Xi Jinping Mounts A Charm Offensive To Win Foreign Investments

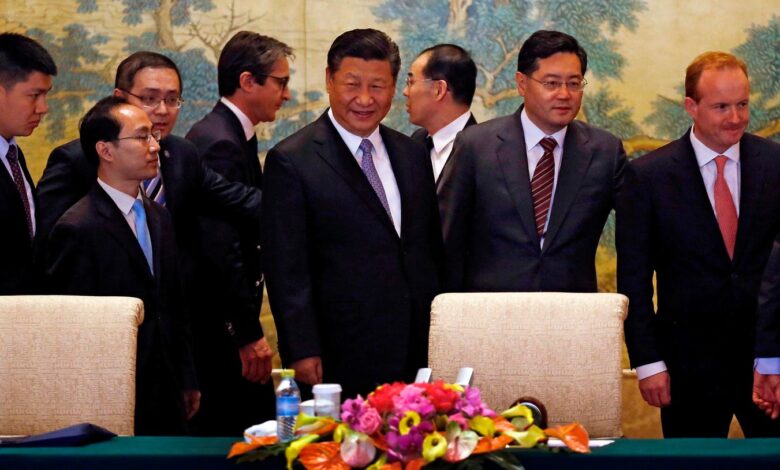

Chinese President Xi Jinping (C) chats with chief executives. (Photo by Andy Wong / POOL / AFP) … [+]

Chinese President Xi Jinping has poured the charm on foreign business leaders. Last November in San Francisco, he carved out time from the Asia-Pacific Economic Cooperation (APEC) summit and meeting with President Joe Biden to speak at a dinner for American executives. There he promised that his country would remain a safe, reliable, and profitable place in which to invest. More recently he hosted a gathering of foreign executives in Beijing to reassure them again and encourage direct investment in China.

Xi has good reason to court foreign investment. China’s economy needs the kind of growth spur it would bring. The pace of real growth has slowed and Chinese consumers as well as private Chinese business have lost confidence in the country’s economic future. People increasingly are choosing saving over spending. Declining real estate values and falling stock prices have discouraged investing and risk taking generally. Private Chinese business has actually cut the amounts it has set aside for expansion. Government spending on infrastructure is more difficult than it once was, for Beijing is running larger budget deficits than it would like, and local governments face huge debt overhangs. Xi and China need the stimulus of dollars, yen, and euros from abroad just to meet the reduced 5% real growth targets for this year. The foreigners, however, have remained coy.

American executives have indeed exhibited enthusiasm in response to Xi’s entreaties. They applauded Xi’s talk vigorously in San Francisco and even gave him a standing ovation. This year’s invitation to Beijing got a bigger response than last year’s. Only 23 executives from America’s leading companies attended last year. This year the number has risen to 34, and more senior people are attending, from such well-known names as Apple, McKinsey, Blackstone, AMD, Qualcomm, Micron Technology, Exxon Mobil, Cargill, Bristol-Meyers Squibb, Pfizer, and Hewlett-Packard. But for all the smiles, applause, and positive RSVPs, the money has not followed. Nor is it likely to do so.

Beijing’s Ministry of Commerce reports that in the first two months of this year foreign direct investment into China continued its months-long decline. In January and February, China attracted the equivalent of some 215 billion yuan of such money ($30 billion), down about 20% from a year ago. This latest reading shows a downward acceleration from the overall 8% decline in 2023. If action speaks louder than words, the ebbing flow of foreign money is drowning out the applause Xi heard in San Francisco.

Most telling for the future are the reasons why the money is staying away. Part of the problem is China’s slowed pace of growth. There is also the legacy of the pandemic and the lockdowns of President Xi’s zero-Covid policies that persisted for years. The inevitable delivery failures that occurred and recurred during that time have undermined China’s reputation for reliability that had once drawn investment money from the United States, Europe, and Japan. Nothing Beijing can do now will alter this history, though in time the memories will fade.

Nor can Beijing change the issue of rising costs. Even though China is suffering from deflation now, years of rising wages have ended the economy’s former reputation as a low-cost producer. In the last ten years, Chinese wages have risen over 100%, about 7.5% a year. In the past five years the pace has slowed but only marginally. Wage growth over this more recent period has averaged almost 5.5% a year. Most important for investment flows is that this rate of gain is faster than domestic wage growth in America, Europe, or Japan and faster than China’s competition for foreign investment funds, in Vietnam, for instance, Indonesia, the Philippines, and Mexico. China is hardly likely to reverse this situation, especially with domestic Chinese public dissatisfaction already high.

Though it could, Beijing is highly unlikely to reverse a big impediment to investment flows: its growing obsession with security and espionage. American, European, and Japanese executives have all complained of greater intrusions resulting from this obsession, explaining how those intrusions interfere with the ability to conduct business, especially when it comes to things such as data collection and communications with their headquarters. These executives point to raids conducted under Beijing’s latest espionage laws on two American consultants, Bain & Co. and the Mintz Group. In the case of Mintz, several employees were detained, and the firm was fined. Though such disruptions are far from widespread – at least not yet – they give pause to any decision to invest in China, as do new such laws recently imposed in Hong Kong. If Beijing were to reverse policy on this front, it could make a big difference, but that hardly seems likely.

Xi clearly is aware of China’s economic need for foreign investment as well as the existing impediments. He has turned on the charm, of which, if his standing ovation in San Francisco is any indication, he has in copious amounts. But as the actions of foreign investors show, they want substance more than they want charm.