Commodities rise in 1Q24 despite groans from grains | Insights

This article was written by Jim Wiederhold, Commodity Indices Product Manager at Bloomberg.

Will classic late cycle commodities outperformance occur?

Commodities, as measured by the Bloomberg Commodities Index (BCOM), rose 2.2% on a total return basis in the first quarter of 2024 as energy powered higher and gold achieved new all-time highs. The total return of BCOM outperformed the excess return by 1.3% as the 3M US T-bill yield (the collateral yield component of the total return) rose over the course of February as fixed income sold off. The macro landscape is rife with tailwinds for the commodities asset class and several key themes crystallized to start the year when looking at specific commodities markets. The breadth of advance in equity markets was not mirrored in commodities as seen with the grains sector continuing lower after four consecutive quarters of losses throughout 2023. Diversification is key within a broad commodities allocation and a balanced index like the Bloomberg Commodity Index (BCOM) can enhance returns in a portfolio when dispersion picks up.

Explore our index families.

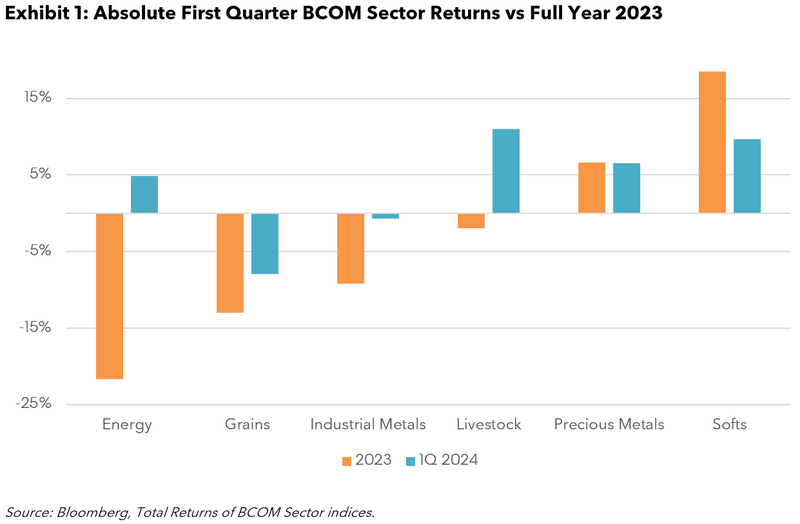

Commodity sector performance and the late cycle environment in the US

Exhibit 1 shows the disparate nature of returns across commodities markets over the first three months of 2024. Some sectors reversed the negative performance seen in 2023, like energy and livestock, while others continued their trends lower in the case of grains and industrial metals. On the opposite side of the spectrum, precious metals and softs kept up their strong positive return momentum. One of the major tailwinds for the energy sector came from OPEC+ which continued to agree to production cuts enacted last year. Geopolitical flareups also contributed to the rise in prices with attacks in the Red Sea adding to the uncertainty of energy commodities supply. Geopolitical conflict was one of the six key themes we highlighted in our 2024 outlook at the start of this year. Grains prices moved lower with the momentum continuing from last year. Ample supply of corn, soybeans, and wheat provided a fundamental reason for market participants to increase short positions which are now near multiyear extreme levels. The two best performing sectors from 2023, precious metals and softs, continued to rise in price to start 2024. Uncertainty in the markets, and a search for a store of value, led central banks to boost their gold holdings and push the price to all-time highs. Softs all rose this quarter with similar themes seen across cocoa, coffee, cotton, and sugar. Conversely to grains, the supply of the soft commodities has been strained. After years of softs’ prices trading near cost of production lows, the last year and quarter may be the start of a new bull market for this less traded sector of commodities.

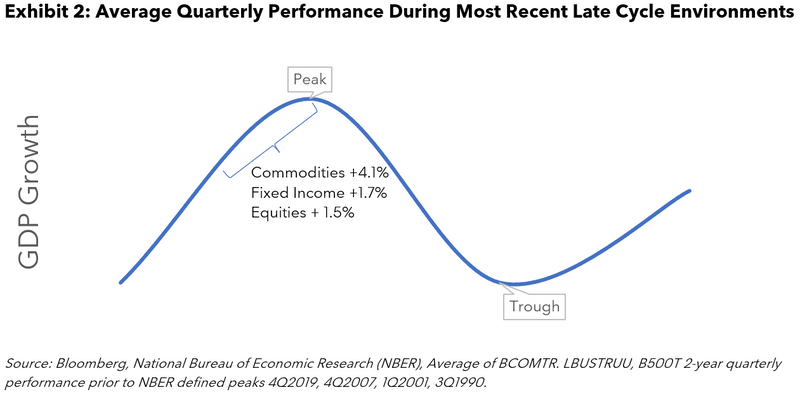

Late cycle environments, like what we may be in now, tend to be conducive for commodity outperformance. Economic activity reaches a peak where growth slows but remains positive. Key interest rates are reduced by central banks stimulating economic activity. Capital expenditures start to decline leading to drops in production and supply. With growth still positive, demand stays strong but the reduction in supply can lead to commodity price increases. Exhibit 2 highlights typical asset class performance during the late phase of the expansion within the business cycle. We looked at the two years prior to the peaks in 2019, 2007, 2001, and 1990. As the performance of equities and bonds cooled, diversifying with an asset class like commodities would’ve helped dampen overall portfolio volatility and increase returns when markets started to turn over after the business cycle peaks.

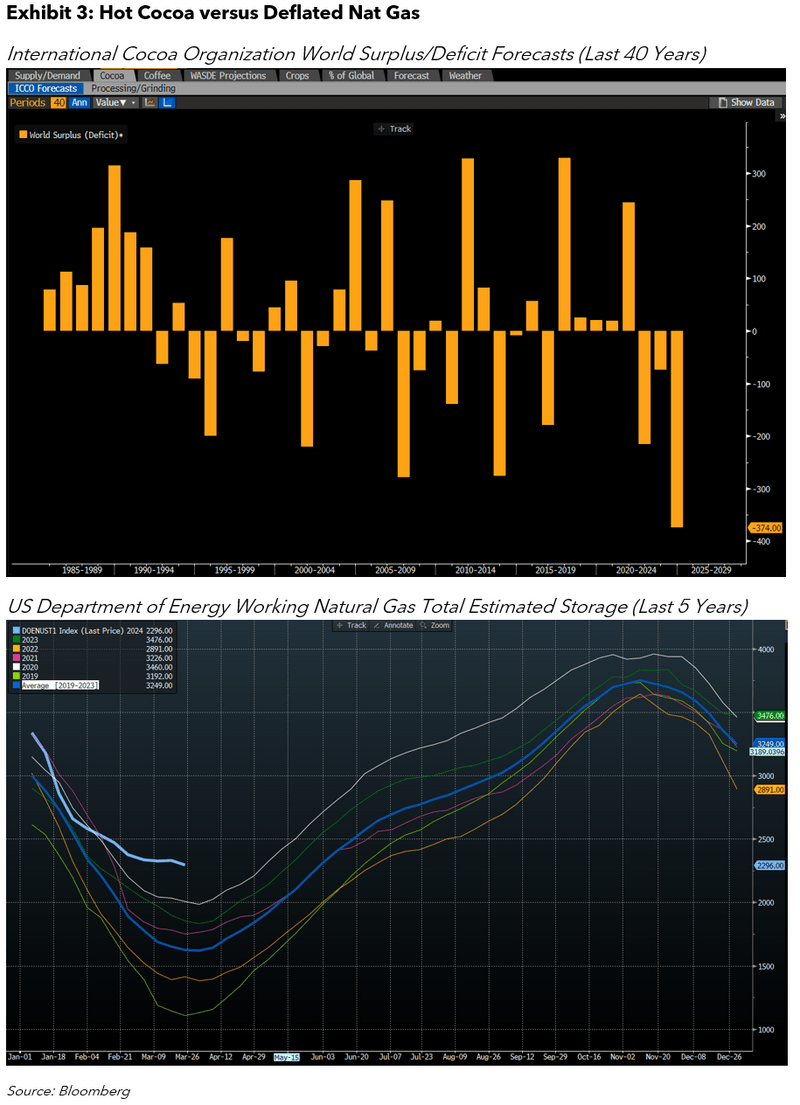

Tail of two commodities – Huge difference between best and worst performing

The most striking performances last quarter belonged to natural gas and cocoa. Nat gas prices flirted with multi decade lows falling 25% as storage was filled well above 5y averages. A very mild winter in the northern hemisphere reduced demand for one of the hardest to store major commodities. Red hot cocoa prices in NY screamed past previous all-time highs seen back in the 1970s more than doubling in the first quarter of 2024. Global demand for chocolate has risen but the worst supply shortage in 40 years caused the surge in cocoa prices. The crop produced in Africa was hit hard by adverse weather (another key theme in our 2024 outlook blog), shortages of fertilizer and most importantly outbreaks of disease of the trees that produce it. Cocoa has some of the longest production cycles due to the number of years it takes for a tree to grow into a productive plant. When Cacao trees are infected with disease, they need to be cut down to stop the spread. This drastically reduced supply forecasts and led to the bullish price action in the cocoa futures markets.

Mostly positive commodity 1Q performance mirrored good economic data in this late cycle

Despite inflation cooling, commodities rose to start the year. Late business cycle environments tend to be a good time for commodities within a strategic asset allocation. Individual commodity performance varied widely from the best performing to the worst performing as can be expected based on history. Exposure to the asset class from a diversified approach like BCOM can help market participants who may be overexposed to equities and fixed income as the latter asset classes potentially reach near term peaks.

The data and other information included in this publication is for illustrative purposes only, available “as is”, non-binding and constitutes the provision of factual information, rather than financial product advice. BLOOMBERG and BLOOMBERG INDICES (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. (“BFLP”). BFLP and its affiliates, including BISL, the administrator of the Indices, or their licensors own all proprietary rights in the Indices. Bloomberg L.P. (“BLP”) or one of its subsidiaries provides BFLP, BISL and its subsidiaries with global marketing and operational support and service.