on Wednesday, May 22nd. Zacks Research analyst R. Department now anticipates that the real estate investment trust will post earnings per share of $2.20 for the quarter, down from their previous estimate of $2.25. The consensus estimate for Mid-America Apartment Communities’ current full-year earnings is $8.87 per share. Zacks Research also issued estimates for Mid-America Apartment Communities’ Q3 2024 earnings at $2.20 EPS, FY2024 earnings at $8.84 EPS, Q1 2025 earnings at $2.24 EPS, Q2 2025 earnings at $2.24 EPS, Q3 2025 earnings at $2.30 EPS, Q4 2025 earnings at $2.32 EPS, FY2025 earnings at $9.10 EPS, Q1 2026 earnings at $2.33 EPS and FY2026 earnings at $9.68 EPS.

Mid-America Apartment Communities (NYSE:MAA – Get Free Report) last issued its earnings results on Thursday, May 2nd. The real estate investment trust reported $1.22 earnings per share for the quarter, missing analysts’ consensus estimates of $2.23 by ($1.01). The company had revenue of $543.60 million for the quarter, compared to the consensus estimate of $541.44 million. Mid-America Apartment Communities had a return on equity of 8.90% and a net margin of 25.92%. Mid-America Apartment Communities’s revenue was up 2.8% compared to the same quarter last year. During the same quarter in the prior year, the company posted $2.28 EPS.

MAA has been the subject of several other research reports. Morgan Stanley increased their price objective on shares of Mid-America Apartment Communities from $129.50 to $138.50 and gave the company an “equal weight” rating in a research report on Wednesday, May 15th. Mizuho cut their price target on shares of Mid-America Apartment Communities from $132.00 to $126.00 and set a “neutral” rating on the stock in a report on Wednesday, February 28th. Piper Sandler reaffirmed a “neutral” rating and issued a $140.00 price objective on shares of Mid-America Apartment Communities in a research report on Tuesday, March 26th. UBS Group raised their price target on shares of Mid-America Apartment Communities from $126.00 to $131.00 and gave the stock a “sell” rating in a research note on Tuesday, May 14th. Finally, Royal Bank of Canada restated a “sector perform” rating and set a $136.00 price objective on shares of Mid-America Apartment Communities in a report on Friday, February 9th. Two equities research analysts have rated the stock with a sell rating, ten have issued a hold rating and four have issued a buy rating to the stock. Based on data from MarketBeat.com, Mid-America Apartment Communities currently has an average rating of “Hold” and a consensus price target of $144.18.

Check Out Our Latest Analysis on MAA

Mid-America Apartment Communities Stock Down 0.4 %

Shares of MAA opened at $136.00 on Thursday. The business’s 50 day simple moving average is $131.25 and its 200-day simple moving average is $129.62. Mid-America Apartment Communities has a 1 year low of $115.56 and a 1 year high of $158.46. The stock has a market capitalization of $15.89 billion, a price-to-earnings ratio of 28.51, a price-to-earnings-growth ratio of 3.04 and a beta of 0.80. The company has a debt-to-equity ratio of 0.74, a current ratio of 0.12 and a quick ratio of 0.12.

Mid-America Apartment Communities Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Wednesday, July 31st. Investors of record on Monday, July 15th will be issued a dividend of $1.47 per share. This represents a $5.88 dividend on an annualized basis and a yield of 4.32%. The ex-dividend date is Monday, July 15th. Mid-America Apartment Communities’s dividend payout ratio (DPR) is presently 123.27%.

Insider Activity at Mid-America Apartment Communities

In other news, CEO H Eric Bolton, Jr. sold 2,642 shares of the firm’s stock in a transaction dated Friday, April 5th. The stock was sold at an average price of $126.07, for a total transaction of $333,076.94. Following the sale, the chief executive officer now directly owns 317,737 shares in the company, valued at approximately $40,057,103.59. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Over the last quarter, insiders have sold 2,807 shares of company stock worth $353,955. 1.30% of the stock is owned by company insiders.

Institutional Trading of Mid-America Apartment Communities

Several institutional investors have recently bought and sold shares of the business. Norges Bank purchased a new position in shares of Mid-America Apartment Communities during the 4th quarter valued at approximately $713,500,000. Massachusetts Financial Services Co. MA raised its position in shares of Mid-America Apartment Communities by 188.9% during the 4th quarter. Massachusetts Financial Services Co. MA now owns 1,451,578 shares of the real estate investment trust’s stock worth $195,179,000 after purchasing an additional 949,171 shares during the last quarter. Blackstone Inc. lifted its stake in Mid-America Apartment Communities by 51.8% in the 3rd quarter. Blackstone Inc. now owns 2,043,861 shares of the real estate investment trust’s stock valued at $262,943,000 after buying an additional 697,200 shares in the last quarter. Balyasny Asset Management L.P. boosted its holdings in Mid-America Apartment Communities by 96.9% in the 4th quarter. Balyasny Asset Management L.P. now owns 1,220,328 shares of the real estate investment trust’s stock worth $164,085,000 after buying an additional 600,547 shares during the last quarter. Finally, FMR LLC increased its stake in Mid-America Apartment Communities by 12.2% during the 3rd quarter. FMR LLC now owns 5,457,634 shares of the real estate investment trust’s stock worth $702,125,000 after buying an additional 592,306 shares in the last quarter. 93.60% of the stock is owned by institutional investors and hedge funds.

About Mid-America Apartment Communities

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

See Also

Receive News & Ratings for Mid-America Apartment Communities Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Mid-America Apartment Communities and related companies with MarketBeat.com’s FREE daily email newsletter.