Dollar holds ground as US inflation data looms

Trading was thinned in Asia with Japan out on a holiday.

Against the yen, the dollar rose 0.05% to 144.67, extending its gain from last week when it jumped 2.6% on the Japanese currency, its best weekly performance since June 2022.

The kiwi edged 0.1% higher to $0.6248, after having slid 1.2% last week. The dollar index steadied at 102.38.

The greenback’s rally was underpinned by a rebound in U.S. Treasury yields as traders tempered their expectations of the pace and scale of Fed cuts this year.

A reading on U.S. inflation due on Thursday could again alter those views, after data on Friday showed U.S. employers hired more workers than expected in December while raising wages at a solid clip, pointing to a still-resilient labor market.

However, a separate survey out the same day showed the U.S. services sector slowed considerably last month, with a measure of employment dropping to the lowest level in nearly 3-1/2 years, painting a mixed picture of the world’s largest economy.

“On balance, the key labor market themes remain in place. The labor market is no longer as tight as it was earlier in the recovery as signaled by slower job growth, less turnover and slower wage gains,” said economists at Wells Fargo of the nonfarm payrolls report.

“That said, job growth remains solid on an absolute basis even if it has slowed on a relative one, and the low level of layoffs remains encouraging.

“We suspect the FOMC will keep the Fed funds rate unchanged over the next few months as it awaits additional confirmation that inflation is durably on its way to 2%.”

Market pricing now shows a roughly 64% chance that the Fed could begin easing rates as early as March, compared to a nearly 90% chance a week ago, according to the CME FedWatch Tool.

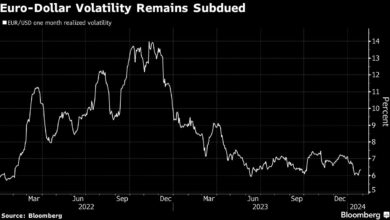

Elsewhere, sterling tacked on 0.02% to $1.2721, while the euro edged 0.08% higher to $1.0948, after slipping 0.9% last week.

The Aussie gained 0.1% to $0.6721, recouping some of its losses from a 1.5% fall last week.

A reading on Australian inflation is also due later this week.

“We do need to see some easing in the core measure, because that’s really where the (Reserve Bank of Australia) is focusing,” said Tony Sycamore, market analyst at IG Australia.