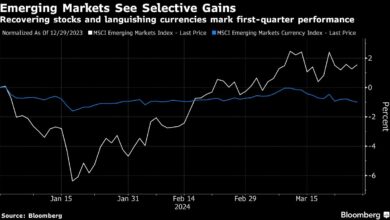

Emerging Assets at Risk as Governments Clash With Central Banks

(Bloomberg) — Central bank independence is becoming an increasingly key battleground in emerging markets, and one that bodes ill for currency and bond investors.

Most Read from Bloomberg

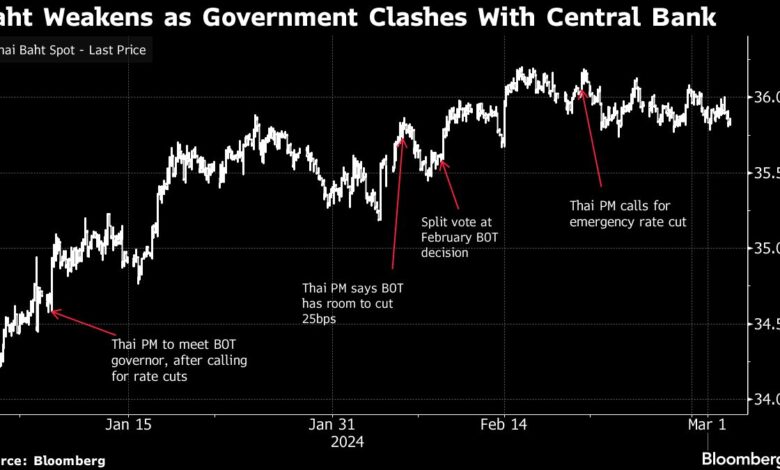

The Thai baht has come under recurring pressure in recent weeks due to a standoff between the prime minister and policymakers over the timing of interest-rate cuts. Hungary’s forint neared a one-year low versus the euro this past week amid an ongoing clash between Prime Minister Viktor Orban and the country’s central bank chief. Brazil’s real and the Turkish lira have long been whipsawed by the two countries’ leaders calling for lower borrowing costs.

“For investors, the autonomy of central banks is a pivotal consideration in the allocation of capital within EM currencies and sovereign debt,” said Rajeev De Mello, a global macro portfolio manager at Gama Asset Management SA in Geneva. “I prefer to invest in bonds and currencies of those countries that pro-actively addressed inflationary upticks, and have been reticent towards markets where central banks are encumbered by political interference.”

Fractious relations between central banks and governments are nothing new. But the current challenges facing the global economy — where the highest interest rates in decades are starting to crimp growth — mean tensions have ratcheted up to an unusually high level, flaring up even in developed countries.

Read more: Central Bankers Used to Keep Out of Politics. Not Any More

Traders typically react to such conflicts by selling currencies. That’s because the standoffs tend to begin with a government pushing back against hawkish monetary policy, as the former prefer stimulating the economy over containing inflation. Lower rates and sustained price pressures then drive capital outflows and lower returns from currencies and bonds.

Heavy Pressure

The baht has slumped about 5% this year as Prime Minister Srettha Thavisin has stepped up pressure on the central bank to cut rates to cushion an economic slowdown. Srettha and his advisers have campaigned on television and social media to argue commercial banks are profiting from the unnecessary high rates.

Central bank Governor Sethaput Suthiwartnarueput has responded by saying rate cuts are no panacea for the structural problems plaguing the economy.

Traders took note by boosting pricing on a rate cut over the next six months, while global funds have pulled out $478 million from Thai bonds since the start of January, the biggest outflow in emerging Asia for economies that provide updated data.

‘Significant Attack’

In Hungary, the long-running feud deepened when Governor Gyorgy Matolcsy warned Thursday that Orban’s government was planning regulatory changes that represent a “significant attack” against central bank independence. The comments hit the forint just two days after policymakers accelerated the pace of easing amid pressure to deliver more stimulus.

The planned legislation seeks to broaden the purview of the central bank’s supervisory board, which includes government appointees. It would allow the board to look into investments, including controversial foundations the central bank set up and which the European Central Bank has also scrutinized in the past.

The government said it respects central bank independence and only aims to boost transparency and prudent financial management in areas unrelated to monetary policy, according to a Facebook post by Finance Minister Mihaly Varga.

Possible Hotspot

The next potential hotspot may be Indonesia, where the incoming president’s plans to boost spending risks widening the budget deficit and creating a conflict with the monetary authority.

“When people are already saying that there will be a potential risk to fiscal spending — i.e. higher fiscal spending — there could also be another push for cuts,” said Jerome Tay, an investment manager at abrdn in Singapore. At the same time, Indonesia has inflation under control, so investors may not react too negatively if the central bank does cut rates, he said.

Read more: Power Shift to Test Brazil Central Bank Autonomy, Ex-Chief Says

While conflict over central bank policy has been increasing in recent months, it has long been a part of the investment landscape.

“Question marks over central bank independence in emerging markets is just part of the game,” said Philip McNicholas, an Asia sovereign strategist at Robeco Group in Singapore. Politicians will always seek to pressure hawkish central banks as this will harm their re-election chances, he said.

What to Watch

-

South Korea, Hungary and South Africa will publish GDP figures

-

The Philippines, Korea, Taiwan, China, Mexico, Colombia, Hungary and Chile will all release inflation data

-

Poland’s central bank will announce a rate decision on Wednesday, while Peru’s will do so the following day

-

The Malaysian central bank also decides rates Thursday, and the decision may generate extra attention as the ringgit is currently trading near a 26-year low

–With assistance from Marton Kasnyik.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.