Porphyries: Deposits holding the winning trifecta with copper, gold, silver

Source: ProRealTime

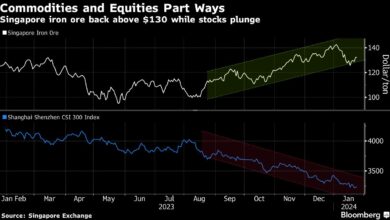

And it’s this broad lift across different commodity classes (precious and base metals) that’s starting to create an air of ‘commodity super cycle’ within mining circles.

Rumblings of the 2003 to 2011 upswing years are starting to stir.

Back then, everything swelled—from rare earths to iron ore to wheat. The list of commodities that experienced exponential rises in value over that time is extensive.

That includes high-profile commodities like gold. Back in 2003, it sold for just $360/ounce.

By the end of the boom years in 2011, it had surged 400% reaching a high of more than $1,900/ ounce.

And just like today, copper followed in gold’s wake.

Despite having different demand drivers, the last commodity boom witnessed a 528% gain for copper.

It went from a low of $0.70/pound to a peak of more than $4.40/pound by 2011.

So, are gold, copper and silver prices signalling something big in 2024?

Last year, S&P Global wrote a piece titled: ‘The world isn’t in a commodity yet, but it should be.’

That was based on strong broad demand for commodities and poor supply outlooks as companies and investors dismiss project developments based on extreme capex demands.

Add in permitting delays and lack of discoveries and this coming boom could be as much of a demand story as it is about supply.

So, what’s the angle here for investors?

Ideally, you should be focussed on high quality geological assets with multi-decades worth of mine supply.

Ideally, targeting companies entering maidan production within one to two years to capitalise on a higher metal prices.

But there is one class of deposit that should sit high on investors’ watchlists…

Porphyries… deposits perfectly positioned for a commodity supercycle

Investing in companies that can push beyond junior mining status means they must own or have potential of finding enormous deposits.

That’s why companies exploring or developing deposits known as porphyries could benefit enormously in the years to come.

These are the world’s largest storehouses for copper.

Escondida, the world’s biggest, began production in the late 1990s, the deposit holds an enviable 40-year mine life.

But there is another key feature positioning these deposits for potential outsized gains in the years ahead… porphyries are often endowed with gold and silver.

Given the unfolding trend in 2024, gold, silver and copper motherlodes could become the winning trifecta if a commodity super cycle plays out.

Common along the west coast of South and North America, dense oceanic plates collide and subduct below the continental crust.

This slow-motion collision compresses the crust, forming a long north-south chain of mountains from Patagonia all the way up to Alaska.

But this subduction zone also gives birth to gigantic porphyry deposits; where rich mineralised fluids combine with plumes of rising magmatic rock.

Source: Science Direct

While gold and silver are typically considered ‘by-products’ at these mines, at times, the quantity can be so large that it exceeds the total ounces at a standalone precious metal mine.

For example, one of the world’s largest development projects, the Filo Del Sol project in Argentina holds a ‘byproduct’ totalling 4.6 million ounces of gold.

That would be an enormous gold mine in its own right.

Yet the company’s primary focus is copper… The company holds a resource of 3.2 billion pounds plus almost 160 million ounces of silver.

Assets like this sit high among the majors as potential takeover targets.

This is another bonus for those investors looking at these porphyry hunters.

The mood for commodities is lifting, but are we in a SUPERCYCLE?

Copper is a clear bellwether for the broader strength of the commodity market.

Rising copper prices should see a lift across base metals from nickel to aluminium.

That’s why investors ought to watch the copper market to find clues of a budding super cycle ahead.

With the recent strength in 2024, copper has just begun testing an important resistance level…

The January 2023 high at around $4.26 per pound, see below:

Source: Trading Economics

This is a critical juncture for the copper market, and perhaps the resource sector more broadly.

If the metal can break through this level copper may head rapidly to its next major test, around US$4.80 per pound.

This would be a retesting of its all-time highs from early-2022.

Copper still has two major hurdles to overcome.

Eventually though, if copper follows gold’s lead and breaks out into all-time new highs, this would be a definitive indication that we have entered a new commodity super cycle.

And we may be far closer to this outcome then most would believe.

The coming weeks will be a pivotal moment for the resource sector, copper remains the key metal to watch.

Positioning ahead of the crowd

The resource market is notorious for doing very little for years then exploding rapidly with little warning.

As famous mining legend Rick Rule would say… ‘Commodity bull markets move a little, at first, then all at once!’

What we’re seeing right now could be the ‘little’, it may pay to start preparing now in case we enter the ‘all at once’ phase.

How can you capitalise on the potential commodity boom ahead?

Remain selective; focus on companies with high quality geological assets. That includes porphyry deposits.

There’s still plenty of value in this market, especially at the junior end. But as I’ve shown you, this could change very quickly.

James Cooper runs the commodities investment service Diggers and Drillers. You can also follow him on X (Twitter) @JCooperGeo