Q1 2024 EPS Estimates for Triple Flag Precious Metals Corp. (NYSE:TFPM) Lowered by National Bank Financial

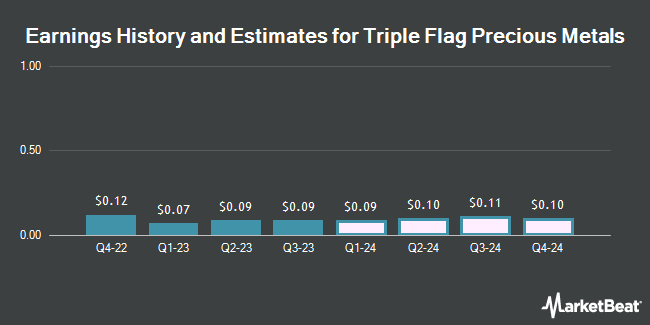

Triple Flag Precious Metals Corp. (NYSE:TFPM – Free Report) – Research analysts at National Bank Financial cut their Q1 2024 earnings per share (EPS) estimates for shares of Triple Flag Precious Metals in a research note issued on Thursday, February 22nd. National Bank Financial analyst S. Nagle now forecasts that the company will earn $0.08 per share for the quarter, down from their prior forecast of $0.10. The consensus estimate for Triple Flag Precious Metals’ current full-year earnings is $0.44 per share. National Bank Financial also issued estimates for Triple Flag Precious Metals’ Q2 2024 earnings at $0.11 EPS, FY2024 earnings at $0.35 EPS, FY2025 earnings at $0.46 EPS and FY2026 earnings at $0.42 EPS.

Separately, TheStreet upgraded Triple Flag Precious Metals from a “d+” rating to a “c-” rating in a research note on Wednesday, December 27th. Four analysts have rated the stock with a buy rating, According to data from MarketBeat.com, Triple Flag Precious Metals presently has a consensus rating of “Buy” and an average price target of $23.10.

Check Out Our Latest Stock Report on Triple Flag Precious Metals

Triple Flag Precious Metals Stock Performance

NYSE:TFPM opened at $12.19 on Monday. The company has a debt-to-equity ratio of 0.03, a quick ratio of 3.84 and a current ratio of 3.29. Triple Flag Precious Metals has a 52-week low of $11.81 and a 52-week high of $17.33. The firm has a market cap of $2.45 billion, a price-to-earnings ratio of 64.16, a PEG ratio of 4.45 and a beta of -0.04. The business’s fifty day moving average is $12.79 and its 200 day moving average is $13.02.

Institutional Investors Weigh In On Triple Flag Precious Metals

Several institutional investors have recently bought and sold shares of the stock. Barclays PLC lifted its holdings in Triple Flag Precious Metals by 0.7% in the 3rd quarter. Barclays PLC now owns 123,003 shares of the company’s stock worth $1,608,000 after buying an additional 907 shares during the period. Orion Portfolio Solutions LLC raised its position in shares of Triple Flag Precious Metals by 6.6% in the 4th quarter. Orion Portfolio Solutions LLC now owns 16,187 shares of the company’s stock worth $207,000 after acquiring an additional 1,000 shares in the last quarter. Meixler Investment Management Ltd. increased its position in Triple Flag Precious Metals by 8.4% during the 4th quarter. Meixler Investment Management Ltd. now owns 14,575 shares of the company’s stock valued at $194,000 after buying an additional 1,125 shares in the last quarter. Geode Capital Management LLC increased its position in Triple Flag Precious Metals by 6.1% during the 2nd quarter. Geode Capital Management LLC now owns 20,512 shares of the company’s stock valued at $282,000 after buying an additional 1,171 shares in the last quarter. Finally, Commonwealth Equity Services LLC increased its position in Triple Flag Precious Metals by 1.9% during the 2nd quarter. Commonwealth Equity Services LLC now owns 67,384 shares of the company’s stock valued at $929,000 after buying an additional 1,250 shares in the last quarter. 80.91% of the stock is currently owned by hedge funds and other institutional investors.

Triple Flag Precious Metals Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, March 15th. Stockholders of record on Monday, March 4th will be issued a $0.052 dividend. This represents a $0.21 dividend on an annualized basis and a dividend yield of 1.71%. The ex-dividend date is Friday, March 1st. Triple Flag Precious Metals’s payout ratio is currently 110.53%.

About Triple Flag Precious Metals

Triple Flag Precious Metals Corp., a gold-focused streaming and royalty company, engages in acquiring and managing precious metals and other streams and royalties in Australia, Canada, Colombia, Mongolia, Peru, South Africa, and the United States. The company has a portfolio of streams and royalties providing exposure primarily to gold and silver.

Recommended Stories

Receive News & Ratings for Triple Flag Precious Metals Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Triple Flag Precious Metals and related companies with MarketBeat.com’s FREE daily email newsletter.