Zacks Research Brokers Reduce Earnings Estimates for WESCO International, Inc. (NYSE:WCC)

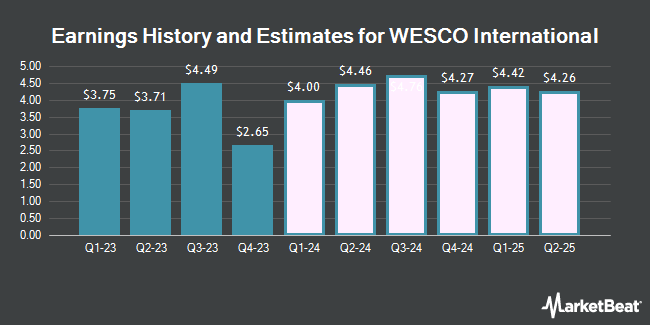

WESCO International, Inc. (NYSE:WCC – Free Report) – Equities researchers at Zacks Research cut their Q1 2024 earnings estimates for WESCO International in a report released on Tuesday, March 5th. Zacks Research analyst R. Department now expects that the technology company will earn $2.69 per share for the quarter, down from their previous forecast of $3.28. The consensus estimate for WESCO International’s current full-year earnings is $14.64 per share. Zacks Research also issued estimates for WESCO International’s FY2024 earnings at $14.64 EPS, Q1 2025 earnings at $3.73 EPS, Q3 2025 earnings at $4.57 EPS and FY2025 earnings at $16.98 EPS.

Other equities analysts also recently issued reports about the company. Royal Bank of Canada downgraded WESCO International from an “outperform” rating to a “sector perform” rating and reduced their price target for the company from $202.00 to $173.00 in a report on Tuesday, February 13th. Robert W. Baird reduced their target price on WESCO International from $203.00 to $170.00 and set an “outperform” rating for the company in a report on Wednesday, February 14th. KeyCorp lowered their price target on WESCO International from $185.00 to $165.00 and set an “overweight” rating on the stock in a report on Wednesday, February 14th. Oppenheimer lifted their price objective on WESCO International from $175.00 to $190.00 and gave the stock an “outperform” rating in a report on Thursday. Finally, StockNews.com cut shares of WESCO International from a “buy” rating to a “hold” rating in a report on Wednesday, February 14th. Two analysts have rated the stock with a hold rating and four have issued a buy rating to the company’s stock. According to MarketBeat.com, WESCO International presently has an average rating of “Moderate Buy” and a consensus price target of $181.33.

View Our Latest Analysis on WCC

WESCO International Price Performance

WCC stock opened at $159.86 on Friday. The company has a debt-to-equity ratio of 1.06, a quick ratio of 1.42 and a current ratio of 2.48. The firm has a market capitalization of $8.15 billion, a price-to-earnings ratio of 11.81, a PEG ratio of 1.06 and a beta of 2.05. The firm has a 50 day moving average price of $165.12 and a 200-day moving average price of $156.24. WESCO International has a 52-week low of $121.90 and a 52-week high of $195.43.

WESCO International (NYSE:WCC – Get Free Report) last posted its earnings results on Tuesday, February 13th. The technology company reported $2.65 EPS for the quarter, missing the consensus estimate of $3.86 by ($1.21). WESCO International had a return on equity of 17.01% and a net margin of 3.42%. The company had revenue of $5.50 billion during the quarter, compared to analysts’ expectations of $5.59 billion. During the same period in the prior year, the business posted $4.13 earnings per share. The company’s revenue for the quarter was down 1.8% on a year-over-year basis.

WESCO International Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, March 29th. Shareholders of record on Friday, March 15th will be issued a dividend of $0.4125 per share. This is a boost from WESCO International’s previous quarterly dividend of $0.38. This represents a $1.65 dividend on an annualized basis and a yield of 1.03%. The ex-dividend date of this dividend is Thursday, March 14th. WESCO International’s dividend payout ratio is currently 12.19%.

Insider Buying and Selling

In other WESCO International news, EVP Nelson John Squires III sold 3,490 shares of WESCO International stock in a transaction that occurred on Thursday, February 8th. The shares were sold at an average price of $190.00, for a total transaction of $663,100.00. Following the transaction, the executive vice president now owns 54,385 shares of the company’s stock, valued at $10,333,150. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. 2.60% of the stock is owned by insiders.

Institutional Trading of WESCO International

Several institutional investors have recently made changes to their positions in WCC. KB Financial Partners LLC boosted its stake in WESCO International by 76.8% in the 3rd quarter. KB Financial Partners LLC now owns 198 shares of the technology company’s stock worth $28,000 after purchasing an additional 86 shares during the period. Anchor Investment Management LLC purchased a new position in WESCO International during the fourth quarter valued at $48,000. Park Place Capital Corp increased its holdings in WESCO International by 41.3% in the 3rd quarter. Park Place Capital Corp now owns 294 shares of the technology company’s stock valued at $42,000 after acquiring an additional 86 shares during the last quarter. GAMMA Investing LLC purchased a new stake in WESCO International in the 4th quarter worth $56,000. Finally, Fred Alger Management LLC bought a new position in shares of WESCO International during the 3rd quarter valued at about $60,000. Hedge funds and other institutional investors own 99.15% of the company’s stock.

About WESCO International

WESCO International, Inc provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally. It operates through three segments: Electrical & Electronic Solutions (EES), Communications & Security Solutions (CSS), and Utility and Broadband Solutions (UBS).

Read More

Receive News & Ratings for WESCO International Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for WESCO International and related companies with MarketBeat.com’s FREE daily email newsletter.