Dollar holds ground ahead of key U.S. inflation data

Story continues below Advertisement

The U.S. dollar held steady versus major currencies on Friday ahead of key inflation data later in the day, as traders weighed how the U.S. economy’s faster than expected growth would influence Federal Reserve thinking on interest rate policy.

Data on Thursday showed the world’s largest economy grew more than forecast in the fourth quarter at 3.3% and showed price pressures were easing, adding to speculation the Fed would be in no rush to cut interest rates.

Story continues below Advertisement

U.S. personal consumption expenditures data – the Fed’s preferred gauge of inflation – is due out at 1330 GMT on Friday.

The European Central Bank (ECB) held rates as expected on Thursday, and comments from its president Christine Lagarde that seemed less worried about the inflation outlook added to bets on a rate cut in April.

The dollar index, which measures the greenback against a basket of six major currencies, was last broadly flat on the day at 103.55.

Currency analysts at MUFG said in a note that Thursday’s U.S. economic data presented a mixed picture for monetary policy.

“…the strong end to the year must surely place further doubt on the scope for the Fed to commence its easing cycle by March. But March still remains feasible primarily due to the very favourable inflation data within the GDP report,” the note said.

The euro was last down 0.1% at $1.08390, having earlier drifted to a fresh six-week low against the dollar after a survey showed weaker-than-expected German consumer sentiment.

Story continues below Advertisement

Eurozone inflation could fall faster than expected this year as economic growth remains anaemic, according to two key surveys published by the ECB on Friday, potentially bolstering bets for rate cuts.

Sterling was last broadly flat at $1.27060, ahead of a Bank of England decision on interest rates next Thursday.

Elsewhere, the dollar edged 0.3% higher against the yen to 148.015.

Minutes released on Friday of the Bank of Japan’s December meeting showed policymakers actively debated the conditions for phasing out its stimulus, in a sign they were gearing up for a near-term exit from negative interest rates.

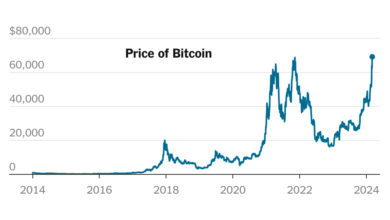

In cryptocurrencies, bitcoin was last up 0.7% at $40,207.00.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!