2 UK shares that could surge in 2024 if the Bank of England cuts rates

Billionaire investor Warren Buffett once described interest rates as a gravity that can hold asset prices down. And we’ve seen that in action in 2023, as rising interest rates had a negative impact on UK shares.

Looking forward however, interest rates are expected to start falling in 2024. In fact, traders have priced in nearly 100 basis points of cuts for the year ahead, suggesting that the Bank of England (BoE) rate could fall to around 4.25% in 2024.

In theory, this should have a positive impact on share prices. So here are some stocks on my radar that could benefit as rates fall.

Lloyds

As the BoE lifted rates, banks stood to benefit by boosting their net interest margins, positively impacting interest income.

However, challenges loomed as these higher rates — which are far above optimal levels — have put increasing pressure on borrowers. In turn, banks have needed to increase their provisions for customer defaults.

While many banks experienced such setbacks, Lloyds (LSE:LLOY), with its customer base boasting an average income of £75,000, appeared relatively insulated. But that hasn’t stopped investors from swerving the stock.

It had strong quarterly results, and the worst-case scenario in which we would see mass defaults is now fading (although it’s still possible). So Lloyds could be among the biggest winners as interest rates (and risk) fall.

Investors haven’t given the bank much love over the past year. Risks still remain, and these are exacerbated as Lloyds doesn’t have an investment arm — it’s just a lender.

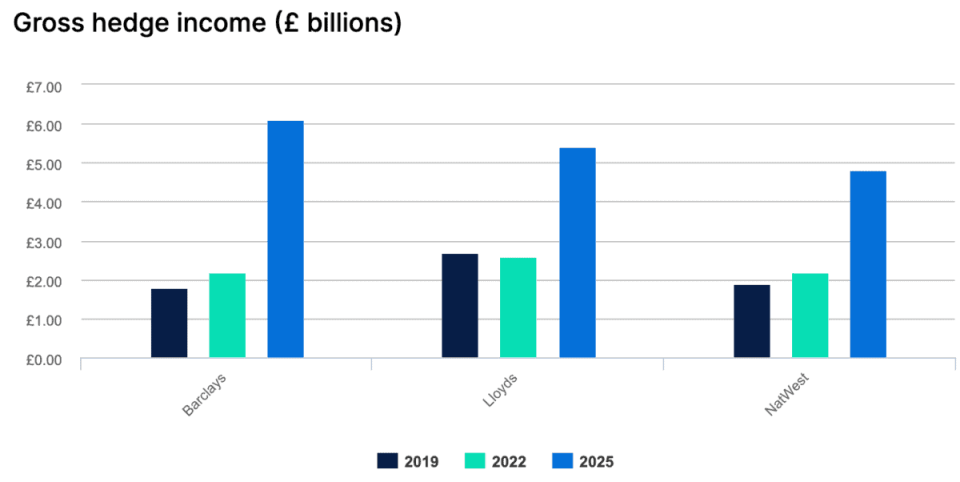

We may also see the company’s hedging strategy start to pay dividends. According to research, Lloyds will see more than £5bn in gross hedge income in 2025.

Moreover, it’s very cheap with a price/earnings-to-growth rate of 0.55.

Hargreaves Lansdown

It’s more expensive than its peers and it’s exchange rate fees eat into my profits, but Hargreaves Lansdown (LSE:HL.) has an excellent platform and great customer service.

And there, I believe, is the biggest issue for the UK’s largest investment platform. It needs to convince new investors that its services are worth the fees.

Nonetheless, I remain bullish on Hargreaves, partially because of the falling interest rate environment.

Millions of Britons will have started receiving bumper returns on their savings accounts over the past 12 months. But if they want to continue receiving these kinds of returns as interest rates fall, they may need to shift their capital away from savings accounts, and towards stocks and shares.

Even novice investors can generate much stronger returns on the stock market than they can in a savings account. Of course, investments do require research.

In turn, we could see a host of new investors, and Hargreaves could be their first port of call.

However, I will caveat this by recognising that higher interest rates have allowed Hargreaves to generate huge returns on investors’ uninvested cash.

The post 2 UK shares that could surge in 2024 if the Bank of England cuts rates appeared first on The Motley Fool UK.

More reading

James Fox has positions in Hargreaves Lansdown Plc and Lloyds Banking Group Plc. The Motley Fool UK has recommended Hargreaves Lansdown Plc and Lloyds Banking Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024