S&P 500 Keeps Rising to Defy Valuation Warnings: Markets Wrap

(Bloomberg) — Stocks climbed anew ahead of data expected to underscore further disinflation — paving the way for the Federal Reserve to start cutting interest rates this year.

Most Read from Bloomberg

Less than 24 hours before the consumer price index, a report showing a drop in medium-term inflation expectations to the lowest since at least 2013 bolstered trader sentiment. Defying concerns about an overstretched market, the S&P 500 kept rising above 5,000, with Nvidia Corp. overtaking Amazon.com Inc.’s market capitalization to become the fourth most-valuable US company.

“This run to 5,000 has been supported by the fundamentals, with a soft landing looking increasingly likely and earnings season nicely exceeding expectations after a messy start,” said Jeffrey Buchbinder at LPL Financial. “A market trading over 20 times earnings seems high, but it’s reasonable if the US economy avoids recession and earnings grow double-digits this year — which is not out of the question.”

After struggling in the first hour of New York trading, the S&P 500 topped 5,040. Chip designer Arm Holdings Plc soared as much as 42% in the wake of last week’s blockbuster earnings report that showed artificial intelligence spending is fueling sales. Treasury 10-year yields were little changed at 4.18%. Bitcoin hit $50,000 for the first time since December 2021.

The annual CPI is forecast to have dropped to 2.9% in January from 3.4% the prior month, according to consensus estimates of economists surveyed by Bloomberg. That would be the first reading below 3% since March 2021, supporting a disinflationary trend that will determine the scope and timing of rate cuts.

Fed Governor Michelle Bowman reiterated the central bank’s benchmark lending rate is in a good place to keep downward pressure on inflation, and she doesn’t see a need to ease policy soon.

In the derivatives markets, traders started pricing in that the Fed will carry out just four — or five at the most — quarter-point rate cuts in 2024, only slightly more than the three penciled in by policymakers. That’s a sharp shift from the end of last year, when futures traders were wagering on seven such moves, anticipating the Fed would cut rates by a full percentage point more than it was telegraphing at the time.

“It’s important not to lose sight of the big picture, which is that continued disinflation should allow the central bank to start easing this year,” said Mark Haefele at UBS Global Wealth Management. “This is a significant change in the investment landscape, so we think it’s less important whether the Fed cuts three, four, or five times this year. Any of these scenarios should be a positive macro outcome for bonds.”

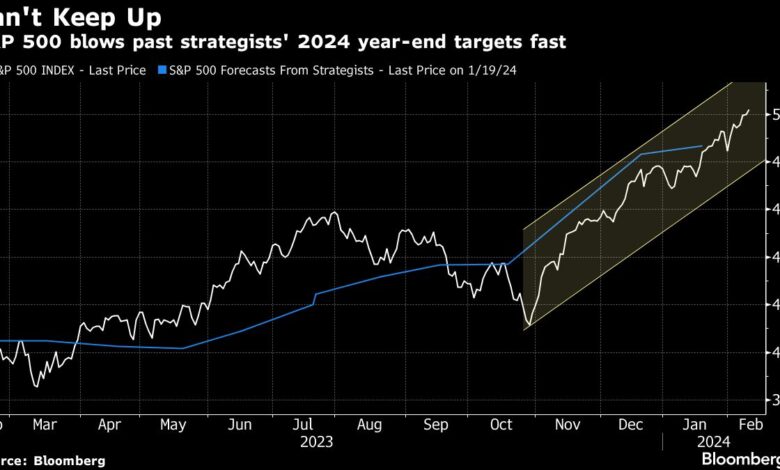

“Most people will be fixated on this week’s inflation numbers, but there’s also a potential tug-of-war between how extended the current market rally may be vs. the buzz surrounding the S&P 500 topping 5,000,” said Chris Larkin at E*Trade from Morgan Stanley. “While it’s true the S&P has often pushed higher after crossing ‘round-number’ thresholds like this one, it hasn’t always done it after the type of rally that has unfolded since late October.”

Since 1968, whenever the S&P 500 rallied at least 20% over a 70-trading-day period, which it did between Oct. 27 and last Thursday, more often than not it was lower two weeks later, Larkin noted.

Sam Stovall at CFRA says that

If history is any guide, while short-term digestions of gains have indeed occurred, they have been fairly short in duration. When looking at the S&P 500’s cumulative return in the 3-, 6-, and 12-months after crossing above the 100, 500, 1,000, 2,000, 3,000, and 4,000 levels, the S&P 500 posted average price gains of 4.7%, 9.8%, and 12.3%, and rose in price during 83% of all periodic observations, he noted.

Last week’s news and data reinforced the four drivers of this bull market: Fed rate cuts by May, solid economic growth, continued disinflation and strong earnings, according to Tom Essaye at the Sevens Report.

“It’s important to acknowledge that this rally has been driven by actual good news and bullish expectations being reinforced by actual data,” Essaye said. “At the same time, the risks that kept investors worried in October (and even throughout 2023) haven’t been vanquished — they simply haven’t shown up, yet.”

The S&P 500 is currently trading around 20 times forward earnings — a level it has only hit in two other periods over the last 25 years: the dot-com bubble and the post-pandemic bull market, said Nicholas Colas at DataTrek Research.

“Valuations get to these levels when investors have high confidence in three factors: monetary/fiscal policy, the US/global banking system, and strong corporate earnings,” Colas added. “Even with 2022’s bear market, investors feel that the future is highly predictable. It will likely take an exogenous shock to change their minds.”

To Rob Swanke at Commonwealth Financial Network, some caution is warranted at the current valuation levels.

“I wouldn’t say we’re in bubble territory, but the market is pricing closer to perfection now and companies will have to continue to hit high earnings targets in 2024, something they didn’t have to do in 2023,” he added.

Corporate Highlights:

-

The Federal Reserve slapped Citigroup Inc. with a series of demands to change the way it measures the risk of its trading partners, according to a Reuters report, the latest blow to Chief Executive Officer Jane Fraser’s turnaround effort.

-

Diamondback Energy Inc. agreed to buy fellow Texas oil-and-gas producer Endeavor Energy Resources LP in a $26 billion cash-and-stock deal to create the largest operator focused on the prolific Permian Basin.

-

Gilead Sciences Inc. agreed to purchase CymaBay Therapeutics Inc., a developer of an experimental liver disease drug, for $4.3 billion in equity value.

-

Hewlett Packard Enterprise Co. is seeking as much as $4 billion from Autonomy Corp.’s former bosses following a London judge’s finding that they fraudulently boosted the value of the company before its sale.

Key Events this Week:

-

Germany ZEW survey expectations, Tuesday

-

US CPI, Tuesday

-

Eurozone industrial production, GDP, Wednesday

-

BOE Governor Andrew Bailey testifies to House of Lords economic affairs panel, Wednesday

-

Chicago Fed President Austan Goolsbee speaks, Wednesday

-

Fed Vice Chair for Supervision Michael Barr speaks, Wednesday

-

Japan GDP, industrial production, Thursday

-

US Empire manufacturing, initial jobless claims, industrial production, retail sales, business inventories, Thursday

-

ECB President Christine Lagarde speaks, Thursday

-

Atlanta Fed President Raphael Bostic speaks, Thursday

-

Fed Governor Christopher Waller speaks, Thursday

-

ECB chief economist Philip Lane speaks, Thursday

-

US housing starts, PPI, University of Michigan consumer sentiment, Friday

-

San Francisco Fed President Mary Daly speaks, Friday

-

Fed Vice Chair for Supervision Michael Barr speaks, Friday

-

ECB executive board member Isabel Schnabel speaks, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.4% as of 12:20 p.m. New York time

-

The Nasdaq 100 rose 0.3%

-

The Dow Jones Industrial Average rose 0.5%

-

The MSCI World index rose 0.3%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0776

-

The British pound was little changed at $1.2629

-

The Japanese yen was little changed at 149.33 per dollar

Cryptocurrencies

-

Bitcoin rose 3.7% to $49,895.56

-

Ether rose 2.3% to $2,562.04

Bonds

-

The yield on 10-year Treasuries was little changed at 4.17%

-

Germany’s 10-year yield declined two basis points to 2.36%

-

Britain’s 10-year yield declined three basis points to 4.06%

Commodities

-

West Texas Intermediate crude fell 0.2% to $76.68 a barrel

-

Spot gold fell 0.4% to $2,016 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Alexandra Semenova, Michael Mackenzie, Liz Capo McCormick, Ye Xie and Denitsa Tsekova.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.