Artificial intelligence factors into uncertainty of commodities future

You rely on precision instruments to accurately place each seed into the ground and GPS to guide your sprayer and evenly apply herbicide. You may even trust your phone to automatically shut off your irrigation system. But are you ready for technology to manage your marketing strategies?

Ready or not, artificial intelligence (AI) is already at play in the marketplace. Based on the volatility and economic events over the past few years, it is hard not to jump to conclusions about the impact AI could have on market prices.

Economist Mike Zuzolo believes AI is why producers perceive a growing disconnect in how commodity prices are determined. He began researching AI marketing to allay fears for his producer clients of how it could impact markets.

Zuzolo embarked on his career in economics 29 years ago. In 2001, he and three other men formed their own company, then in 2009 he started his own consulting firm and brokerage company in Atchison, Kansas. Global Commodity Analytics and Consulting LLC is celebrating its 15th year in 2024. Most of Zuzolo’s clients are on the “supply side” of the markets.

His investigation of AI in the marketplace is based on the premise that “knowledge is the antidote of fear,” to quote Ralph Waldo Emerson.

“Producers don’t understand what’s happening, and they often don’t have time to understand it unless they have people looking at it for them. We in commodities need to connect those dots for producers,” said Zuzolo.

As the CEO of AgWest Commodities, Justin Trompke also works closely with producers from all commodity sectors. An agricultural brokerage firm based out of Holdrege, Nebraska, AgWest Commodities has 10 total offices in Nebraska, Iowa, Colorado and Kansas and 2,600 customer accounts in 24 states. Trompke is not concerned that AI will take over the personal way they do business, but he is wary of AI’s influence on markets.

Trompke poses a valid question: Will artificial intelligence make markets more volatile or less volatile?

The answer to that is as complex as the markets themselves.

“Technology gains, coupled with the financialization of commodities, have created an environment where prices are as much about macro-economics—like currencies, interest rates, GDP, crude oil demand—as they are about their own supply fundamentals of each individual commodity,” Zuzolo said.

Trade once involved manually taking notes with pen and paper, researching and gathering marketing data and making transactions in-person at the Board of Trade. Trompke explained the traditional fundamentals and technical aspects of marketing.

“We get articles every day about what’s going on in Brazil, China, Russia, what the weather’s doing, what’s driving prices,” he said. “We read through subscriptions of news articles, then try to formulate a decision based on where you think that risk is for the day, week, month, year.”

The desire to have a computerized trade model likely began in the 1970s and especially into the 1980s, when computers became number crunchers, Zuzolo conjectured based on his research. Electronic trading, which is a computerized exchange programmed on set parameters, is nothing new.

“In my experience, algorithmic trading, or the price discovery that algorithms do, is what has been done since I started with marketing in 1995,” said Zuzolo.

Algorithmic trading sped up the research process involved in the trade industry by scrubbing news articles for key words, USDA reports for predefined triggers or the stock exchange for patterns and anomalies. Trompke referred to it as “Cliff Notes” for bundling extensive information into something easier to digest.

AI elevates the process to a whole new level. It not only augments the speed of data surveillance but also has a learning mechanism to “act intelligently based on the conclusions made,” as stated in the article “Leveraging AI: The Future of Commodity Trading.”

These analytical capabilities are brand new, said Zuzolo: “Generative artificial intelligence is going to try to think like a human being and make assumptions and decisions and recommendations like a human being.”

In 2020, the International Journal of Engineering described what AI systems are capable of doing in the marketing division: “The data component in financial trading does not just calculate fluctuations and changes in price; it also tries to comprehend the various reasons for these price fluctuations. The process of data collections makes way for various predictive models.”

The afore-mentioned article “Leveraging AI” outlined two AI technologies utilized within the commodity trading arena, which are paraphrased below:

1. Natural Language Processing (NLP): can sift through thousands of documents, emails, messaging platforms, video streams and phone conversations in seconds to harness and translate information; can create summaries based on the data evaluated

2. Machine Learning (ML): gathers data from internal and external venues, surveys markets and assesses NLP data to predict risk and outcomes; the more information it is exposed to, the smarter it becomes

With these intellectual attributes, AI could become a powerful force in the commodities marketplace. At this point, AI has limitations, though. The Commodity Futures Trading Commission (CFTC) alleges that “no matter how innovative the technology may be, AI neither has the ability to predict the future nor to foresee sudden market changes.”

Yet the fact that the CFTC released an AI Advisory (Release No. 8854-24) and an AI Request for Comment (RCF) shows that they are concerned about the technology’s potential. According to an article from “The National Law Review” published on Feb. 8, CFTC announced their regulatory involvement after President Joe Biden also issued an executive order of New Standards for AI Safety and Security.

CFTC had already attempted to regulate AI by establishing LabCFTC in July 2022. This unit is “focused on efforts to promote responsible fintech innovation and fair competition,” as stated in the article “How AI is Advancing the Securities and Commodities Industry,” published Jan. 19, 2023.

Conversely, the Financial Industry Regulatory Authority (FINRA) is relying on “deep learning” to ensure safer markets. AI is being used as a tool for market manipulation surveillance “to address changing market conditions, increased volatility, increased volumes and change in conduct in order to protect investors and ensure market integrity.”

People are also reading…

But to Zuzolo, the request from a federal agency for information about AI shows that the government also sees that disconnect is arising in the marketplace.

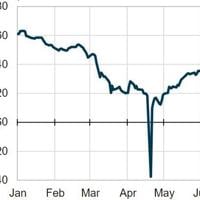

Wheat prices are an example of the growing disconnect between producers and commodity prices. This chart reflects the stocks to use ratio for both U.S. and world wheat.

To show the prolonged incongruency in both the grain and commodities markets, Zuzolo used wheat as a prime example because it is produced all over the world and is very sensitive to currencies.

At the time of Zuzolo’s interview with Midwest Messenger during the second week of February, wheat ending stocks were the second lowest since 2014. The world stocks to use ratio were the lowest since 2014, as well. Wheat prices for both the U.S. and world were the lowest in almost a decade and still lingering near a 3-year low.

“Why would we continue to see these kind of depressed prices given the stock numbers we have right now?” questioned Zuzolo.

While there is no documentation that AI or electronic trading controls the market, one can speculate that the use of technology in marketing incites volatility in price movement. Trompke referred to corn swinging from $8 to $4 as the “rubber band” of emotional marketing.

“In my opinion, the emotion is why markets react pretty violently to a drought or headline,” Trompke said, adding that he could see AI calming volatility because it is designed to remove the human reaction within the trading process.

Zuzolo does not consider technology within marketing as good or bad in and of itself until a significant event occurs that a computer cannot navigate. Remember the pandemic, for example. On April 20, 2020, the West Texas Intermediate crude oil futures spiraled from $17.85 to -$40.32.

“Within a 24-hour timeframe, crude oil had a $53 price change,” Zuzolo said.

Typically, a $50 move spans a six-month range.

This -$40 price lasted only a few hours. By the next day, the markets had returned to $16.74 and $13.86.

“In that one instance, you can see a fundamental factor of maximum fear in the trade because of the pandemic. Price movement was magnified and amplified in a matter of hours,” said Zuzolo. “The crude oil market and futures did something they had never done before—go negative.”

The current unrest in the Middle East is causing oil market fluctuations, which are incited by algorithmic trading, as revealed by a Feb. 8 article from Bloomberg. The article charts how crude oil slumped following an announcement of Gaza cease-fire negotiations. The next week, the Israeli prime minister refuted his peace claims, and crude oil rose 3.2% to $76 a barrel.

The “triggered algorithmic buying” that initiated the oil rally is not surprising as one-third of the world’s oil is supplied by this war-torn region.

“It’s not as important to know whether AI controls markets as it is to understand that they can impact the markets so substantially, they can do a lot of damage,” Zuzolo said.

With such a delicate and global marketing system, the threat of a food crisis is real. If the market for corn, soybeans or livestock were to follow crude oil into negative values, it could completely disrupt production.

“A result of this AI reliance is the increasing potential for a food crisis, because prices are not held in check to what a human would think about,” Zuzolo said.

Production could be lost to the point that it never returns. Farming unfortunately involves taking risks, but even farmers know you cannot make a living or pay the bills with negative prices. Technology would not understand the dire implications that could result. AI may be able to analyze and digest information, but its critical thinking cannot equate human comprehension.

Humans still dominate the trading world, but as Trompke said, AI is the new frontier of trading and commodity marketing. He believes speculators could gain an advantage from AI, whereas his line of business in the hedging arena likely will not be affected. The need remains for brokers and trade advisors to guide producers through marketing decisions in a face-to-face fashion.

“With marketing being an incredibly emotional part of the farmer’s duties, they can get paralyzed by the violent swings in markets,” Trompke said. “We dive deep into our clients’ operations to understand what they want and need, and then we focus on managing the risk they have—both price risk and emotional risk—so they can make better decisions and understand what an opportunity looks like specifically for them. That’s something AI can’t do.”

Zuzolo strives to educate his clients so they better understand the disconnect and volatility occurring in the commodities.

He shared a piece of advice for all producers: “We can’t fight funds. We can be aware of them, and we can stay focused on hedging for profit when profit comes and recognize that profits may not be around for as long because of the way they trade and impact our futures market.”

Providing good research and analysis to his producer clients is his life’s work. “I want to protect the producer side,” said Zuzolo.

He understands how emotional marketing can be for all involved.

“We in agriculture are very emotional because we love what we do,” Zuzolo said. “Whether a broker or producer, in either line of work we have passion and love for our job, our vocation.”

AI may vacuum the emotion from marketing, but it can never replace the passion farmers feel when caring for their land or livestock. As this emerging technology evolves, time will tell how the commodities markets fare in the AI era. Are we in for a tumultuous future, or will AI reduce volatility?

Regardless of what happens, just remember—don’t get too emotional. Commodity trading involves substantial risk of loss and is not suitable for all investors.

Reporter Kristen Sindelar has loved agriculture her entire life, coming from a diversified farm with three generations working side-by-side in northeastern Nebraska. Reach her at Kristen.Sindelar@midwestmessenger.com.