SiriusXM Earnings: Decent Results With Plan for Technology and Content Investment to Drive Growth

Key Morningstar Metrics for SiriusXM Holdings

What We Thought of SiriusXM Holdings’ Earnings

SiriusXM Holdings’ SIRI first quarter was not bad, but revenue remains stagnant, and the company’s subscriber base has continued to contract. With investment in content and technology to improve the SiriusXM streaming app and vehicle integration, management expects subscriber growth to pick up. However, we now forecast slower long-term growth and are reducing our fair value estimate from $7.50 per share to $5.00.

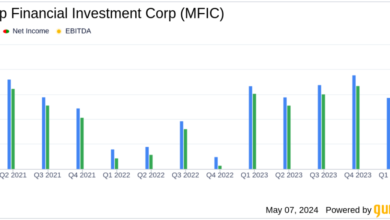

Total revenue was up 1% year over year, as 7% growth at Pandora—driven by a jump in advertising revenue—was mostly offset by a slight decline in subscriber revenue in the much larger SiriusXM segment. Adjusted EBITDA grew by 4% year over year, with lower fixed costs leading to about 1 percentage point of margin expansion.

SiriusXM revenue declined 1% year over year, as the service lost a net of 359,000 self-paying subscribers during the first quarter and revenue per customer increased only $0.07. Customer defections are typically higher in the first quarter, and a lower level of trial starts at the end of 2023 reduced the funnel for potential gross additions this quarter. With the trial funnel now at 7.5 million, up from 7.2 million a year ago, a recently rebuilt SiriusXM app, and traction with car manufacturers with the 360L platform (which integrates the Sirius app into vehicles), management expects more trial conversions and an improvement in subscriber results in the second half.

Podcasts, with associated revenue up 16% year over year, were a big driver of the ad revenue growth. Management said its biggest incremental investments are now in podcasting, and the firm is focusing on podcasts for the Sirius XM subscriber base. The company will add an exclusive podcast library to other programming that is exclusive for SiriusXM subscribers, which should also underpin subscriber stability.

The author or authors do not own shares in any securities mentioned in this article.

Find out about Morningstar’s editorial policies.