February 2024 Stock Market Outlook – Forbes Advisor

Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

After a strong performance in 2023, the S&P 500’s bullish momentum has continued in January. Strong economic data and anticipation of a Federal Reserve pivot to interest rate cuts has propelled the S&P 500 to its first new all-time highs in over two years. In fact, by month’s end the popular benchmark set new all-time closing highs on six trading days.

The S&P 500 followed its 26.28% gain in 2023 with a 1.68% gain in January despite a lackluster start to fourth-quarter earnings season. Recent inflation data suggests the Fed still has work to do in getting prices under control, but gross domestic product and labor market readings indicate the U.S. economy remains on solid footing for now.

Investors are optimistic the S&P 500 can continue its recent momentum in February, a month that has historically been one of the worst of the year for the market.

Good Omens for the S&P 500

The S&P 500’s current rally bodes well for the month of February and for the rest of 2024.

“The S&P 500 has set six new all-time highs in 2024, all in January. That works out to an annualized rate of 72 new highs,” says Sam Stovall, Chief Investment Strategist of CFRA Research.

Stovall added, “Whenever the S&P 500 set a new high in January, additional new highs were set in February 74% of the time. What’s more, whenever there were new highs in both January and February, the full-year return averaged 15.8%—and rose in price 88% of the years.”

That 15.8% tops the 9.2% annual average for all years since 1954, which was the year the S&P 500 set its first all-time high after the stock market crash of 1929.

Is There a Fed Pivot Ahead?

Adding to investor optimism, the Federal Reserve has made tremendous progress on the inflation front in the past two years, which means the Fed could be positioned to finally begin cutting interest rates in the first half of 2024.

The consumer price index gained just 3.4% year-over-year in December, down from peak 2022 inflation levels of 9.1% but still above the Federal Reserve’s 2% long-term target. Unfortunately, December’s CPI inflation reading was up from 3.1% annual inflation in November and above economist expectations of 3.2%.

The core personal consumption expenditures price index, which excludes volatile food and energy prices and is the Fed’s preferred inflation measure, was up 2.9% year-over-year in December.

How Many Rate Cuts in 2024?

The stock market’s January rally occurred despite the Federal Open Market Committee opting to maintain its fed funds interest rate range at between 5.25% and 5.5%, its highest level in 22 years.

However, the bond market is pricing in a 20% chance the Fed will cut interest rates by at least 25 basis points at its March meeting, according to CME Group.

Jerry Klein, managing director at Treasury Partners, says investors are way too optimistic about interest rate cuts in 2024.

“The market is pricing in five rate cuts in 2024, which is overly optimistic because the economic picture right now isn’t dire enough to justify what would essentially equate to a rate cut at almost every Fed meeting this year,” Klein says.

“A pace of three or four rate cuts this year is a much more realistic cadence than the five rate cuts that the market expects because the economy is still at full employment, which means the Fed can afford to be patient with interest rates to ensure that high inflation has truly been eliminated.”

Investors will be particularly interested in the FOMC’s January meeting minutes, expected to come out on February 21. They will be looking for any commentary or hints from Fed officials about the outlook for inflation, the U.S. economy or interest rates.

U.S. Recession Watch

The Fed is reaching a critical point in its battle against inflation, and the next couple of months may determine if it can navigate a so-called soft landing for the U.S. economy without tipping it into a recession or allowing it to overheat.

The New York Fed Recession indicator suggests there is a 62.9% probability of a recession sometime in the next 12 months. At the same time, the economy has remained so strong that some economists are concerned about the possibility it will grow too much in 2024 and inflation will rebound.

One of the most important variables in the Fed’s inflation battle is the labor market, which has remained remarkably resilient. The Labor Department reported the U.S. economy added 353,000 jobs in January. That was significantly more than economists’ expectations of 176,000 new jobs.

That number was even up from a revised gain of 333,000 jobs in December, which topped economists’ forecasts for that month of 170,000 new jobs.

In addition, U.S. wages were up 4.1% from a year ago. Through January, the unemployment rate remains historically low at just 3.7%. This is the first time since the late 1960s that the U.S. jobless rate has been under 4% for at least two years in a row.

U.S. gross domestic product growth of 3.3% in the fourth quarter also came in hotter than the 2% growth economists had expected.

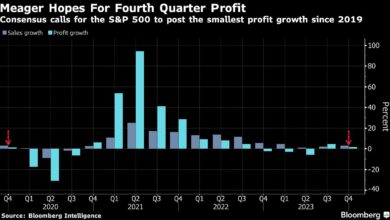

Disappointing Earnings

Fourth-quarter earnings season kicked off in mid-January, and results have been somewhat disappointing up to this point. S&P 500 companies have reported a 1.4% year-over-year decline in earnings per share in the quarter, putting the market on track for its fourth consecutive annual earnings decline in the past five quarters.

The S&P 500 communication services sector is reporting the highest earnings growth of any sector so far in the fourth quarter, with EPS up 40.4% from a year ago. The energy sector has reported a 31.4% year-over-year drop in earnings so far in the fourth quarter, weighing on overall growth.

Wall Street analysts are expecting earnings to rebound in the first half of 2024, projecting a 4.6% increase in S&P 500 earnings in the first quarter and another 9.4% growth in the second quarter.

S&P 500 companies may be struggling with earnings growth, but investors seem to be shrugging off stagnant fourth-quarter numbers and anticipating extremely strong earnings growth in 2024.

Stretched Valuations

With the S&P 500 now back at all-time highs, some analysts are growing concerned about how much growth is already priced into stock prices at their current level, particularly in the high-flying technology sector.

The S&P 500’s forward price-to-earnings ratio, which incorporates estimated earnings growth over the next 12 months, is currently 20, above its 10-year average of 17.6. Since the end of December, the S&P 500 has gained 2.96% compared to only a 0.3% increase in consensus earnings estimates for 2024.

Not surprisingly, the technology sector has the highest forward P/E ratio of all at 28.3 followed by the consumer discretionary sector at 24.4.

Even with the index at all-time highs, analysts still see more gains ahead over the next 12 months. The consensus S&P 500 price target of 5,280 suggests about an 8% upside from current levels.

Jeffrey Buchbinder, chief equity strategist for LPL Financial, says investors should keep their expectations in check given the S&P 500’s elevated valuation.

“With the S&P 500 having recently ascended to a fresh record high after such a strong 2023, it’s natural for investors to worry that valuations have become over-extended. On traditional valuation measures, valuations do appear high and it does seem reasonable to expect more moderate stock market returns going forward,” Buchbinder says.

How To Invest In February

Yung-Yu Ma, chief investment officer at BMO Wealth Management, says investors should take a cautious approach to the market for now given there may be limited upside in the near term.

“The broader market looks more prone to consolidating its gains from November and December rather than rallying to new highs,” Ma says.

“Our message for investors is to maintain balanced risk that fits with the current backdrop and include high-quality fixed income investments in portfolios, which provides both yield and stability.”

David Bahnsen, chief investment officer at The Bahnsen Group, says investors shouldn’t count on a select group of just five or 10 mega-cap technology stocks to continue to perform well enough to lift the entire S&P 500 higher.

“The gains in big technology stocks are unsustainable, especially since they were overvalued even before the 2023 tech stock surge. Another year of a select few mega-cap tech companies driving all of the stock market’s return is completely off the table for 2024, and that’s an important dynamic for investors to consider, especially if their portfolio is overexposed to tech stocks,” Bahnsen says.

He says Wall Street is currently anticipating double-digit S&P 500 earnings growth in 2024 and 2025, and the market could experience a significant correction if companies fall short of those expectations.