Wheaton Precious Metals (NYSE:WPM) Price Target Raised to $61.00 at BMO Capital Markets

Wheaton Precious Metals (NYSE:WPM – Free Report) had its price objective hoisted by BMO Capital Markets from $59.00 to $61.00 in a report issued on Tuesday, BayStreet.CA reports. BMO Capital Markets currently has an outperform rating on the stock.

Wheaton Precious Metals (NYSE:WPM – Free Report) had its price objective hoisted by BMO Capital Markets from $59.00 to $61.00 in a report issued on Tuesday, BayStreet.CA reports. BMO Capital Markets currently has an outperform rating on the stock.

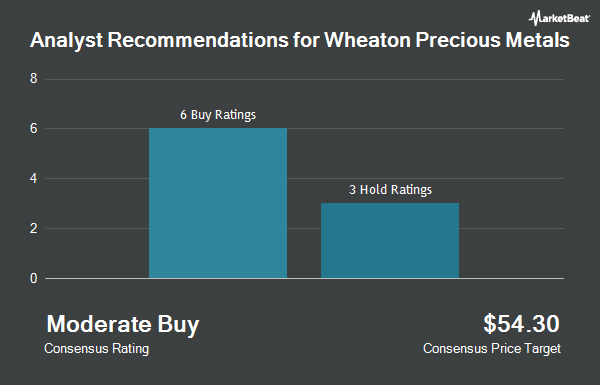

WPM has been the subject of a number of other reports. Berenberg Bank lifted their target price on shares of Wheaton Precious Metals from $52.00 to $54.00 and gave the company a buy rating in a research note on Wednesday, March 27th. Raymond James reduced their target price on shares of Wheaton Precious Metals from $60.00 to $58.00 and set a market perform rating for the company in a research note on Thursday, February 22nd. TD Securities upgraded shares of Wheaton Precious Metals from a hold rating to a buy rating and lifted their target price for the company from $51.00 to $53.00 in a research note on Monday, March 18th. Jefferies Financial Group lifted their target price on shares of Wheaton Precious Metals from $52.00 to $61.00 and gave the company a buy rating in a research note on Monday, April 22nd. Finally, Scotiabank reduced their target price on shares of Wheaton Precious Metals from $60.00 to $59.00 and set a sector outperform rating for the company in a research note on Wednesday, February 28th. Four analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. According to data from MarketBeat, the stock has an average rating of Moderate Buy and an average price target of $58.45.

Check Out Our Latest Report on Wheaton Precious Metals

Wheaton Precious Metals Stock Performance

WPM stock opened at $57.85 on Tuesday. The stock has a market cap of $26.22 billion, a P/E ratio of 44.50, a P/E/G ratio of 7.60 and a beta of 0.75. The firm has a 50 day simple moving average of $50.99 and a 200 day simple moving average of $47.91. Wheaton Precious Metals has a 52 week low of $38.37 and a 52 week high of $57.87.

Wheaton Precious Metals (NYSE:WPM – Get Free Report) last posted its quarterly earnings results on Thursday, May 9th. The company reported $0.36 EPS for the quarter, topping the consensus estimate of $0.29 by $0.07. The business had revenue of $296.80 million during the quarter, compared to analysts’ expectations of $278.95 million. Wheaton Precious Metals had a net margin of 53.74% and a return on equity of 8.53%. The firm’s quarterly revenue was up 38.7% compared to the same quarter last year. During the same period last year, the company posted $0.23 earnings per share. Sell-side analysts predict that Wheaton Precious Metals will post 1.28 EPS for the current year.

Wheaton Precious Metals Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Tuesday, June 11th. Investors of record on Wednesday, May 29th will be given a dividend of $0.155 per share. This represents a $0.62 dividend on an annualized basis and a yield of 1.07%. The ex-dividend date is Wednesday, May 29th. Wheaton Precious Metals’s dividend payout ratio (DPR) is currently 47.69%.

Hedge Funds Weigh In On Wheaton Precious Metals

A number of institutional investors and hedge funds have recently bought and sold shares of WPM. Norges Bank bought a new position in Wheaton Precious Metals during the fourth quarter worth $387,481,000. TD Asset Management Inc increased its position in Wheaton Precious Metals by 71.2% during the first quarter. TD Asset Management Inc now owns 4,857,837 shares of the company’s stock worth $229,026,000 after acquiring an additional 2,019,722 shares during the period. Van ECK Associates Corp increased its position in Wheaton Precious Metals by 9.9% during the fourth quarter. Van ECK Associates Corp now owns 20,521,065 shares of the company’s stock worth $1,012,517,000 after acquiring an additional 1,856,031 shares during the period. Mirae Asset Global Investments Co. Ltd. increased its position in Wheaton Precious Metals by 31.0% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 5,672,800 shares of the company’s stock worth $272,975,000 after acquiring an additional 1,342,264 shares during the period. Finally, Price T Rowe Associates Inc. MD increased its position in Wheaton Precious Metals by 16.0% during the first quarter. Price T Rowe Associates Inc. MD now owns 7,309,175 shares of the company’s stock worth $344,483,000 after acquiring an additional 1,010,307 shares during the period. Institutional investors own 70.34% of the company’s stock.

Wheaton Precious Metals Company Profile

Wheaton Precious Metals Corp. primarily sells precious metals in North America, Europe, and South America. It produces and sells gold, silver, palladium, and cobalt deposits. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals Corp. in May 2017. Wheaton Precious Metals Corp.

Read More

Receive News & Ratings for Wheaton Precious Metals Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Wheaton Precious Metals and related companies with MarketBeat.com’s FREE daily email newsletter.