Global Private Equity Market to See Robust Growth With Projected CAGR of 13.45% Through 2028

Global Private Equity Market

Dublin, Feb. 06, 2024 (GLOBE NEWSWIRE) — The “Private Equity Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, 2018-2028F” report has been added to ResearchAndMarkets.com’s offering.

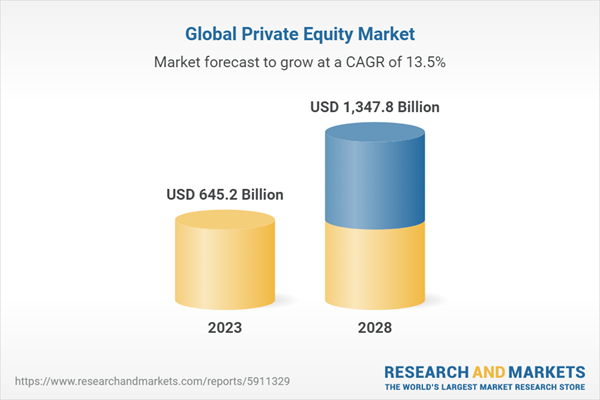

The Global Private Equity Market has been valued at USD 645.2 Billion in 2022 and is anticipated to exhibit significant growth through the year 2028, with a CAGR of 13.45%.

The private equity sector, which has played a pivotal role in the transformation of businesses around the world, is projected to continue its robust growth trajectory, as reported in a comprehensive research publication. Private equity, a fundamental component of the global financial market, has attracted substantial attention due to its potential to deliver attractive returns outshining those from public markets. This hands-on investment avenue demonstrates distinction and influence by actively shaping the management and strategic pathways of portfolio companies, thereby optimizing operations and accelerating growth.

With a broad spectrum of sectors ranging from technology, healthcare, and energy & power, the private equity market remains diverse and expansive, leveraging the expertise of skilled professionals to capitalise on lucrative opportunities. Furthermore, the burgeoning trend of impact investing, guided by environmental, social, and governance (ESG) principles, signals a transformative phase within the industry, aligning investment decisions with sustainable and societal impact considerations.

Key Catalysts Driving Market Growth

-

Globalization of Capital and Investments: A sweeping trend sees investors, including sovereign wealth funds and pension schemes, diversifying geographically to seek out new opportunities internationally, particularly in emerging and high-growth markets.

-

Technological Innovation: The surge in investments within the tech sector stands testament to the digital disruption underway across industries. This trend encompasses early-stage startups to mature tech companies that are reshaping the market with cutting-edge technologies such as artificial intelligence and blockchain.

-

Focus on ESG Compliance: A significant driver for the market is the escalated emphasis on ESG-integrated investment strategies, reflecting a deepened investor consciousness towards sustainable and responsible investing.

-

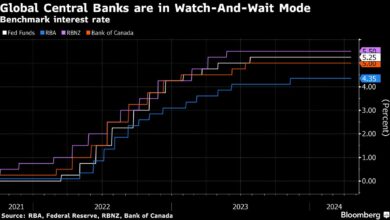

Low-Interest Rate Environment: The prevailing low-interest rates have primed the private equity landscape for a conducive borrowing environment, promoting leveraged buyouts and investment activities.

Challenges and Considerations

Despite its growth, the private equity market confronts a series of challenges, from heightened competition for high-quality investments to regulatory complexities, and evolving compliance requirements. Additionally, liquidity and exit strategy considerations, as well as the integration of ESG factors into investment portfolios, pose both challenges and opportunities within the sector.

Emerging Trends and Outlook

Technology continues to attract significant private equity funding, shaping a future that relies on digital innovation and transformation. Impact Investing and ESG Integration

There is an observable shift towards investments that generate both financial returns and positive social and environmental impact—a change indicative of the broader movement towards sustainable business practices.

Geographic Diversification and Healthcare Spotlight

Diversification across geographies is coupled with a focus on the healthcare and biotechnology sectors, underscoring the critical nature of these industries, especially in light of the global health crisis. In the backdrop of these developments, the Global Private Equity Market is poised for continued success, characterized by a steady flow of capital injections and strategic investments that promise to redefine industries and economies at large.

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

188 |

|

Forecast Period |

2023 – 2028 |

|

Estimated Market Value (USD) in 2023 |

$645.2 Billion |

|

Forecasted Market Value (USD) by 2028 |

$1347.8 Billion |

|

Compound Annual Growth Rate |

13.4% |

|

Regions Covered |

Global |

A selection of companies mentioned in this report include

-

Apollo Global Management, Inc.

-

Bain and Co. Inc.

-

Bank of America Corp.

-

BDO Australia

-

Blackstone Inc.

-

CVC Capital Partners

-

Ernst and Young Global Ltd.

-

HSBC Holdings Plc

-

The Carlyle Group

-

Warburg Pincus LLC

For more information about this report visit https://www.researchandmarkets.com/r/i3gb6l

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900