Japan’s Currency Chief Warns Against Speculative Moves in Market

(Bloomberg) — Japan’s top currency official delivered his most robust salvo of warnings in months against speculative moves in the foreign exchange market as the yen continues to hover near a 2022 intervention level.

Most Read from Bloomberg

“The current weakening of the yen is not in line with fundamentals and is clearly driven by speculation,” vice finance minister for international affairs Masato Kanda told reporters Monday. “We will take appropriate action against excessive fluctuations, without ruling out any options.”

“We are always prepared,” Kanda said when asked about a possible direct intervention in the currency market. Japan intervened in markets in 2022 to prop up the yen when the currency hit 151.95 against the dollar.

The Japanese currency dropped near that level last week, weakening to 151.86 per dollar on Friday. The yen strengthened as Kanda spoke, briefly reaching 151.09 from 151.40 before paring some of the gains.

“We have seen a large fluctuation of 4% in just two weeks in the dollar-yen, a move that isn’t reflecting fundamentals and I find this unusual,” Kanda said.

Kanda’s warnings on the currency were his first since February. The currency has been trading around 150-151 per dollar since the Bank of Japan raised interest rates last week for the first time since 2007.

“The tone of verbal intervention is intensifying and the yen may draw short-term support amid growing risk of real action,” said Takeshi Ishida, a strategist at Resona Holdings Inc. in Tokyo. “Kanda acknowledges the move is speculative and seems to pay close attention to the 152 line for the currency pair.”

While a rate hike might be expected to strengthen the currency, Governor Kazuo Ueda’s remarks emphasizing that financial conditions will remain easy are among the factors that have contributed to continued weakness.

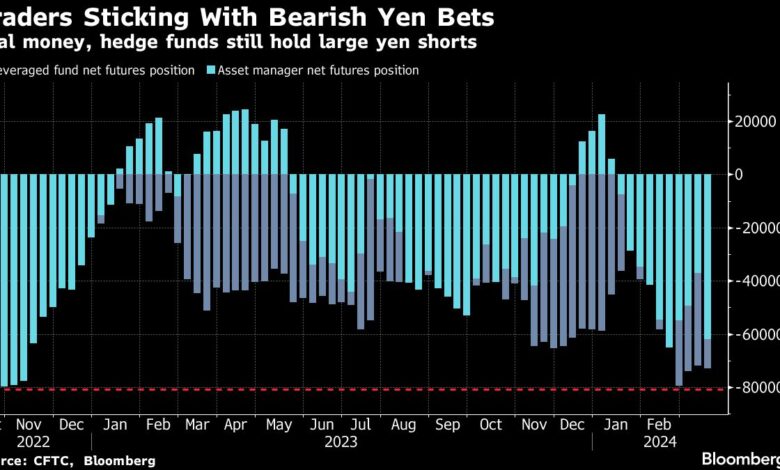

Bearish Bets

Hedge funds ramped up bearish yen wagers in the week stretching through the BOJ’s March meeting. Leveraged speculators in the currency market increased their holdings of contracts tied to bets the yen will fall to 80,805, approaching the six-year high of 83,562 reached last month, according to data through March 19 from the Commodity Futures Trading Commission.

Goldman Sachs Group Inc. raised its forecasts for the dollar versus the yen, expecting a benign macro setup to weigh on the Japanese currency in coming months. The firm now expects the US currency to trade around 155 yen, 150, and 145 in three, six and 12 months, compared with previous forecasts of 145, 142 and 140, strategists including Kamakshya Trivedi wrote in a note Friday.

Much of the recent movement in the dollar-yen exchange rate is linked to expectations of when the Federal Reserve will cut interest rates, a move that would likely weaken the greenback against Japan’s currency. With those expectations pushed back, the yen has come under renewed pressure.

The yen is the worst performing G10 currency this year and has shed 6.8% against the dollar.

–With assistance from Momoka Yokoyama, Yumi Teso and Daisuke Sakai.

(Adds more comments from Kanda)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.