The Worst Bond Bear Market Ever Marches On

I write a lot about bear markets.

Here’s a random assortment of my greatest hits in recent years:

I focus on corrections, bear markets, and crashes because those are the truly important times for investors. Success as an investor comes from your actions during the bad times.

These pieces are all about the stock market because there haven’t been many downturns in the bond market historically. Bonds are boring, and they’re not as volatile as the stock market…most of the time.

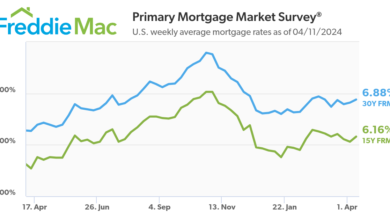

The Fed took interest rates from 0% in the pandemic to 5% in a hurry as inflation accelerated:

As interest rates rise, bond prices fall. When rates rise quickly, bond prices fall quickly.

The Bloomberg Aggregate Bond Index is currently experiencing its largest drawdown since its inception in 1976 in terms of both magnitude and length of time:

At its nadir, the Agg was down more than 18%. It’s still down double-digits.

Other areas of the bond market are still in the midst of even worse drawdowns:

Zero coupon bonds, which are essentially long-duration bonds on steroids, are still down almost 60%. Long-term Treasuries are still down more than 40%. Even 7-10 year Treasuries are down 20%.

All of these numbers include interest but it’s even worse than it looks because inflation has taken another 20% or so off the top.

So why aren’t investors freaking out more?

Can you imagine if we were four years into a stock market crash and the losses were still in the 40-60% range?

There would be endless headlines in the financial media. Investors would be freaking out.

Yet bond investors seem relatively calm. Money is actually pouring into long-term Treasuries despite the route:

A lot of this has to do with investors positioning for lower rates that haven’t come yet but it’s not like people are running for the exits.

Why aren’t more investors blowing a gasket out about bonds?

Some thoughts:

Yield matters. Bonds have gotten killed because rates rose. Now that rates have risen, yields are higher. Investors like higher yields!

The losses are the past. The yields are the future.

There is an alternative. When the stock market crashes there are generally few places to hide. Sure, low vol or high quality dividend stocks might not fall nearly as much as the overall market but a 30% loss instead of 40% drawdown offers little consolation.

There are much better alternatives regarding volatility reduction in fixed income.

T-bills have yielded more than 4% for nearly two years. Yields on ultra short-term government paper have been over 5% for more than a year.

Plus, you have money market funds, online savings accounts, and CDs with similarly high yields.

There aren’t all that many investors who have a high allocation to the areas of the bond market with the biggest losses because better options have been available.

Stocks and bonds are different. Bonds are governed more by math than stocks when it comes to expected returns.

Buying stocks when they are down is generally a wonderful strategy but there are no guarantees they will come back. There’s more uncertainty involved during a stock bear market.

Bond yields could always rise further, but the starting yields are a good indication of long-run expected returns. The yield tells the story in high-quality fixed income.

There are more emotions involved with the stock market, as well.

If anything, the bond bear market shows investors, on average, continue to get smarter with their decisions.

The bear market has been painful if you went into it with long duration assets. But if you were intelligent about how you invest your fixed income allocation and spread your bets, the bond bear market hasn’t been all that painful.

And now that yields are higher, the future looks much brighter from here.

Further Reading:

The Difference Between Stocks & Bonds