Cion Investment Corp president buys $43.1k in company stock By Investing.com

© Reuters.

Gregg A. Bresner, President and Chief Investment Officer of CION Investment Corp (NYSE:CION), has purchased 4,000 shares of the company’s common stock, according to a recent filing with the U.S. Securities and Exchange Commission. The transaction, which took place on March 20, 2024, amounted to a total investment of approximately $43,120, with the shares acquired at a weighted average price of $10.78 each. The prices ranged from $10.77 to $10.79 per share.

This latest acquisition increases Bresner’s direct ownership stake in the company to 50,099 shares. Notably, the filing includes a footnote indicating that this total includes 11,500 shares held in certain investment retirement accounts for which Bresner has sole voting and investment power.

The purchase reflects a vote of confidence from the executive in the company’s prospects. Investors often monitor insider transactions as they provide insights into how the top management perceives the financial health and future performance of the company.

CION Investment Corp, based in New York, has not made any public comments regarding the transaction. The details of the purchase, including the number of shares bought at each price point, will be made available to the SEC staff, the issuer, or any security holder of the issuer upon request.

InvestingPro Insights

As Gregg A. Bresner, President and Chief Investment Officer of CION Investment Corp, shows his confidence in the company with a recent stock purchase, the broader financial metrics offer additional insights. CION’s commitment to shareholder value is evident through its consistent dividend raises, as noted by an InvestingPro Tip highlighting that the company has raised its dividend for three consecutive years.

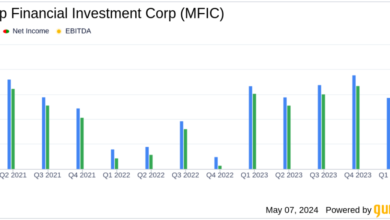

Moreover, CION’s financial health is underscored by its attractive valuation metrics. The company is currently trading at a low earnings multiple, with a P/E Ratio (Adjusted) of just 5.49 for the last twelve months as of Q4 2023, and a PEG Ratio of 0.06, indicating potential for growth relative to earnings. Additionally, the company boasts a solid Revenue Growth of 28.79% for the same period.

Investors interested in more in-depth analysis will find a wealth of additional InvestingPro Tips at InvestingPro’s dedicated company page, which could further inform investment decisions. There are five more tips available, including predictions by analysts on the company’s profitability for the year and a note on its significant dividend payouts to shareholders. To enhance your research experience, use the coupon code PRONEWS24 to get an additional 10% off a yearly or biyearly Pro and Pro+ subscription.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.