ETY: 9% Income Yield, Paid Monthly, But Is It A Good Investment? (NYSE:ETY)

Khanchit Khirisutchalual

Introduction:

Eaton Vance Tax-Managed Diversified Equity Income Fund (NYSE:ETY) is a closed-end fund that was incepted in Nov. 2006. The fund’s primary objective is to provide a high level of tax-advantaged income, along with capital appreciation. The fund invests in domestic equity stocks with an emphasis on growth stocks and uses zero leverage. Recently, the fund increased its distribution and currently pays a very attractive yield of 9.03% (paid on a monthly basis). As the name indicates, the fund tries to pay the distributions in an efficient tax manner as much as possible. To make distributions tax efficient, it tries to provide qualified dividends as much as possible. Many times, it provides distributions as ROC (return of capital). ROC reduces the shareholder’s basis in the investment, essentially deferring the tax to a future date (when the investment is sold). So, in that sense, it may be better to hold this fund in a taxable account.

As per the fund’s literature,

The Fund’s primary investment objective is to provide current income and gains, with a secondary objective of capital appreciation. Under normal market conditions, the Fund’s investment program consists of owning a diversified portfolio of common stocks. The Fund seeks to earn high levels of tax-advantaged income and gains by (1) investing in stocks that pay dividends that qualify for favorable federal income tax treatment and/or (2) writing (selling) stock index call options with respect to a portion of its common stock portfolio value. Under normal market conditions, the Fund invests at least 80% of its total assets in a combination of (1) dividend-paying common stocks and (2) common stocks, the value of which is subject to covered written index call options.

Typically, the Fund invests in common stocks of United States issuers. The Fund may invest up to 40% of its total assets in securities of foreign issuers. The Fund may invest up to 5% of its total assets in securities of emerging market issuers. The Fund expects that its assets will normally be invested across a broad range of industries and market sectors. The Fund may not invest 25% or more of its total assets in the securities of issuers in any single industry.

Other salient features of this fund are as follows:

- The fund is managed by the Eaton Vance fund family, one of the oldest and largest fund management companies. It manages over $17 Billion in CEFs (Closed-End Fund) assets alone. Please be aware that Eaton Vance is part of Morgan Stanley’s asset management division.

- The fund ETY uses zero leverage. Obviously, leverage can pad the returns in a bull market, but this fund is already concentrated in growth equity names, so in a way, it does not need leverage.

- The funds’ mandate allows it to invest globally, but it primarily invests in the U.S. equity market. It is invested nearly 97% in U.S.-based companies or U.S. listed securities.

- It is a diversified equity fund but still concentrated in its top holdings. It has a total of 59 holdings (as of Dec. 31, 2023). The top names include many of the names from ‘Magnificent Seven’ as they are also the top names in the S&P 500. It overwrites nearly 50% of the value of the portfolio to generate income.

- The fund has a reasonably good past record of long-term performance, but it has underperformed the S&P 500 for most periods. Longer term, as of Mar.31, 2024, since Jan. 2007, the fund has returned 8.06% on NAV basis, annualized, compared to 9.92% for the S&P 500. Based on its NAV, it has returned 9.56%, 12.48%, and 8.64% over 10-year, 5-year, and 3-year timeframes, respectively. These results assume that all distributions were reinvested.

- The fund pays a monthly distribution. It also follows a ‘managed’ distribution policy, which would mean that the fund may not always earn enough in investment income and realized capital gains. At the same time, the fund attempts to make distributions in a tax-efficient manner, so at times, they are characterized as non-dividend distributions (also known as ‘return of capital’).

- As of Dec.31, 2023, the fund under its management had roughly $2.0 billion in total (or net) assets with zero leverage.

- The fund is an actively managed fund and has an expense ratio of 1.07% on the managed assets, including the 1.00% management fee.

- As of April 02, 2024, its distribution yield on the market price was 9.03% and 8.55% on the NAV.

- As of April 02, 2024, ETY’s market price offered a discount of -5.24% to its NAV. The 3-year average premium/discount is +0.17% (premium), while the 12-month average is -3.77% (discount).

- The fund’s NAV, as of April 02, 2024, stood at $13.92, which is an improvement of 19% from its NAV as of the last annual report (Oct.31, 2023).

Financial Outlook:

Let’s look at the fund’s financial health to see if the fund is earning enough to pay for the distributions. The most recent detailed report that is available to investors is the annual report for the period of Nov. 2022 – Oct. 31, 2023.

Net Investment Income:

The net investment income (or NII in short) is the net income that a fund earns from its investment in the form of dividends, distributions, and interests or derivatives like options, minus all of the fund’s expenses, including management fees, operating expenses, commissions, and interest on leverage, etc. For equity-based funds, especially in high-growth sectors like technology, the NII is not very relevant. However, for fixed-income or bond funds, it is highly relevant. In the case of ETY, it invests almost all of its assets in equities, especially high-growth equities, and the income from dividends is minimal. However, it also writes call options for 40-50% of its assets to generate some extra income. But just like with other such funds, more than half of NII gets spent on expenses. So, the bulk of the burden of distributions has to fall back on capital gains. Since this fund is aimed to be tax-efficient, it many times pays the distributions in the form of ROC, even when it may have sufficient realized or unrealized capital gains.

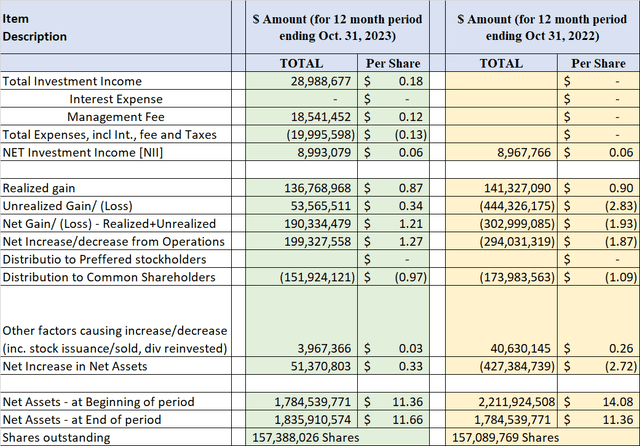

Here is what it looks like in terms of NII, Distributions, and Net Assets at the beginning and end of the statement period.

(all amounts are in US $ (except Shares Outstanding); negative amounts are shown inside parentheses, per the Annual report, 12 months ending Oct.31, 2023. We also provide the per-share data and comparison with the year 2022.

Table-1:

Data source: ETY’s 2023 Annual report, 12 months ending Oct. 31, 2023.

Distributions:

ETY provides a monthly distribution of $0.0992 per share, which comes out to be a yield of 9.03% at current prices (as of 04/02/2024) and 8.55% on the NAV. The fund follows a ‘managed’ distribution policy. The fund’s policy is to make tax-efficient distributions as much as possible. It has paid fairly consistent dividends since 2013, but it did reduce the payout in 2022 after increasing it in 2021.

So, is the distribution covered?

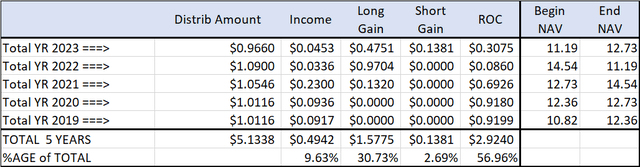

Table-2: Distribution (from 2019-2023)

The current regular distribution amount is $0.0992 per month for the year. It was increased last month from a level of $0.0805, a 23% increase. We checked the distribution record for the last five years and found that nearly 50% of the distributions were paid as ROC (return of capital). However, if you look at the year-begin-NAV and year-end-NAV, there is not much correlation of ROC with the fund’s gains. For example, in 2019 and 2020, the NAV gained quite a bit, but nearly 90% of the distributions were paid as ROC. In 2022, when NAV took a nosedive, the fund paid almost no ROC. So, the ROC that this fund pays is NOT destructive, but it specifically uses ROC as a tool to keep the distributions tax-efficient or tax-advantaged.

That said, this fund is an equity fund, and that, too, has a high concentration of growth stocks, so there is very little investment income after accounting for the expenses. Though this fund is not leveraged, so there are no interest expenses. So, the fund has to depend on capital gains to sustain the distributions and/or the growth of NAV. As long as the down cycles are not prolonged multi-years, this fund should do just fine.

Since its inception over 17 years ago, the fund has gone through many market conditions and economic cycles. They did cut the distributions after the 2008-2009 crisis sequentially for three years. But since 2013, they have had a pretty good record. They also adjusted the payout lower in 2022 after increasing it in 2021, but the overall impact was minimal. Now, in 2024, the distribution has increased significantly to the extent of 23%. We can rate the dividend reliability and consistency as pretty good, but one should expect some variations and adjustments depending on the market conditions. Also, the dividend yield is very high, which does not leave much scope for capital appreciation.

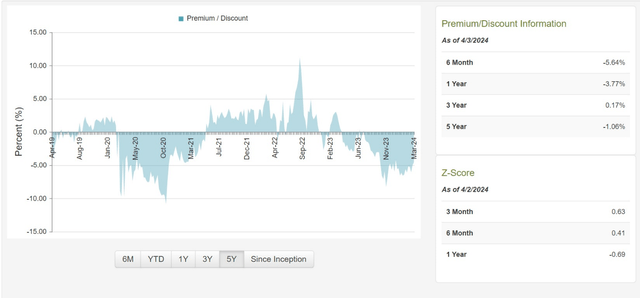

Discount/Premium:

The fund is currently trading at a very attractive discount of -5.24% (to its NAV, as of Apr. 02, 2024), which is slightly better than its 52-week average of -3.77%. At the same time, the 3-year average shows a slight premium of 0.17%, so the current discount is still attractive.

Below is the five-year history of premium/discount. As visible in the chart, the fund has spent most of 2021 and 2022 in the premium and then 2023 in the discount area. The discount has narrowed a bit recently. Moreover, we should always look at both the premium/discount and the overall valuation of the fund within its sector.

Chart-2: ETY – Premium/Discount Chart (over five years)

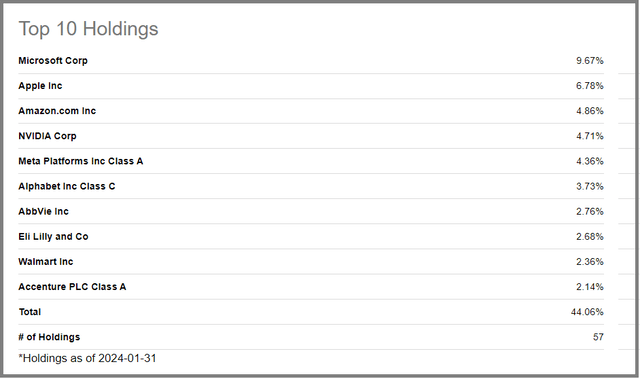

Funds Holdings:

The fund is mostly invested in common stocks listed in the U.S. market. In terms of holdings, the fund is a bit concentrated, as the number of holdings stood at 57 as of Jan. 31, 2024. The top 10 holdings make up about 44% of the assets. The top 10 holdings as of Jan. 31, 2024, and asset composition are presented below. Some of the top equity holdings are well-known names, for example, Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), NVIDIA (NVDA), Meta (META), Google (GOOGL), AbbVie (ABBV), Eli Lilly (LLY), and Walmart (WMT).

Table-3:

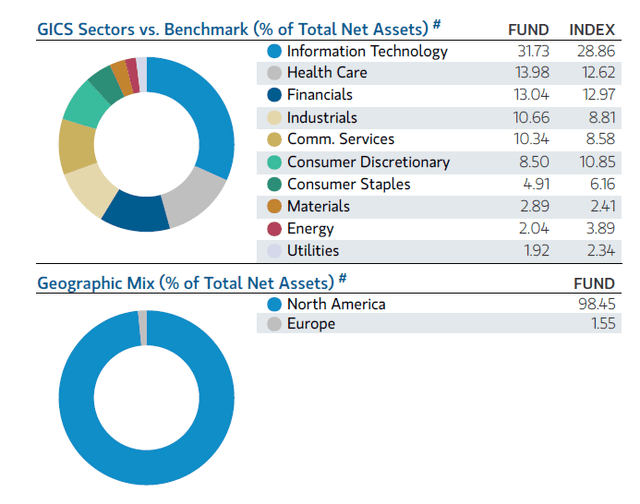

Chart-3: Sector allocation (as of Dec. 31, 2023)

Performance and Valuation:

If you are looking for a reliable and relatively stable source of nearly 9% income (paid monthly), you should consider this fund. If your objective was simply total returns over a very long period of time, the S&P 500 would beat this fund by one or two percentage points. That said, that is not the objective of most income investors. They are rather looking for a reliable source of monthly income and do not want the headache of figuring out when and what to buy or sell and when to raise income. Obviously, there is a cost to this, and that’s why we see the fund performance lag 1 to 1.5% compared to that of the S&P 500 for most periods. Obviously, these figures could change if you are looking at a short time horizon.

In the table below, we compare several performance-related metrics with one other fund from Eaton Vance and the S&P 500. The following are included:

- ETY

- (SPXX) Nuveen S&P 500 Dynamic Overwrite

- (CII) BlackRock Enhanced Capital and Income

- (ETG) Eaton Vance Tax-Adv Global Dividend Inc

- (SPY) S&P 500 ETF Trust

Table 4: (Data – period as specified, otherwise as of Mar. 31, 2024)

|

Item Desc. |

ETY |

SPXX |

CII |

ETG |

S&P 500 |

|

Dividend Yield% (as of 04/02/2024) |

9.03% |

7.57% |

6.17% |

8.61% |

1.33% |

|

Discount/Premium |

-5.34% |

-8..93% |

-7.72% |

-12.02% |

n/a |

|

Annualized Return [CAGR] From 2008-2023 |

8.57% |

7.18% |

9.21% |

5.70% |

9.69% |

|

Max. Drawdown (2008-2023) |

-37.5% |

-41% |

-47.5% |

-62.2% |

-48.5% |

|

Std. Deviation (2008-2023) |

17.8% |

16.5% |

19.2% |

24.4% |

16.2% |

|

10-Year CAGR |

10.33% |

7.90% |

11.34% |

8.08% |

11.88% |

|

5-Year CAGR |

12.82% |

8.68% |

14.25% |

13.21% |

15.53% |

|

3-Year CAGR |

8.39% |

6.60% |

11.38% |

5.53% |

9.85% |

|

1-Year CAGR |

21.86% |

0.82% |

18.47% |

21.98% |

26.11% |

|

Fees (excluding interest) |

1.07% |

0.94% |

0.89% |

1.18% (plus 1.53% interest) |

0.09% |

|

Leverage |

0% |

0% |

0% |

20% |

0% |

|

No of holdings |

59 |

437 |

57 |

183 |

504 |

|

Assets (total) |

$2.0 Billion |

$308 Million |

$926 Million |

$1.9 Billion |

$484 Billion |

|

Allocation |

100% equity, 50% Overwritten |

100% equity, 55% Overwritten |

100% equity, 50% Overwritten |

80% equity (50% domes.), 20% Preferred and Fixed Income |

Largest 500 US companies |

Note: Some of the data (e.g., number of holdings and leverage) may not be current.

Now, ETY’s past performance looks decent but not exceptional. The other fund that stands out in terms of performance in most periods is CII (BlackRock Enhanced Capital and Income), though it comes at a slightly higher volatility. Also, CII differs from ETY in a few respects, including that it writes options on single (individual) stocks, while ETY mostly writes on the index. We will cover it in more detail in the coming weeks.

Risk Factors:

Investors need to be aware of certain risk factors that are associated with this fund and CEFs in general. Risk factors could be summarized as follows:

- Even though the ETY fund carries no leverage and there is no interest expense to pay, the valuations of its underlying holdings, especially the tech sector, are significantly impacted by the direction of interest rates. However, this is not unique to ETY. Moreover, as of now, all indicators and expectations are pointing towards interest rates going down in 2024, in spite of the Fed’s tough-speak.

- The fund has nearly 100% exposure to domestic equity stocks. The US markets have been on a tear in the last decade and, in turn, are quite expensive compared to global equities. But, eventually, this trend may reverse.

- Options risk: The fund overwrites nearly 50% of the value of the portfolio and writes call options on the S&P 500 index. Call options would generate income that would limit the downside risk, but at the same time, it will also limit the upside in a bull market.

- The general risks such as the geo-political situation.

- Market risks: There is still some possibility of a recession in 2024 or 2025, though most market participants expect a shallow one if that happens.

Concluding Thoughts:

As stated earlier, ETY’s past performance looks decent but not the best among similar funds. If acquired opportunistically and at good discounts, the fund offers several attractive features to income investors and retirees.

- The fund provides a very high current distribution (at 9%). We would recommend reinvesting at least one-third of income back into the fund to achieve a decent capital appreciation. If all of the income is withdrawn, then the investor should not expect much capital appreciation.

- The past record is reasonably good. But, if you look at many different time periods, it is about 1% to 2% lower than the S&P 500. We should expect 8% to 10% of total returns from this fund on a long-term basis; however, much depends on how the US equities perform in the next decade.

- With the improvement in market sentiment, valuations of most equities have gone up 20% (if not more) in the last six months. That makes any equity-based fund expensive, but the good thing is that we are being offered a decent discount. Also, with interest rates set to decline in the second half of 2024 and 2025, equities may have more room to run.

- This fund is more like a proxy for the S&P 500, with a slight under-performance but over six times income (paid on a monthly basis).

If you do not need a very high income, there are certainly better choices. That said, if you are a new buyer, you should preferably accumulate this fund on a dollar-cost-average basis or wait for the discount to widen a bit more. The existing owners should hold the shares as we think the broader market has more room to run with the expectations of lower interest rates.