Asia FX steady amid China stimulus cheer, dollar muted before GDP data By Investing.com

© Reuters.

Investing.com– Most Asian currencies fell slightly on Thursday, but were sitting on strong gains following more stimulus measures from China, while the dollar nursed some losses ahead of key fourth-quarter GDP data due later in the day.

Sentiment towards regional currencies was aided by an unexpected cut to China’s , which heralds more liquidity in the Chinese economy to spur growth. The People’s Bank of China also flagged more stimulus measures in the coming months to help support an economic recovery.

The fell 0.1%, given that increased liquidity presents more headwinds. But the currency still rebounded from recent lows on hopes of improved Chinese economic prospects. The PBOC also supported the yuan with a series of strong daily midpoints.

Near-term optimism over China buoyed sentiment towards broader Asian currencies, particularly those with exposure to China. The rose slightly on Thursday after paring a bulk of its weekly losses.

The fell 0.3% even as data showed the economy in the fourth quarter. But the pace of growth still remained underwhelming.

The was flat on Thursday after paring all of its losses earlier in the week, while the rose 0.1%.

The fell 0.1% after rising sharply earlier this week. Gains in the yen came as Bank of Japan Governor Kazuo Ueda offered more signals on a potential pivot away from negative interest rates- which were a key pain point for the yen over the past two years.

Ueda said that the BOJ’s pivot will be largely dependent on the path of inflation, which turned market focus squarely to upcoming , due on Friday.

Dollar steadies near 1-week low before GDP, inflation and Fed cues

The and rose slightly in Asian trade on Thursday, but were sitting close to a one-week low amid increased uncertainty before a barrage of signals on the U.S. economy and interest rates.

Fourth-quarter data due later on Thursday is expected to show some cooling in growth. But U.S. economic growth is still expected to remain well ahead of its developed world peers.

data- the Federal Reserve’s preferred inflation gauge- is due on Friday, and is expected to show inflation remained sticky in December. Economic resilience and sticky inflation give the Fed more impetus to keep rates higher for longer.

The data comes just days before the , which will be closely watched for any cues on when the central bank will begin trimming interest rates.

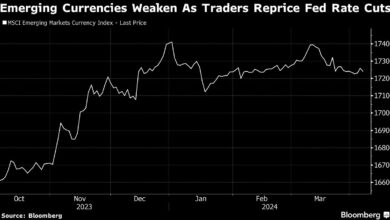

The dollar recently shot up to six-week highs amid growing conviction that rate cuts will come later, rather than earlier, in 2024. This trend saw most Asian currencies mark a weak start to 2024.

The showed traders pricing in a 55.6% chance the Fed will leave rates unchanged in March.

Upgrade your investing with our groundbreaking, AI-powered InvestingPro+ stock picks. Use coupon INVPRO2024 to avail a limited time discount on our Pro and Pro+ subscription plans. Click here to know more, and don’t forget to use the discount code when checking out!