Switzerland Shocks With Interest Rate Cut. What It Means for the Rest of Europe.

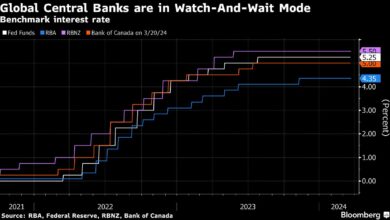

The Swiss National Bank delivered a surprise interest-rate cut this past week, kicking off what’s likely to become a widespread trend of policy easing among major central banks this year.

The Swiss franc’s reaction to the cut could create a possible incentive for other central banks to move early and catch markets off guard.

The SNB’s move is important not only because it makes Switzerland the first major economy to lower rates since the Covid-19 pandemic, but it also highlights a key side effect of monetary policy. All else being equal, raising interest rates tends to strengthen a currency by making the investments in the economy more attractive. Lowering rates tends to weaken a currency.

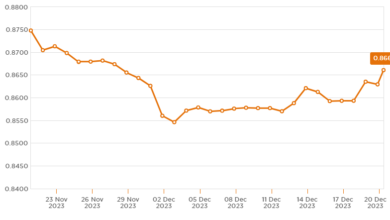

With its unexpected rate cut, the SNB managed, within minutes, to push the Swiss franc down almost 2% against the dollar. It fell almost 1% against the euro, the currency used by the country’s most important trading partners.

The franc’s drop makes Switzerland an example for other countries that might want to give economic activity a jolt in coming months—as long as it also looks like inflation rates will continue to fall.

Advertisement – Scroll to Continue

“The Swiss franc is likely to keep weakening against the euro and the U.S. dollar in the short term as uncertainty remains about the timing of European Central Bank and Federal Reserve rate cuts, while the SNB has already kicked off its easing cycle,” said UBS economists led by Alessandro Bee.

Exchange rates are critical for Switzerland and other open economies that rely heavily on trade. By making exports cheaper for foreign buyers, a weaker currency can help drive economic growth.

The Swiss economy—known for its big banks such as UBS and watchmakers like Rolex—might need the boost. While it avoided the recessions seen in the U.K. and Germany at the end of 2023, it is expected to see anemic growth for the next two years.

Advertisement – Scroll to Continue

The SNB’s surprise move might not be the last of the season, considering that Europe and Asia’s economies are considerably weaker than the U.S. currently.

Economists see the ECB making its first cut in June, but moving earlier could give the euro region some extra help. Ditto for the Bank of England, which most expect to make its first rate reduction in August. A shock cut before then, however, might be tempting.

While the Bank of England’s decision to hold rates this week certainly was no surprise, the British pound still reacted. Because two of the bank’s rate setters abandoned their previous push for a hike, the pound is now about 1% lower versus the dollar than it was at the start of the week. The International Monetary Fund expects the U.K. to be the second-worst performing Group-of-Seven economy this year, behind Germany.

After World War I, countries engaged in what became known as a currency war in which they raced to devalue their currencies against one another to improve their competitiveness. That beggar-thy-neighbor approach isn’t what’s happening now—the main battlefront is still inflation. But there could be echoes of that if central banks start to worry that waiting too long to cut might make their currencies too strong for growth.

Advertisement – Scroll to Continue

The U.S., however, might be in less of a rush than its European counterparts.

The dollar’s exchange rate is less important because the world’s largest economy relies more heavily on domestic consumption. But it certainly matters, as it affects both the price of imports and the value of a company’s sales made overseas.

Advertisement – Scroll to Continue

“For currencies, central bank policy expectations are dominating the market and the Fed is lining up to be the last bank to cut interest rates from the current policy cycle peak as the U.S. economy is showing the most resilience,” said Tom Essaye in Friday’s Sevens Report. “If that continues, expect the Dollar Index to make a run.”

The U.S. dollar has broadly strengthened this year as expectations for the first Federal Reserve rate cut have been pushed back from March to June. The Dollar Index, a measure of the currency’s strength against a basket of peers, has increased 2.9% since Jan. 1.

Write to Brian Swint at brian.swint@barrons.com