Zacks Research Brokers Decrease Earnings Estimates for Murphy USA Inc. (NYSE:MUSA)

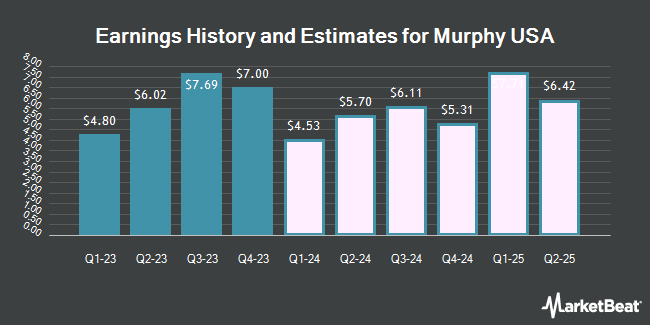

Murphy USA Inc. (NYSE:MUSA – Free Report) – Analysts at Zacks Research decreased their Q1 2024 earnings per share estimates for Murphy USA in a research report issued on Wednesday, February 21st. Zacks Research analyst N. Choudhury now expects that the specialty retailer will post earnings of $4.97 per share for the quarter, down from their previous forecast of $5.20. The consensus estimate for Murphy USA’s current full-year earnings is $25.58 per share. Zacks Research also issued estimates for Murphy USA’s Q4 2024 earnings at $6.69 EPS, Q1 2025 earnings at $7.71 EPS, Q3 2025 earnings at $4.17 EPS and Q4 2025 earnings at $6.06 EPS.

Murphy USA (NYSE:MUSA – Get Free Report) last posted its earnings results on Wednesday, February 7th. The specialty retailer reported $7.00 EPS for the quarter, topping analysts’ consensus estimates of $5.79 by $1.21. The company had revenue of $5.07 billion for the quarter, compared to the consensus estimate of $5.32 billion. Murphy USA had a return on equity of 70.92% and a net margin of 2.59%. The firm’s revenue for the quarter was down 5.5% on a year-over-year basis. During the same period in the previous year, the business earned $5.21 earnings per share.

MUSA has been the topic of a number of other research reports. Jefferies Financial Group raised Murphy USA from a “hold” rating to a “buy” rating and upped their target price for the company from $375.00 to $425.00 in a research note on Thursday, January 4th. Stephens reaffirmed an “overweight” rating and set a $425.00 target price on shares of Murphy USA in a research note on Thursday, February 8th. Royal Bank of Canada upped their target price on Murphy USA from $382.00 to $408.00 and gave the company a “sector perform” rating in a research note on Thursday, February 8th. Finally, Wells Fargo & Company upped their target price on Murphy USA from $395.00 to $440.00 and gave the company an “overweight” rating in a research note on Friday, February 9th. One analyst has rated the stock with a sell rating, one has issued a hold rating and four have issued a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of “Moderate Buy” and an average target price of $395.60.

Murphy USA Trading Up 1.6 %

Shares of NYSE MUSA opened at $413.46 on Friday. The business’s 50 day moving average is $371.34 and its two-hundred day moving average is $354.85. The company has a debt-to-equity ratio of 2.15, a current ratio of 0.95 and a quick ratio of 0.56. Murphy USA has a 1-year low of $231.65 and a 1-year high of $414.15. The stock has a market capitalization of $8.60 billion, a P/E ratio of 16.21 and a beta of 0.74.

Institutional Inflows and Outflows

A number of large investors have recently added to or reduced their stakes in the business. Resonant Capital Advisors LLC increased its position in shares of Murphy USA by 3.6% during the third quarter. Resonant Capital Advisors LLC now owns 801 shares of the specialty retailer’s stock worth $274,000 after acquiring an additional 28 shares during the period. Creative Planning increased its holdings in Murphy USA by 1.4% in the fourth quarter. Creative Planning now owns 2,011 shares of the specialty retailer’s stock valued at $717,000 after buying an additional 28 shares during the last quarter. Quadrant Capital Group LLC increased its holdings in Murphy USA by 19.0% in the fourth quarter. Quadrant Capital Group LLC now owns 188 shares of the specialty retailer’s stock valued at $67,000 after buying an additional 30 shares during the last quarter. Blue Trust Inc. increased its holdings in Murphy USA by 7.3% in the fourth quarter. Blue Trust Inc. now owns 499 shares of the specialty retailer’s stock valued at $170,000 after buying an additional 34 shares during the last quarter. Finally, Fifth Third Bancorp increased its holdings in Murphy USA by 34.2% in the third quarter. Fifth Third Bancorp now owns 153 shares of the specialty retailer’s stock valued at $52,000 after buying an additional 39 shares during the last quarter. 83.95% of the stock is currently owned by institutional investors and hedge funds.

Murphy USA Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, March 7th. Investors of record on Monday, February 26th will be issued a $0.42 dividend. The ex-dividend date is Friday, February 23rd. This is a boost from Murphy USA’s previous quarterly dividend of $0.41. This represents a $1.68 dividend on an annualized basis and a yield of 0.41%. Murphy USA’s dividend payout ratio is currently 6.43%.

Murphy USA Company Profile

Murphy USA Inc engages in marketing of retail motor fuel products and convenience merchandise. The company operates retail stores under the Murphy USA, Murphy Express, and QuickChek brands. It operates retail gasoline stores principally in the Southeast, Southwest, and Midwest United States. The company was founded in 1996 and is headquartered in El Dorado, Arkansas.

Recommended Stories

Receive News & Ratings for Murphy USA Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Murphy USA and related companies with MarketBeat.com’s FREE daily email newsletter.