Asian currencies hobbled by broadly firmer dollar, shares subdued

Taiwanese dollar, Chinese yuan rise 0.4%

Asian stocks mixed; Shanghai shares up 0.6%

Malaysia Feb inflation +1.8% year-on-year

By Poonam Behura

March 25 (Reuters) –Emerging Asian currencies drifted through tight ranges on Monday as strong U.S. economic data reinforced expectations the Federal Reserve will keep interest rates higher for longer in a boost to dollar bulls.

The Taiwanese dollar TWD=TP advanced 0.4%, topping gains in the region. It was on course for its biggest intraday gain in 13 weeks. The Singaporean dollar SGD= inched 0.2% higher, while the Thai baht THB=TH was unchanged.

The Chinese yuan CNY=CFXS rose 0.4% to 7.2 per U.S. dollar at 0358 GMT, after major state-owned banks sold dollars for yuan to stabilise the Chinese currency. It had weakened to a four-month low on Friday, breaching the psychologically important 7.2 per dollar level.

The yuan intervention “pushed back speculation that policymakers may allow another round of RMB depreciation,” OCBC currency strategist Christopher Wong said.

Asian shares were mixed due to the absence of strong catalysts and as investors were wary a key U.S. inflation gauge – core personal consumption expenditure (PCE) price index – due on Friday could derail the outlook for lower U.S. rates.

The PCE index is seen rising 0.3% last month. A stronger outcome would be taken as a setback to hopes for a Federal Reserve rate cut in June.

“Stronger U.S. data and hawkish Fed speaks may keep USD broadly supported. At this point, USD still present a relative yield advantage and Fed has communicated that they are in no hurry to cut rates,” Wong said, referring to the dollar’s recent strength.

The U.S. dollar index =USD, which measures the greenback against a basket of major currencies, ticked higher to trade at 104.380 as at 0419 GMT.

“This would probably change only when U.S. data starts to show more signs of softening and this puts focus on core PCE this Friday,” Wong added.

Stocks in Seoul .KS11 and Manila .PSI weakened 0.5% each. Shanghai’s shares index .SSEC surged 0.6%, while those in Taipei .TWII and Bangkok .SETI were marginally up by 0.2% and 0.1%, respectively.

In Malaysia, government data showed consumer price index (CPI) in February rose 1.8% from a year earlier. The ringgit MYR= was last up 0.2%, while stocks .KLSE traded 0.5% lower.

In Vietnam, the dong VND= appreciated 0.1% to 24,578.0 per dollar, recovering some last ground over the past few sessions as political uncertainty roiled investors.

Elsewhere in emerging Asia, Singapore is slated to release its inflation numbers later in the day. Indian markets were closed for a public holiday.

HIGHLIGHTS:

** South Korea’s push to make its markets global dogged by FX history

** Japan top currency diplomat Kanda says yen weakness doesn’t reflect fundamentals

** China could grow faster with pro-market reforms, IMF managing director says

|

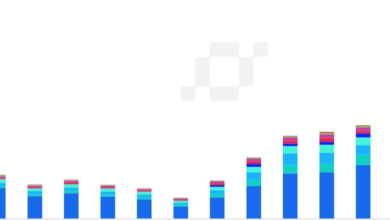

Asia stock indexes and currencies at 0337 GMT |

||||||

|

COUNTRY |

FX RIC |

FX DAILY % |

FX YTD % |

INDEX |

STOCKS DAILY % |

STOCKS YTD % |

|

Japan |

JPY= |

+0.16 |

-6.69 |

.N225 |

-0.65 |

21.4 |

|

China |

CNY=CFXS |

+0.35 |

-1.47 |

.SSEC |

0.51 |

2.98 |

|

India |

INR=IN |

– |

-0.26 |

.NSEI |

– |

1.68 |

|

Indonesia |

IDR= |

-0.09 |

-2.50 |

.JKSE |

-0.15 |

0.91 |

|

Malaysia |

MYR= |

+0.19 |

-2.88 |

.KLSE |

-0.46 |

5.55 |

|

Philippines |

PHP= |

+0.14 |

-1.53 |

.PSI |

-0.52 |

6.14 |

|

S.Korea |

KRW=KFTC |

-0.10 |

-3.86 |

.KS11 |

-0.49 |

3.01 |

|

Singapore |

SGD= |

+0.15 |

-2.02 |

.STI |

-0.19 |

-0.87 |

|

Taiwan |

TWD=TP |

+0.35 |

-3.49 |

.TWII |

0.19 |

13.02 |

|

Thailand |

THB=TH |

+0.03 |

-5.96 |

.SETI |

0.12 |

-2.34 |

Reporting by Poonam Behura in Bengaluru

Editing by Shri Navaratnam