Traders Await Market Reaction to Middle East Events

Israel’s stock market shrugged off the weekend’s attack by Iran, and cryptocurrencies were regaining from earlier losses as the world braced for a broader market reaction to start the week.

Officials said most of the 300 drones and missiles Iran launched toward Israel on Saturday were intercepted, and tensions appeared to be de-escalating on Sunday. President Joe Biden condemned the attack and said U.S. forces helped Israel take down nearly all of the incoming drones and missiles.

“While we have not seen attacks on our forces or facilities today, we will remain vigilant to all threats and will not hesitate to take all necessary action,” Biden said. He plans to convene a meeting with other leaders from the Group of Seven nations.

The Tel Aviv Stock Exchange 125 Index and the Tel Aviv Stock Exchange 35 Index were each up 0.3% on Sunday.

the largest cryptocurrency, was up 3.4% after rebounding from losses on Saturday.

was up 5%.

Iran’s foreign minister Hossein Abdollahian said on Sunday that his government had no plans to continue attacks against Israel, according to a translated social media post.

Advertisement – Scroll to Continue

Traders are watching the opening of markets in Asia later on Sunday in the U.S. for a reading on how stocks and other assets will react globally. Oil closed Friday already on an upswing, while the U.S. stock market ended lower.

The attack could pressure lawmakers on Capitol Hill to bring foreign aid back to the front burner. Byron Callan at Capital Alpha Partners said “this should increase the probability that the House passes a security

supplemental if members conclude that Iran’s drone/missile industry is a common link between Russia’s war in Ukraine and Israel’s security.”

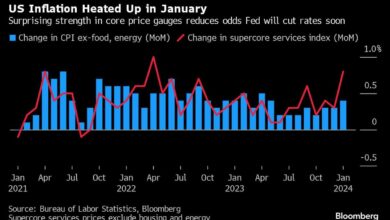

It could also complicate the Federal Reserve’s fight against inflation and its decision on the timing of any interest-rate cuts. “Our sense is that events in the Middle East will add to the reasons for the Fed to adopt a more cautious approach to rate cuts, but they won’t prevent it from cutting altogether,” Capital Economics wrote in a note on Sunday. “We expect the first move in September.”

Advertisement – Scroll to Continue

Premarket trading begins in Australia in the afternoon U.S. Eastern time.

Write to Liz Moyer at liz.moyer@barrons.com