Zacks Research Brokers Decrease Earnings Estimates for Ally Financial Inc. (NYSE:ALLY)

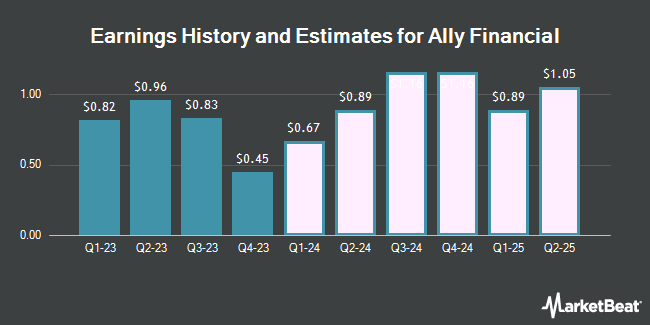

Ally Financial Inc. (NYSE:ALLY – Free Report) – Zacks Research reduced their Q1 2024 earnings per share (EPS) estimates for Ally Financial in a research note issued on Thursday, April 4th. Zacks Research analyst N. Kataruka now forecasts that the financial services provider will post earnings of $0.44 per share for the quarter, down from their prior estimate of $0.59. The consensus estimate for Ally Financial’s current full-year earnings is $3.06 per share. Zacks Research also issued estimates for Ally Financial’s Q2 2024 earnings at $0.60 EPS, Q3 2024 earnings at $0.77 EPS, Q4 2024 earnings at $0.73 EPS, FY2024 earnings at $2.54 EPS, Q3 2025 earnings at $1.05 EPS, Q4 2025 earnings at $1.03 EPS, FY2025 earnings at $3.97 EPS, Q1 2026 earnings at $1.27 EPS and FY2026 earnings at $7.23 EPS.

A number of other equities analysts also recently commented on the company. Raymond James downgraded Ally Financial from a “market perform” rating to an “underperform” rating in a research report on Friday, January 5th. Deutsche Bank Aktiengesellschaft began coverage on Ally Financial in a report on Wednesday, January 10th. They issued a “buy” rating and a $47.00 price target for the company. JPMorgan Chase & Co. downgraded Ally Financial from a “neutral” rating to an “underweight” rating and upped their price target for the company from $37.00 to $39.00 in a report on Wednesday, April 3rd. Royal Bank of Canada reissued an “outperform” rating and issued a $40.00 price objective on shares of Ally Financial in a report on Monday, January 22nd. Finally, Morgan Stanley raised Ally Financial from an “equal weight” rating to an “overweight” rating and increased their price objective for the company from $37.00 to $47.00 in a report on Thursday, February 8th. Five analysts have rated the stock with a sell rating, seven have issued a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of “Hold” and an average target price of $36.25.

Get Our Latest Analysis on Ally Financial

Ally Financial Stock Performance

Shares of Ally Financial stock opened at $38.38 on Monday. Ally Financial has a one year low of $22.54 and a one year high of $41.56. The company has a market cap of $11.58 billion, a PE ratio of 12.84 and a beta of 1.40. The company has a debt-to-equity ratio of 1.54, a quick ratio of 0.90 and a current ratio of 0.90. The business has a 50-day simple moving average of $37.46 and a 200-day simple moving average of $32.18.

Ally Financial (NYSE:ALLY – Get Free Report) last announced its quarterly earnings data on Friday, January 19th. The financial services provider reported $0.45 EPS for the quarter, topping analysts’ consensus estimates of $0.44 by $0.01. Ally Financial had a return on equity of 9.41% and a net margin of 12.42%. The business had revenue of $2.07 billion during the quarter, compared to the consensus estimate of $1.99 billion. During the same period in the previous year, the company posted $1.08 earnings per share.

Ally Financial Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Thursday, February 15th. Stockholders of record on Thursday, February 1st were given a $0.30 dividend. This represents a $1.20 dividend on an annualized basis and a dividend yield of 3.13%. The ex-dividend date was Wednesday, January 31st. Ally Financial’s dividend payout ratio is currently 40.13%.

Institutional Inflows and Outflows

Hedge funds have recently made changes to their positions in the company. NBC Securities Inc. purchased a new position in shares of Ally Financial in the third quarter valued at $26,000. Salem Investment Counselors Inc. increased its position in shares of Ally Financial by 115.0% in the first quarter. Salem Investment Counselors Inc. now owns 645 shares of the financial services provider’s stock valued at $28,000 after buying an additional 345 shares in the last quarter. PCA Investment Advisory Services Inc. purchased a new position in shares of Ally Financial in the second quarter valued at $30,000. Northwest Financial Advisors purchased a new position in shares of Ally Financial in the fourth quarter valued at $31,000. Finally, Quarry LP increased its position in shares of Ally Financial by 165.7% in the fourth quarter. Quarry LP now owns 959 shares of the financial services provider’s stock valued at $33,000 after buying an additional 598 shares in the last quarter. Hedge funds and other institutional investors own 88.76% of the company’s stock.

About Ally Financial

Ally Financial Inc, a digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda. The company operates through Automotive Finance Operations, Insurance Operations, Mortgage Finance Operations, and Corporate Finance Operations segments.

Featured Articles

Receive News & Ratings for Ally Financial Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Ally Financial and related companies with MarketBeat.com’s FREE daily email newsletter.