Domestic Chinese sustainability-linked bond market ‘lacking credibility’ :: Environmental Finance

Chinese onshore sustainability-linked bond (SLB) issuance fell in 2023 after a record 2022 as issuers were “less incentivised” to offer material and credible structures for investors, according to Sustainable Fitch.

In 2021, the Chinese interbank regulator – the National Association of Financial Market Institutional Investors (NAFMII) – published guidelines for sustainability-linked and transition bond issuance. In response, several major state-owned enterprises (SOEs) in the energy, industrial and utilities sectors entered the market – especially for the performance-based SLBs.

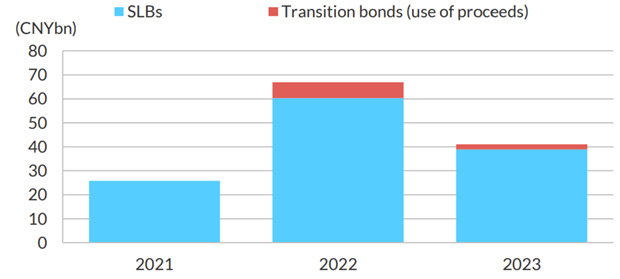

Sustainable Fitch said this resulted in onshore Chinese SLB issuance more than doubling from around CNY25 billion ($3.5 billion) in 2021 to CNY60 billion in 2022 (see Figure). In 2023, however, total issuance fell a third to CNY40 billion – just 5% of the total Chinese onshore sustainable bond market.

Transition bonds, meanwhile, have struggled to secure an issuance foothold in the Chinese onshore bond market.

Onshore bonds are instruments issued in their domestic bond market. Meanwhile, offshore bonds are issued in foreign countries and are often used to appeal to international investors.

Chinese onshore SLB and transition bond issuance by year

Sustainable Fitch sustainable finance associate director Jingwei Jia said investor demand for these instruments has been impacted by concerns around the credibility of the key performance indicators (KPIs) chosen or pricing structure, however.

“The majority of SLB and transition bond issuers are large SOEs with strong government support and lower borrowing costs,” she said. “These issuers are generally less incentivised to select credible KPIs that are material to their businesses and set effective interest rate step-up mechanisms to drive the company’s sustainability improvement.”

For example, Sustainable Fitch said many onshore Chinese SLB issuers have set their coupon step-up rate if a target is not achieved within the five basis point (bp) to 20bp range – materially lower than the 25bp to 50bp range found in the international market.

“Target observation dates are often placed close to the bond’s maturity, meaning the step-up mechanism would only be triggered in the final year of the tenor if it fails to achieve its sustainability performance targets,” she added.

Domestic issuance of SLBs and transition bonds has also been limited by the lack of formal science-based transition finance guidelines or taxonomies in China which could help issuers to determine credible targets and projects, she said.

“Current issuers commonly refer to China’s national climate roadmap to demonstrate how the financing will contribute towards meeting the country’s climate targets, as well as NAFMII’s high-level SLB issuance guidelines in 2021. However, these documents do not provide specific instructions and guidelines on sustainability performance-target setting or technical standards for eligible low-carbon technologies.”

She added that there was also limited application of international guidance and best practice related to SLBs in the domestic Chinese bond market.

Alignment with the widely used International Capital Market Association (ICMA)-administered Sustainability-linked Bond Principles (SLBP) is still “not yet a common practice” among domestic SLB issuers, and neither is setting interim targets on the way to a medium- or long-term target.

But, with the current pool of domestic SOE issuers lacking incentive to issue “credible” SLBs, Jia said the “technical challenge” to set ambitious targets aligned with international best practice “may deter more issuance” in the future.