Near 52-week high! CarTrade Tech’s shares surge 10.5% on record revenue in Q4

Shares of CarTrade Tech jumped as much as 10.5 percent in intra-day trade on Tuesday to near their 52-week high of ₹896.50 apiece after the company reported its highest-ever revenue in the quarter ended March 2024 (Q4FY24).

The stock had hit its 52-week high of ₹899 on November 12, 2023. It has now given multibagger returns, soaring almost 121 percent from its 52-week low of ₹406, hit on May 18, 2023.

Today’s rally comes following an around 9 percent surge in the previous session, when it reported its Q4 results. Meanwhile, it is also the fourth straight session of gains. The stock has gained almost 28 percent in the 4 sessions of May.

Before this, it rose 10 percent in April after a 19.2 percent decline in March. However, it was positive in the first 2 months of the year, rising 8.2 percent and 2.2 percent in February and January, respectively. Overall on 2024 YTD, the stock has advanced 25.6 percent while it has rallied 86 percent in the last 1 year.

Earnings

In the March quarter, the firm posted a 50 percent year-on-year (YoY) jump in its net profit at ₹22.5 crore as against ₹14.96 crore during the same quarter last year.

The company’s revenue also surged 51 percent YoY to ₹145.27 crore, largely helped by OLX’s classifieds business. It had posted a revenue of ₹95.86 crore during the previous quarter ended March 2023. On the operating front, its EBITDA for the quarter under review increased 23 percent YoY to ₹49.11 crore while EBITDA margin expanded to 18.9 percent.

Meanwhile, for the full year, the company’s net profit declined 57.94 percent to ₹14.30 crore in the year ended March 2024 as against ₹34.00 crore during the previous year ended March 2023. Its sales, however, rose 34.70 percent to ₹489.95 crore in the year ended March 2024 as against ₹363.74 crore during the previous year ended March 2023.

CarTrade Tech operates an automotive digital ecosystem that connects automobile customers, OEMs, dealers, banks, insurance companies and other stakeholders. The company owns and operates under several brands: CarTrade, CarWale, and AutoBiz.

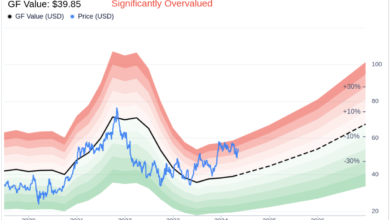

In an earlier report from April 2024, domestic brokerage house JM Financial stated that CarTrade’s stock is undervalued due to investor skepticism stemming from its performance since 2021. They suggested that a lack of understanding of CarTrade’s business models and competitive advantages among the investor community has contributed to this underappreciation.

The report also highlighted CarTrade’s operation in a favorable competitive landscape and its ability to achieve sustained top-line growth of 20-25 percent, as well as significant potential for margin expansion. Based on this outlook, the brokerage had reiterated a ‘buy’ rating on the stock, setting a target price of ₹1,000 for March 2025, indicating a potential upside of over 23 percent. The brokerage also believes that the stock has the potential for further annualised growth of 20-25 percent.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before taking any investment decisions.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!