Joe Duran’s RIA Investment Firm Hires Opto Investments Co-Founder

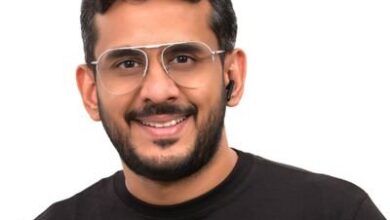

Rise Growth Partners, the new RIA investing company launched by former United Capital CEO Joe Duran, has hired Will Armenta as managing director.

Armenta co-founded Opto Investments alongside technology entrepreneur Joe Lonsdale. He was one of the earliest employees at Addepar, the wealth management portfolio reporting platform, also founded by Lonsdale and currenty is an advisor to 8VC, the tech entrepreneur’s venture capital fund.

“[Will] brings a wealth of industry knowledge and expertise, gained from his time as a co-founder of Opto and in leadership roles at Addepar,” said Darius Mirshahzadeh, co-founder and executive managing partner, Rise Growth Partners, in a statement. “We anticipate that Will to bring huge value to RISE and the partner firms we invest in. Will’s strategic acumen and forward-thinking mindset will be integral to our success as we help nurture the next generation of enterprise RIAs at RISE.”

Armenta was an early employee at Addepar, a wealth management platform provider founded in 2009 by serial entrepreneur Lonsdale, and led the company’s first acquisition. Before he left, he held the title of senior director of product.

In 2019, Armenta co-founded Opto Investments, a private alts platform, alongside Lonsdale and others. He was responsible for the strategy, recruited the leadership team and led the company through a Series A funding. He remains an advisor.

Armenta joined Duran’s company in November to build “the platform to fuel the growth of exceptional advisory firms,” according to his LinkedIn profile. A month prior, Duran hired Terri Kallsen, former chief operating officer of RIA Wealth Enhancement Group, as managing partner and senior operating advisor.

Late last year, Duran said Rise Growth Partners would launch in early 2024, with the intention to acquire a roughly 30% stake in “next-generation” RIAs, targeting those that manage anywhere from $750 million to $5 billion in AUM. Rise Growth will provide the firms capital and operational resources to grow into national RIA platforms with $10 billion or more in assets, he said. Last year, Duran reportedly was meeting with investment firms to fund the venture.

Duran founded RIA United Capital in 2005, and sold the firm to Goldman Sachs in 2019 for $750 million in cash. He left Goldman Sachs in February 2023.